ECB Can Start Cuts Before Fed, Says Finnish Bank Governor

The European Central Bank did not have to take its cues from the US Federal Reserve and could start to lower rates as soon as June, Bank of Finland governor Olli Rehn told AFP.

"While we don't make policy in a vacuum, the ECB is not the 13th Federal district of the US Federal Reserve," which is split into 12 zones, said Rehn.

"What the Fed does will not determine the case for a rate cut by the ECB," said Rehn.

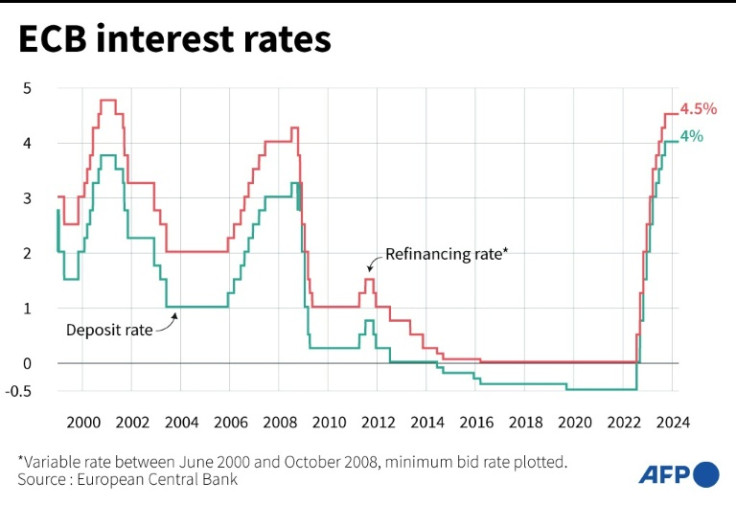

When inflation began to climb upwards, the Fed was faster to respond than the ECB, kicking off a series of interest rate hikes in March 2022.

After some initial hesitation, ECB policymakers followed suit in July of that year, raising rates faster and farther than ever before in the history of the eurozone.

But with consumer prices now having come off the boil, it looks like European policymakers might be poised to move first to reduce borrowing costs at their next meeting in June.

Lingering inflation pressures in the United States have seen Fed policymakers back away from reducing rates again too soon.

But in the eurozone, the "declining trend" in inflation and "moderating wage growth" meant there was a "strong case for starting to ease monetary policy and cut rates in June", Rehn said.

"Beyond that, let's see if the trend continues," said Rehn, who is one of 25 people on the ECB's governing council, which sets the course for interest rates in the eurozone.

Another cut at the ECB's meeting in July was far from a certainty for Rehn, who echoed statements made by many of his colleagues.

"We are not pre-committing to any rate path," Rehn said, an opinion shared by ECB President Christine Lagarde.

As for the Fed, observers should not pay "too much attention to possible small deviations in monetary stance" with the ECB's own decisions, said Rehn.

Concerns have been expressed that lowering rates first in the eurozone could lead to the depreciation of the euro relative to the dollar, potentially importing new inflation.

But the economic cycles in the United States and the eurozone could not be perfectly synchronised, "especially after such exceptional shocks that we have experienced", said Rehn in an allusion to turbulences caused by the coronavirus pandemic and the Russian invasion of Ukraine.

Growing differences in the economic development of the United States and Europe was a "major concern", however, Rehn said.

The United States has recorded stronger growth than the eurozone for 25 years, thanks to demographic advantages and bigger increases in productivity.

The price shock caused by Russia's 2022 invasion of Ukraine and the dwindling of gas supplies from the east also underlined Europe's dependence on Moscow for its energy imports.

"That's why the efforts toward green transition and digitalisation are so critical for Europe," Rehn said.

"We are under-investing for the moment in Europe and I'm very concerned about that because that's hampering our competitiveness," the central banker said.

© Copyright AFP 2024. All rights reserved.