Viktor Bout was busted in a sting operation attempting to sell weapons to a Colombian rebel group, FARC.

Productivity rose this summer in its biggest gain since last winter, a sign the economy's current modest growth will last.

The number of people seeking state unemployment benefits fell for the third straight week, government data showed on Thursday, signaling some hopeful progress in the labor market.

UBS has updated its Tech 10 portfolio by adding semi-packaging/assembly equipment provider ASM Technologies as a least preferred stock.

Canada's central bank is particularly vigilant in monitoring the effects of currency moves on inflation in times of great volatility, Bank of Canada Governor Mark Carney said on Wednesday.

The Canadian dollar is expected to hold steady just below parity with its U.S. counterpart in the next few months before regaining equal status in 6 months and edging higher than the greenback a year from now.

The top pre-market NASDAQ Stock Market gainers are: Medivation, Qualcomm, THQ, Qiagen, and Tesla Motors. The top pre-market NASDAQ Stock Market losers are: Dendreon, WebMD Health, Gentiva Health Services, Encore Capital Group, Fushi Copperweld, and Savient Pharmaceuticals.

Canadian utility Fortis Inc's (FTS.TO: Quote) posted a 29 percent rise in quarterly profit, helped by the termination fee it received in relation to its failed merger with Central Vermont Public Service Inc.

Husky Energy Inc's (HSE.TO: Quote) third-quarter profit doubled on robust production and higher realized crude prices.

Dutch financial services group ING is to cut 2,700 staff and contract jobs, it said on Thursday in announcing third-quarter results, slashing the headcount at its Dutch retail banking operations by 10 percent in the face of deteriorating markets.

Barclays Capital said Apple Inc.'s capital expenditure (capex) projection is really the only major figure it forecasts for investors on an annual basis in every 10Q and 10K filings. The brokerage said capex guidance of $8 billion could mean something for iCloud and revenue.

Stock index futures pointed to a slightly higher opening for equities on Wall Street on Thursday, with futures for the S&P 500, for the Dow Jones and for the Nasdaq 100 up 0.1 to 0.2 percent.

The top aftermarket NYSE gainers on Wednesday were: NetQin Mobile, Fusion-io, CACI International, UBS AG, AMR Corp, Thor Industries, American Eagle Outfitters, Northstar Realty Finance, CoreLogic and Triangle Capital Corp.

The United States on Wednesday expressed interest in selling its most sophisticated fighter plane to India, just six months after New Delhi rejected two older U.S. warplanes.

The top after-market NASDAQ Stock Market gainers are: Novatel Wireless, Wright Medical Group, Anika Therapeutics, Mercadolibre, THQ, Huron Consulting Group, and Qualcomm. The top after-market NASDAQ Stock Market losers are: Dendreon, ValueVision Media, WebMD Health, Nutrisystem, and Big 5 Sporting Goods.

The top after market NYSE Losers on Wednesday were: RealD Inc, MEMC Electronic Materials, Ion Geophysical, Transocean, Penn Virginia, Walter Energy, Hartford Financial Services Group, Education Realty Trust, Teekay LNG Partners and Polypore International Inc.

Kraft Foods Inc. (KFT) reported a 22 percent leap in third-quarter profits Wednesday from the same period a year ago. The company touted its investments in marketing and new products to help turn increased profits despite significantly higher prices.

The companies that are expected to see active trade on Thursday are: Starbucks Corp., American International Group, First Solar, Qualcomm, Teradata Corp, Chesapeake Energy, NetQin Mobile, NYSE Euronext, RealD, Microchip Technology, MGM Resorts International, Frontier Communications and Duke Energy Corp.

The Monetary Policy report from the FOMC was released today as Federal Reserve Chairman; Ben Bernanke will offer his third live video press conference of the year today at 2:15 EDT.

The FOMC statement released on Wednesday announced that the Federal Reserve will continue its program of Operation Twist to support the economy.

Discount retailer Syms Corp. and subsidiary Filene's Basement filed for bankruptcy protection in Delaware on Wednesday, planning to liquidate operations. It is the third time in a decade Filene's has sought protection under Chapter 11.

Sony is forecasting a net loss of 90 billion yen ($1.15 billion), versus a prior expectation for a 60 billion yen profit.

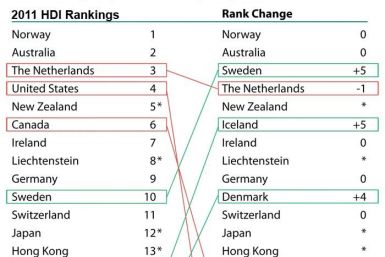

Although the U.S. ranks fourth in overall human development, when the scale is adjusted to account for income, health and education inequality, it falls to 23.

Mega Brands (MB.TO: Quote) posted a marginal dip in third-quarter profit, partly on higher costs, but the Canadian toy-maker said it expected signs of recovery across all its segments ahead of the crucial holiday season.

Procter & Gamble Co. (NYSE: PG) said the sale of Pringles to Diamond Foods Inc. (NASDAQ: DMND) has moved from the front half to the back half of its fiscal year. The deal, which was earlier said to be closed by December 2011, is now expected to close before the end of June 2012.

The Canadian dollar strengthened against its U.S. counterpart in early trade on Wednesday as global markets settled between hope and fear amid Greek debt developments and ahead of a Federal Reserve meeting.

Canada's central bank chief said on Tuesday he understands Greece's call for a referendum on the euro zone's latest bailout package, a plan that stunned other policymakers and triggered a downward spiral on global markets.

The top pre-market NASDAQ Stock Market gainers are: Garmin, Silicon Motion Technology, Magic Software Enterprises, Exelixis, and JDS Uniphase. The top pre-market NASDAQ Stock Market losers are: Syms, Diamond Foods, OpenTable, EZchip Semiconductor, and Cognizant Technology Solutions.

The growth of borrowing among small U.S. businesses moderated in September but the overall level still registered a 14th monthly double-digit increase in a fresh sign the economy is set to grow at a stable pace.

Applications for U.S. home mortgages were little changed last week as purchase demand improved but refinancing activity stagnated, an industry group said on Wednesday.