Easy Money Is No Way to Deal With a Credit Crisis

ANALYSIS

Remember the good old days when Fed chairmen used to warn us about "irrational exuberance"? It's a safe bet to say the tide has turned. Now that Uncle Sam has dug itself into a $14 trillion hole, it's the American taxpayer who should be warning Ben Bernanke and his government cronies about the irrationalities of their exuberant paper printing.

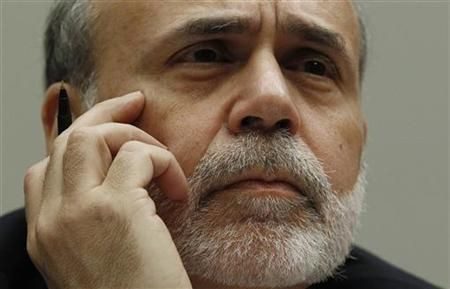

The Fed chairman hit the airwaves Tuesday in an effort to reassure the markets. Sadly, what we're reassured of is how misguided the Fed's undying devotion to easy money really is. Bernanke's wholehearted approval of the last two rounds of quantitative easing should have served as a painful lesson that creating dollars out of thin air is no fix for the American economy.

What quantitative easing has done is to inflate the price of commodities. Bundle in a depressed housing sector, unrest in the Middle East (inflated oil prices) and rampant unemployment, and you get the kind of economic death spiral that we're experiencing. Luckily for us, the Federal Open Markets Committee chooses to refer to this scenario as an "ongoing economic recovery."

At the very least, Bernanke didn't mention QE3 outright. Still, the Fed appears to have no problem with the further deterioration of the value of the dollar. Countries that once pegged their currencies to the dollar are increasingly favoring pegging them to a basket of currencies.

Who can blame them? These nations crave stability and they won't get it by hitching their wagons to what is a rapidly falling star. It took the British about a century to come to terms with the fact that the pound sterling was no longer the world's reserve currency. It might take America just as long.

Speaking of which, it's high time to short the dollar in the hopes of having the kind of success that currency speculators like George Soros have enjoyed. The dollar continues to be beaten by any number of currencies. And the Fed's devotion to cheap credit and easy money will only fuel this mess.

To the gold bugs: Sorry, but when your precious metal is approaching the price of platinum, any opportunity to reap the benefits of gold has passed us by.

© Copyright IBTimes 2024. All rights reserved.