Dow Jones Industrial Average Struggles To Hold Gains As Drop In Oil Weighs On Energy Stocks

UPDATE 4 p.m. EDT

U.S. stocks closed mostly lower Thursday after oil prices tumbled to a six year low, driving the energy sector 1 percent lower. Although concerns eased over China devaluing its currency this week, a rise in U.S. crude stockpiles added to ongoing fears over a growing global glut.

The Dow Jones Industrial Average (INDEXDJX:.DJI) added on 5.74 points, or 0.03 percent, to close at 17,408.25. The Standard & Poor's 500 index (INDEXSP:.INX) ticked down 2.66 points, or 0.13 percent, to end at 2,083.39. And the Nasdaq composite (INDEXNASDAQ:.IXIC) fell 10.83 points, or 0.21 percent, to finish at 5,033.56.

Original story: U.S. stocks traded mildly higher Thursday, struggling to shake off early losses following a decline in oil prices that weighed on the energy sector. Investors also sorted through a series of mixed retail sales and jobless-claims data, searching for further hints as to when the U.S. Federal Reserve will lift interest rates this year.

The Dow Jones Industrial Average (INDEXDJX:.DJI) added 5.11 points, or 0.03 percent, to 17,407.62. The Standard & Poor's 500 index (INDEXSP:.INX) edged down 1.26 points, or 0.07 percent, to 2,084.46. And the Nasdaq composite (INDEXNASDAQ:.IXIC) rose 3.38 points, or 0.07 percent, to 5,047.77.

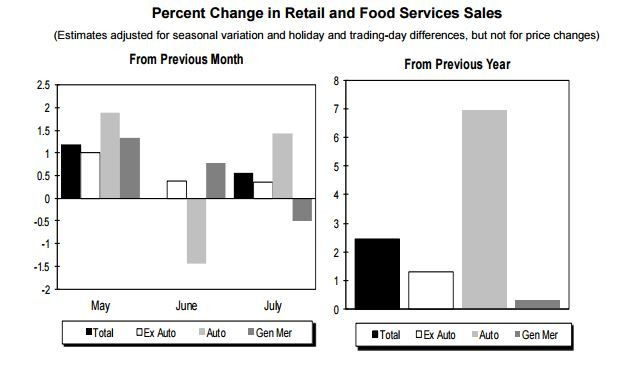

U.S. retail sales bounced back in July, rising 0.6 percent last month after coming in flat in June, the Commerce Department said Thursday. The gains were boosted by auto purchases, which signal consumer spending is off to a solid start in the third quarter following tepid growth at the start of the year due to winter weather.

Consumer spending is a vital driver to U.S. economic growth as it accounts for nearly two-thirds of economic activity. However, core retail sales, which correspond most closely with the consumer spending component of gross domestic product, rose 0.3 percent after a revised 0.2 percent gain in June.

Even so, the jump in retail sales is one data point in favor to bolster the case that the Fed will announce an increase in interest rates when the central bank meets in mid-September.

“We've reached the stage where Fed officials can be confident that the slump in underlying sales growth at the start of the year was genuinely a temporary weather-related blip,” Paul Ashworth, chief U.S. economist at Capital Economics, said in a research note Thursday.

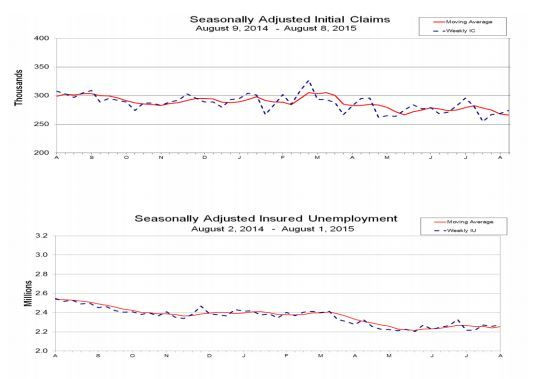

Separately, the number of Americans filing new applications for unemployment benefits unexpectedly rose last week, as initial claims for state unemployment benefits increased 5,000 to a seasonally adjusted 274,000 for the week ending Aug. 8, the Labor Department said Thursday. Economists had forecast claims to be unchanged at 270,000 last week, analysts polled by Thomson Reuters said.

Despite the rise, initial claims have now been below 300,000 for 23 straight weeks, the longest such stretch since 1973, when the workforce was much smaller. Economists say claims continue to run at a pace consistent with job growth of better than 200,000 per month.

“This is more than enough to keep up with growth in the labor force, and thus the economy continues to absorb the labor market slack remaining from the Great Recession,” Gus Faucher, senior macroeconomist at PNC Finanical Services Group, said in a note.

Nine of the 10 S&P 500 sectors traded lower, led by a more than 1 percent decline in energy after U.S. crude oil hit a nearly five-month low of $42.50. The consumer discretionary sector was the biggest gainer, up 0.6 percent.

Dow components Chevron Corporation (NYSE:CVX) and Caterpillar Inc. (NYSE:CAT) led the index lower, both shedding more than 1 percent.

Global stocks turned mostly higher Thursday after the People's Bank of China eased market fears, saying there was no basis for further depreciation of the yuan. China's Shanghai Composite index reversed early losses to close nearly 2 percent higher.

Meanwhile, European stocks received a boost as Greece inches closer to securing its third bailout program, sending the pan-European Stoxx 600 index up more than 1 percent.

© Copyright IBTimes 2024. All rights reserved.