Earnings Preview: Twitter Inc (TWTR), General Motors Co (GM), The Walt Disney Co (DIS), Merck & Co Inc (MRK), Zynga Inc (ZNGA)

Next week, investors will hear from companies like Walt Disney, Merck, Time Warner, Twitter, LinkedIn, Yelp and Zynga.

Wall Street analysts expect fourth-quarter 2013 S&P 500 (INDEXSP:.INX) operating earnings per share to rise by 7 percent from a year ago.

So far, about one-third of the companies in the S&P 500 have already reported results, with 76 percent of those having beaten expectations, according to S&P Capital IQ. Furthermore, 53 percent of those that have already reported beat estimates by 2 percent or more. However, 21 percent of companies have missed estimates by 2 percent or more.

“From a revenue perspective, things are less impressive, in our view, as two out of every three companies beat expectations, and only one-third has exceeded estimates by more than 2 percent,” notes Sam Stovall, chief equity strategist at S&P Capital IQ. He also pointed out that there has been a greater number of revenue disappointments, as 34 percent have missed expectations, while about 8 percent undershot estimates by more than 2 percent.

We ran a screen and produced a list of 31 notable companies set to report their earnings Feb. 3-7. We have highlighted their expected reporting dates and times, along with analysts' earnings-per-share (fully-reported) and revenue estimates from Reuters, as well as the stocks' past 12 months’ performances.

Monday Before Market Open, or BMO:

Sysco Corp. (NYSE:SYY) is a North American distributor of food and related products primarily to the foodservice or food-away-from-home industry. The company has a market cap of $20.37 billion. It is expected to report FY 2014 second-quarter EPS of 40 cents on revenue of $11.36 billion, compared with a profit of 38 cents per share on revenue of $10.80 billion in the year-ago period. Sysco is trading at around $35.08 per share. Over the past 12 months, the stock has gained 10.23 percent.

Monday After Market Close, AMC:

Anadarko Petroleum Corp. (NYSE:APC) is an independent oil-and-gas exploration and production company. The company has a market cap of $40.59 billion. It is expected to report FY 2013 fourth-quarter EPS of 95 cents on revenue of $3.80 billion, compared with a profit of 40 cents a share on revenue of $3.41 billion in the year-ago period. Anadarko Petroleum Corp. is trading at around $80.90 a share. Over the past 12 months, the stock has lost 0.1 percent.

Hartford Financial Services Group Inc. (NYSE:HIG) is an insurance and financial-services company. The company has a market cap of $14.75 billion. It is expected to report FY 2013 fourth-quarter EPS of 86 cents on revenue of $5.00 billion, compared with a loss of 13 cents a share on revenue of $7.74 billion in the year-ago period. Hartford Financial Services is trading at around $32.98 a share. Over the past 12 months, the stock has gained 32.4 percent.

Yum! Brands, Inc. (NYSE:YUM) is a quick-service restaurant company. The company has a market cap of $29.64 billion. It is expected to report FY 2013 fourth-quarter EPS of $1.27 on revenue of $4.27 billion, compared with a profit of 72 cents a share on revenue of $4.15 billion in the year-ago period. Yum Brands is trading at around $66.53 a share. Over the past 12 months, the stock has gained 3.4 percent.

Tuesday BMO:

Arch Coal Inc. (NYSE:ACI) is a coal producer. The company has a market cap of $885.21 million. It is expected to report a loss of 36 cents a share in the fourth quarter of FY 2013 on revenue of $769.49 million, compared with a profit of $1.39 on revenue of $968.23 million in the year-ago period. Arch Coal is trading at around $4.17 a share. Over the past 12 months, the stock has lost 43.5 percent.

Archer Daniels Midland Co. (NYSE:ADM) is engaged in the processing of oilseeds, corn, wheat, cocoa, and other agricultural commodities. The company has a market cap of $25.77 billion. It is expected to report FY 2013 fourth-quarter EPS of 84 cents on revenue of $24.70 billion, compared with a profit of 77 cents on revenue of $24.92 billion in the year-ago period. Archer Daniels Midland is trading at around $39.06 a share. Over the past 12 months, the stock has gained 36.8 percent.

Emerson Electric Co. (NYSE:EMR) is engaged in designing and supplying product technology and delivering engineering services and solutions in a range of industrial, commercial and consumer markets around the world. The company has a market cap of $46.44 billion. It is expected to report FY 2014 first-quarter EPS of 68 cents on revenue of $5.57 billion, compared with a profit of 62 cents per share on revenue of $5.55 billion in the year-ago period. Emerson Electric is trading at around $65.95 per share. Over the past 12 months, the stock has gained 14.8 percent.

International Paper Co. (NYSE:IP) is a global paper and packaging company with a market cap of $20.90 billion. It is expected to report FY 2013 fourth-quarter EPS of 79 cents on revenue of $7.38 billion, compared with a profit of 53 cents per share on revenue of $7.08 billion in the year-ago period. International Paper Co. is trading at around $47.11 per share. Over the past 12 months, the stock has gained 12.4 percent.

Michael Kors Holdings Ltd. (NYSE:KORS) is a global lifestyle brand. The company has a market cap of $16.14 billion. It is expected to report FY 2014 third-quarter EPS of 85 cents on revenue of $860.85 million, compared with a profit of 64 cents per share on revenue of $636.78 million in the year-ago period. Michael Kors is trading at around $79.08 per share. Over the past 12 months, the stock has gained 37.8 percent.

Spectra Energy Corp. (NYSE:SE), through its subsidiaries and equity affiliates, owns and operates a portfolio of complementary natural gas-related energy assets. The company has a market cap of $23.67 billion. It is expected to report FY 2013 fourth-quarter EPS of 39 cents on revenue of $1.46 billion, compared with a profit of 32 cent a share on revenue of $1.35 billion in the year-ago period. Spectra Energy is trading at around $35.24 a share. Over the past 12 months, the stock has gained 27.5 percent.

Wednesday BMO:

Merck & Co., Inc. (NYSE:MRK) is a global health care company with a market capitalization of $152.59 billion. It's expected to report FY 2013 fourth-quarter EPS of 59 cents on revenue of $11.36 billion, compared with a profit of 46 cents per share on revenue of $11.74 billion in the year-ago period. Merck is trading at around $52.18 per share. Over the past 12 months, the stock has gained 19.5 percent.

Time Warner Inc. (NYSE:TWX) is a media and entertainment company. The company has a market cap of $56.32 billion. It is expected to report FY 2013 fourth-quarter EPS of $1.16 on revenue of $8.37 billion, compared with a profit of $1.21 a share on revenue of $8.16 billion in the year-ago period. Time Warner is trading at around $62.44 a share. Over the past 12 months, the stock has gained 24.4 percent.

Wednesday AMC:

The Allstate Corp. (NYSE:ALL) is engaged, principally in the U.S., in the property-liability insurance, life insurance, retirement and investment-product business. The company has a market cap of $23.53 billion. It is expected to report FY 2013 fourth-quarter EPS of $1.31 on revenue of $6.89 billion, compared with a profit of 81 cents a share on revenue of $6.64 billion in the year-ago period. Allstate is trading at around $51.64 a share. Over the past 12 months, the stock has gained 18.0 percent.

Atmel Corp. (NASDAQ:ATML) is engaged in designing, developing and supplying of microcontrollers. The company has a market cap of $3.53 billion. It is expected to report FY 2013 fourth-quarter EPS of 6 cents on revenue of $357.37 million, compared with a loss of 3 cents a share on revenue of $345.08 million in the year-ago period. Atmel is trading at around $8.29 a share. Over the past 12 months, the stock has gained 22.7 percent.

Green Mountain Coffee Roasters Inc. (NASDAQ:GMCR) is engaged in the specialty coffee and coffee maker businesses. The company has a market cap of $11.40 billion. It is expected to report FY 2014 first-quarter EPS of 88 cents on revenue of $1.40 billion, compared with a profit of 70 cents a share on revenue of $1.34 billion in the year-ago period. Green Mountain Coffee Roasters is trading at around $76.65 a share. Over the past 12 months, the stock has gained 77.1 percent.

Marathon Oil Corp. (NYSE:MRO) is an international energy company with a market cap of $23.01 billion. It is expected to report FY 2013 fourth-quarter EPS of 75 cents on revenue of $3.60 billion, compared with a profit of 45 cents a share on revenue of $4.24 billion in the year-ago period. Marathon Oil is trading at around $32.99 a share. Over the past 12 months, the stock has lost 2.7 percent.

Tesoro Corp. (NYSE:TSO) is an independent petroleum refiner and marketer in the U.S. The company has a market cap of $6.88 billion. It is expected to report FY 2013 fourth-quarter EPS of 30 cents on revenue of $8.67 billion, compared with a profit of 19 cents a share on revenue of $8.27 billion in the year-ago period. Tesoro is trading at around $51.79 a share. Over the past 12 months, the stock has gained 7.8 percent.

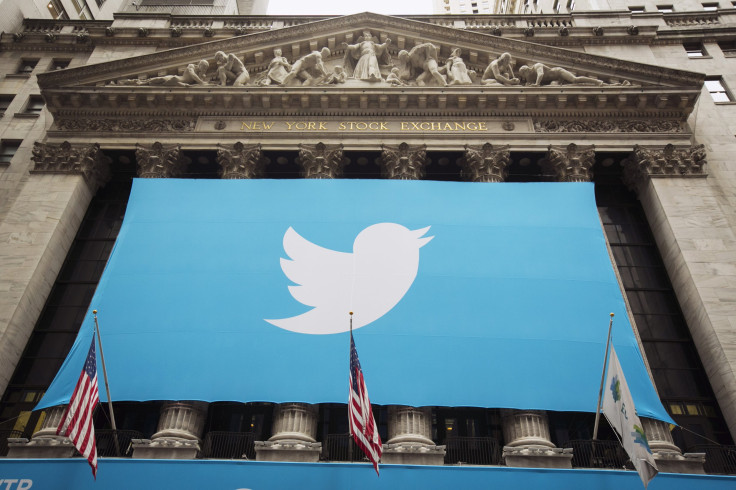

Twitter Inc. (NYSE:TWTR) is a global platform for public self-expression and conversation in real time. The company has a market cap of $33.22 billion. It is expected to report a loss of 39 cents a share in the fourth quarter of fiscal year 2013 on revenue of $217.78 million. Twitter is trading at around $59.94 a share. That’s 131 percent above its $26 IPO price.

Yelp Inc. (NYSE:YELP) connects people with great local businesses. The company has a market cap of $4.76 billion. It is expected to report a loss of 2 cents a share in the fourth quarter of 2013 on revenue of $67.22 million, compared with a loss of 8 cents a share on revenue of $41.16 million in the year-ago period. Yelp is trading at around $72.00 a share. Over the past 12 months, the stock has gained 244.2 percent.

The Walt Disney Co. (NYSE:DIS) is a diversified worldwide entertainment company with a market cap of $124.96 billion. It is expected to report FY 2014 first-quarter EPS of 91 cents on revenue of $12.22 billion, compared with a profit of 77 cents per share on revenue of $11.34 billion in the year-ago period. Walt Disney is trading at around $71.38 per share. Over the past 12 months, the stock has gained 32.4 percent.

Thursday BMO:

Cummins Inc. (NYSE:CMI) is a diesel-engine manufacturer. The company has a market cap of $24.11 billion. It is expected to report FY 2013 fourth-quarter EPS of $1.99 on revenue of $4.21 billion, compared with a profit of $2.02 a share on revenue of $4.29 billion in the year-ago period. Cummins is trading at around $128.61 a share. Over the past 12 months, the stock has gained 10.9 percent.

Exelon Corp. (NYSE:EXC) is a utility services holding company that has a market cap of $24.16 billion. It is expected to report FY 2013 fourth-quarter EPS of 49 cents on revenue of $5.64 billion, compared with a profit of 44 cents a share on revenue of $6.44 billion in the year-ago period. Exelon is trading at around $28.19 a share. Over the past 12 months, the stock has lost 9.1 percent.

Kellogg Co. (NYSE:K) is engaged in the manufacture and marketing of ready-to-eat cereal and convenience foods. The company has a market cap of $21.14 billion. It is expected to report FY 2013 fourth-quarter EPS of 72 cents on revenue of $3.52 billion, compared with a loss of 9 cents a share on revenue of $3.56 billion in the year-ago period. Kellogg is trading at around $58.37 a share. Over the past 12 months, the stock has lost 0.8 percent.

Philip Morris International Inc. (NYSE:PM) is a holding company. PMI’s subsidiaries and affiliates and their licensees are engaged in the manufacture and sale of cigarettes and other tobacco products in markets outside of the U.S. The company has a market cap of $127.59 billion. It is expected to report FY 2013 fourth-quarter EPS of $1.34 on revenue of $7.79 billion, compared with a profit of $1.25 a share on revenue of $7.89 billion in the year-ago period. Philip Morris International is trading at around $79.44 a share. Over the past 12 months, the stock has lost 11.2 percent.

Aetna Inc. (NYSE:AET) is a diversified healthcare benefits company. The company has a market capitalization of $25.01 billion. It's expected to report FY 2013 fourth-quarter EPS of $1.37 on revenue of $13.14 billion, compared with a profit of 56 cents per share on revenue of $9.00 billion in the year-ago period. Aetna is trading at around $68.06 per share. Over the past 12 months, the stock has gained 36.8 percent.

General Motors Co. (NYSE:GM) designs, builds and sells cars, trucks and automobile parts worldwide. The company has a market cap of $50.49 billion. It is expected to report FY 2013 fourth-quarter EPS of 89 cents on revenue of $40.89 billion, compared with EPS of 54 cents on revenue of $39.31 billion in the year-ago period. General Motors is trading at around $36.35 a share. Over the past 12 months, the stock has gained 25.0 percent.

Twenty-First Century Fox Inc. (NASDAQ:FOXA) formerly News Corporation, is a diversified global media and entertainment company with operations in cable network programming; television; filmed entertainment; direct broadcast satellite television, and other, corporate and eliminations. The company has a market cap of $70.12 billion. It is expected to report FY 2014 second-quarter EPS of 35 cents on revenue of $7.91 billion, compared with EPS of $1.01 on revenue of $9.43 billion in the year-ago period. Twenty-First Century Fox is trading at around $30.73 a share. Over the past 12 months, the stock has gained 12.9 percent.

Thursday AMC:

Activision Blizzard Inc. (NASDAQ:ATVI) is a worldwide publisher of online, personal computer, console, handheld, and mobile interactive entertainment products. The company has a market cap of $11.76 billion. It is expected to report FY 2013 fourth-quarter EPS of 2 cents on revenue of $2.22 billion, compared with a profit of 31 cents a share on revenue of $2.60 billion in the year-ago period. Activision Blizzard is trading at around $16.91 a share. Over the past 12 months, the stock has gained 48.5 percent.

LinkedIn Corp. (NYSE:LNKD) is a professional network on the Internet. The company has a market cap of $22.88 billion. It is expected to report FY 2013 fourth-quarter EPS of 1 cent on revenue of $437.90 million, compared with a profit of 10 cents a share on revenue of $303.62 million in the year-ago period. LinkedIn is trading at around $204.13 a share. Over the past 12 months, the stock has gained 64.9 percent.

Zynga Inc. (NASDAQ:ZNGA) is a provider of social game services. The company has a market cap of $2.75 billion. It is expected to report a loss of 3 cents per share in the fourth quarter of fiscal year 2013 on revenue of $141.07 million, compared with a loss of 6 cents a share on revenue of $261.27 million in the year-ago period. Zynga is trading at around $3.42 a share. Over the past 12 months, the stock has gained 37.4 percent.

Friday BMO:

News Corp. (NASDAQ:NWSA) is a diversified media and information services company. The company has a market cap of $9.39 billion. It is expected to report FY 2014 second-quarter EPS of 20 cents on revenue of $2.23 billion. News Corp. is trading at around $16.22 a share. Since the split in June, the stock has gained 2.7 percent.

© Copyright IBTimes 2024. All rights reserved.