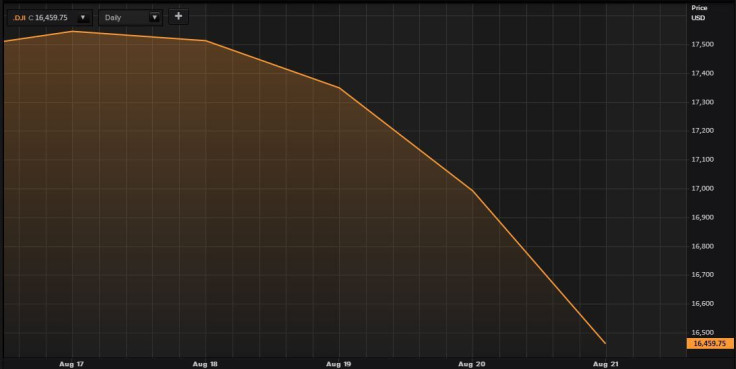

Dow Jones Industrial Average Nosedives 500 Points On Global Slowdown Fear

U.S stocks plummeted Friday on fears of a global economic slowdown spurred by a decelerating Chinese economy. The Dow Jones Industrial Average suffered its worst losses of the year following a global stock sell-off across European and Asian markets, the same day China offered fresh evidence of a sharper-than-expected economic slowdown.

The Dow tumbled more than 500 points to 16,459.75 and entered “correction” territory for the first time in four years, falling more than 10 percent from its all-time high of 18,312.39 on May 19. The last time the blue-chip index posted a more than 500-point drop was Aug. 10, 2011.

Friday's globe-spanning stock rout began with China's posting of numbers that showed factory production in the world’s second-largest economy shrank in August at its fastest rate in more than six years. The numbers fuel concerns that China’s sudden slowing will have far-reaching effects around the world.

As one of the world's fastest-growing economies, China produces immediate and broad ripple effects, notes Bill Adams, senior international economist at PNC Financial Services Group, "so when it slows, it puts downward pressure on global demand for commodities, which then creates downward pressure on global inflation.”

The Dow Jones Industrial Average (INDEXDJX:.DJI) tumbled 531 points Friday, or 3.12 percent, to close at 16,459.75. The S&P 500 index (INDEXSP:.INX) lost 64.84 points, or 3.19 percent, to end at 1,970.89. And the Nasdaq composite (INDEXNASDAQ:.IXIC) dropped 171 points, or 3.52 percent, to finish at 4,706.04.

All 10 sectors in the S&P 500 closed lower, led by a more than 2 percent decline in information technology, consumer discretionary and energy. All 30 stocks in the Dow closed lower, led by losses in technology stocks from Apple Inc. (NASDAQ:AAPL) and Microsoft Corporation (NASDAQ:MSFT), which dropped nearly 6.1 percent and 5.7 percent, respectively.

The Dow, S&P 500 and the Nasdaq composite all took a beating of more than 3 percent for the day.

"For equities, this was more like being put up against a wall, and getting shot. The only thing missing was the blindfold," Stephen Guilfoyle, managing director of NYSE floor operations at Deep Value Inc., said in a note.

Global stocks already were jittery this month after China unexpectedly devalued the yuan Aug. 11. But on Friday, the flash Caixin/Markit China Manufacturing Purchasing Managers' Index fell to 47.1 in August, down from July's final reading of 47.8. A figure below 50 indicates contraction. It was the worst reading since March 2009, sending China’s benchmark Shanghai Composite down more than 4 percent. The index has lost roughly 30 percent of its value from its peak in mid-June.

Following the Chinese manufacturing report, Japanese stocks gave up 3 percent, while European stock markets tumbled, with the pan-European Stoxx 600 trading 1.7 percent lower.

Wall Street's worst week of the year also points to concerns over the health of the U.S. recovery, as market professionals continue to watch the Federal Reserve and oil prices.

The U.S. Federal Reserve hinted in minutes released earlier this week that it may wait even longer than planned after September to raise interest rates. A delayed rate hike would indicate that the Fed is forecasting slower U.S. economic growth.

“Everyone was expecting a rate hike in September, but now this changes the tone ... Maybe the global economy isn’t strong enough to warrant a rate hike this year,” said Jeff Carbone, senior partner and co-founder for Cornerstone Financial Partners.

Adam Sarhan, founder and chief executive officer of Sarhan Capital, agrees. “Investors are concerned about China because they’re seeing a massive slowdown in the global economy with interest rates already at crisis levels," Sarhan said, explaining that market participants fear the global economy is not able to grow despite all of the extraordinary measures central banks have taken to prop up world economies.

"That in and of itself is a massive fundamental problem, which is causing the big sell-off across the board in stocks, commodities and currencies,” Sarhan said.

U.S. oil prices recorded an eighth straight weekly decline, the longest weekly losing streak in nearly 30 years. U.S. crude prices tumbled to six-year lows this week, as oil fell briefly below $40 a barrel in afternoon trading Friday for the first time since 2009, following an unexpected rise in crude stockpiles.

West Texas Intermediate crude, the benchmark for U.S. oil prices, fell 2.11 percent to $40.45 per barrel for October delivery on the New York Mercantile Exchange. On the London ICE Futures Exchange, Brent crude, the global benchmark for oil prices, dropped nearly 2.4 percent to $45.50.

© Copyright IBTimes 2024. All rights reserved.