U.S. stocks recorded solid performance in the second half of the last year though the early part of the year was jittery. While the Dow Jones Industrial Average rose 11 percent, the Nasdaq Composite gained 17 percent and the Standard & Poor's 500 index rose 13 percent. Where do U.S. stocks go from here? There are analysts who think stocks are poised to show further gains this year.

BHP Billiton agreed to acquire all of Chesapeake Energy's interests in the Fayetteville Shale play in central Arkansas for $4.75 billion, marking its entry into the US shale gas business.

Shares in Australian banks and insurers fell between 1.4 and over 2.7 percent after a strong quake hit New Zealand's second-biggest city of Christchurch on Tuesday for the second time in five months.

China Everbright Bank may raise around $7 billion through a share sale in Hong Kong just six months after its Shanghai IPO, leading the way for more fundraising by smaller banks.

The Silver Price rose $1.49 per ounce from Friday's London Fix – a gain of 4.7% to new 31-year highs, and silver's fifth largest one-day move of the last 30 years in Dollars and cents. The market is starting to look towards the record high of $1430 for gold against the backdrop of silver making fresh highs.

Silver touched its highest USD price in 31 years and palladium a 10-year peak. Gold prices rose above $1,400 an ounce on Monday for the first time in nearly seven weeks as violence flared in north Africa and the Middle East, boosting interest in the precious metal as a haven from risk.

Germany’s public debt rose sharply last year, mainly pushed up by the government’s financial support for the ailing banks.

Thailand's economy emerged from a brief recessionary spell in the fourth quarter, recording 1.2 percent growth in gross domestic product.

An Internet oligopoly is emerging among Chinese Internet enterprise such as Baidu, Tencent Holdings, and Alibaba, accounting for 70 percent of the total market value of all listed Internet companies in the country, Chinese website Hexun reported on Friday.

Investors are likely to focus on major economic data to be released during the week to gauge the strength of recovery in the world’s largest economy. The main focus will be housing and economic activity, while rising Middle East tensions are expected to weigh on markets.

Activity in the euro zone's private sector grew faster than expected this month, particularly in the bloc's factories, but the upturn is driving prices higher, business surveys showed on Monday.

Asian stock markets ended mixed on Monday as political unrest in the Middle East weighed on the sentiment.

The index showing business confidence in Germany continued to improve further in February, posting gains for the ninth consecutive month.

Japan has created a covert foreign intelligence agency to spy on China and North Korea and to collect information on terrorist attacks, said a media report citing the whistleblower website WikiLeaks.

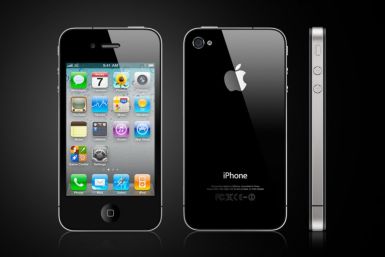

Apple Inc. is expected to release a new cheaper version of the iPhone during 2011 to deal with growing smartphone competition.

Gold inched up on Monday, adding to a weekly gain of nearly 3 percent last week as fears over a European debt crisis and growing unrest in the Middle East underpinned investor sentiment.

Public-sector employees in Ohio are under-compensated by 6 percent on annual basis when compared with workers in private-sector, said the Economic Policy Institute on Friday.

It’s not exactly groundbreaking research, but PIMCO’s Mark Taborsky and Sebastien Page just released a well-constructed chart illustrating the outperformance of the carry trade versus the S&P 500 in the last decade.

U.S. stocks rose Friday, marking the third straight week of market gains, as investors warily watch continuing unrest in the Middle East and North Africa, along with the start of a two-day meeting of G20 finance ministers and central bankers in Paris.

Silver Prices today jumped to fresh 31-year highs at $32.84 per ounce, outpacing the rise in gold prices more than 3 times over since the two metals turned sharply higher three weeks ago.

US stocks rose modestly higher on Friday, with S&P 500 Index up 2.52 points, or 0.19 percent, to trade at 1,342.98 at 12:00 p.m. EST. The Dow Jones Industrial Average is up 42.16 points, or 0.34 percent, to trade at 12,360.30. The Nasdaq Composite Index rose 0.23 percent to trade at 2,837.98.

Cash is a “dead asset,” which earns nothing, and mergers and acquisitions (M&A) is in, said Gary Parr, vice chairman of investment bank Lazard and one of the leading authorities in the world on M&A.

Automakers in China shipped 16.2 percent more cars to dealers in January as they moved aggressively to replenish inventories that were nearly depleted after explosive sales in December.

US stocks were mixed on Friday, with S&P 500 Index edging down 0.27 points, or 0.02 percent, to trade at 1,340.21 at 09:50 a.m. EST. The Dow Jones Industrial Average is up 14.04 points, or 0.11 percent, to trade at 12,332.18. The Nasdaq Composite Index rose 0.07 percent to trade at 2,833.52.

Walt Disney hosted multiple business sessions on Thursday with Street analysts at the Disneyland complex in Anaheim, California and tackled a myriad of strategic issues facing both the company and the media sector in general, at its 2011 Investor conference.

Gold hit five-week highs in Europe on Friday and silver its strongest since 1980 as growing unrest in the Middle East lifted interest in precious metals, though another reserve requirement hike from China curbed gains.

The companies whose shares are moving in pre-market trade on Friday are: Consolidated Edison, Molex, AK Steel Holding, Allergan, Jds Uniphase, Campbell Soup, PepsiCo and American International Group.

The top pre-market NASDAQ stock market gainers are: Red Robin Gourmet Burgers, SunPower, Brocade Communications Systems, Curis, Aruba Networks, and Yucheng Technologies. The top pre-market NASDAQ stock market losers are: Blue Coat Systems, JDS Uniphase, Veeco Instruments, Ryanair Holdings, and ARM Holdings.

Honda Civic GX has been named the greenest vehicle of 2011, while Chevrolet Volt slipped to the last spot, according to Washington-based American Council for an Energy Efficient Economy.

Brokerage Jefferies & Co. said losers at the Mobile World Congress (MWC) are HTC, Motorola Mobility Holdings, Nokia, Sierra Wireless, Novatel Wireless, PC original equipment manufacturers (OEM), and Sony Ericsson.