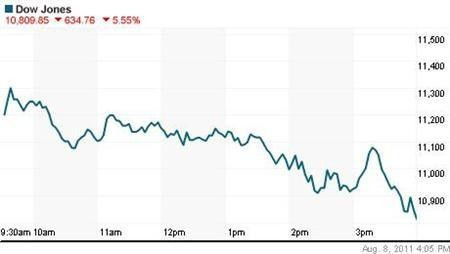

Dow Takes Final Plunge to 634 Points, Investors Finding Alternatives

The Dow Jones Industrial average closed the day on Monday at 634.76 points. The drop is the sixth worst point decline for the Dow in the last 112 years and the worst since December 2008.

Additionally, every stock in the Standard and Poor's 500 index dropped on Monday.

A full-day sell off grew in the final hour of trading because investors are struggling to come to terms with the decision taken by Standard and Poor's to decrease the U.S. triple-A credit rating by a notch on Friday.

The downgrade, which was once thought as impossible, is now coupled with the slowness of the U.S. economy and the mounting debt problems in Europe.

Investors began worrying about two weeks ago during the debt ceiling negotiations in Washington. Washington came through at the last-minute, and since then focus has been shifted on the economic outlook.

Investors' fears are also growing because of the troubled economies of Italy and Spain which are looking for help from the European Union. That the EU could offer a financial rescue package to these two big economies may be tough, because the group of countries already gave assistance to Greece and Ireland, two countries that were struggling to pay their debts.

The signs of a decline for the Dow Jones industrial average were evident from about midday on Monday when it plummeted more than 600 points.

At that time, the Dow traded down 536.18 points, or 4.7 percent, at 10908.43. The Standard & Poor's 500 index sharply went down 68.49 points, or 5.7 percent, to 1130.89.

Worried investors were moving stocks into safer areas such as gold and Treasury bonds, where their confidence still seems to be strong.

The Associated Press reported that the yield on the 10-year Treasury note, which moves in the opposite direction of its price, fell to 2.34 percent from 2.57 percent Friday. Gold, on the other hand, set a record, as it rose $61.40 per ounce to settle at $1,713.20, according to the AP.

© Copyright IBTimes 2024. All rights reserved.