U.S. stocks opened flat in early trade on Thursday, following weaker-than-expected weekly jobless claims and December retail sales data.

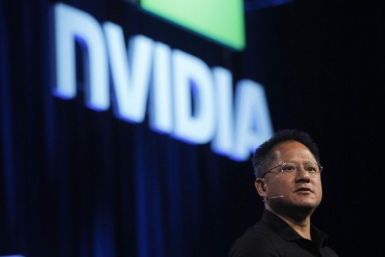

Shares of NVIDIA Corp. (Nasdaq: NVDA) are surging this morning after the graphics chips company announced last night that it has entered into a partnership to manufacture ARM-based central processing unit (CPU) cores that might provide power to PCs, servers, and supercomputers

The top pre-market NASDAQ stock market losers are Sinovac Biotech, Quidel Corp, The Wet Seal, Mindspeed Technologies, Celldex Therapeutics, Leap Wireless and Research in Motion.

Shares of British-based chipmaker ARM Holdings are surging on the London Stock Exchange after Microsoft (Nasdaq: MSFT) said last night that its new Windows operating system would work with chips designed by ARM.

The top pre-market NASDAQ stock market gainers on Thursday are: Lexicon Pharmaceuticals, ARM Holdings, XOMA, Microvision, Glu Mobile and Randgold Resources.

Kuwait and Iran, two of the world's largest crude exporters and prominent members of the Organization of Petroleum Exporting Countries (OPEC), have reiterated that they don't see the need to raise output to keep rising crude prices under check.

Futures on major U.S. indices point to higher opening on Thursday ahead of key weekly jobless claims report from the government.

The UK service sector reported a drop in output in December, its first fall since April 2009, showing that the economy's growth had declined as the last year drew to a close.

The top after-market NASDAQ stock market gainers are: Tasty Baking, Glu Mobile, Resources Connection, SodaStream and ClickSoftware. The top after-market NASDAQ stock market losers are Mindspeed Technologies, Quidel Corp, A. Schulman, Zumiez and Sonic Corp.

The top after-market NYSE gainers on Wednesday are: Sally Beauty, Sandridge Energy, Ruby Tuesday, Resolute Energy, Teekay Tankers, Yingli Green, Zale Corp, CapitalSource and Southwestern Energy.

S&P Equity Research predicts slower, but healthier growth in the technology sector in 2011, including notable developments regarding new products, international activity, and M&A deals.

LinkedIn, the network service for professionals is planning to go public and discussing about a possible IPO, sources informed Reuters.

The companies that reported news on Wednesday after the market close are: Cisco Systems, CenturyLink, Qwest Communications, Delta Air Lines, Massey Energy, AMR, American Airlines, Ruby Tuesday, Resources Connection, Mindspeed Technologies, Quidel, Lacrosse Footwear, and Daqo New Energy.

Stocks climbed, supported by a stunning jobs report from the private sector, raising hopes for a strong nonfarm payroll data on Friday.

We are starting to see retail investors wade back into equities, given that the allure of bonds has virtually dried up and the economic recovery seems to have some traction.

Apple Inc. (Nasdaq: AAPL) could become the world’s first company with a $1-trillion market cap, according to James Altucher, managing partner at hedge fund Formula Capital.

U.S. stocks declined in early trade on Wednesday despite upbeat private sector employment report from ADP as commodities and natural resources stocks were hurt by strong dollar.

Futures on major U.S. indices pared earlier losses on Wednesday after ADP reported that private-sector employment recorded the largest monthly gain in December.

The top pre-market NASDAQ stock market gainers are: Qiao Xing Universal Resources, Glu Mobile, Ku6 Media, NVIDIA, Microvision, and Atheros Communications. The top pre-market NASDAQ stock market losers are: Tekelec, Logitech International, ASML Holding, Siliconware Precision Industries, and Sinovac Biotech.

The companies which are expected to see active trade on Wednesday are Trident Microsystems, Family Dollar, Mosaic, Atheros Communications, Landec Corp and Ruby Tuesday.

John Lipsky, the first deputy managing director of the International Monetary Fund (IMF), has said 2011 will be a pivotal year for the global economic recovery and for international policy cooperation, adding that it's also a crucial year for the Fund as it will try to address these principal challenges.

Inflation will be the biggest concern for the emerging markets in 2011 and an important economic gauge to watch in the new year.

Firefox has dethroned Internet Explorer (IE) in December 2010 to become the number one browser in Europe, as Google’s Chrome stole share from the Microsoft browser, a report said.

Futures on major U.S. indices point to a lower opening on Wednesday as investors eye on economic data including ADP national employment report and ISM non-manufacturing index.

The top after-market NYSE gainers on Tuesday are: Youku.com, Agria, CVR Energy, Mosaic Co, CGI Group, Potash Corp, Sally Beauty and American Greetings.

Wirlesss carrier Sprint has unveiled a new 4G-enabled smartphone HTC Evo Shift priced at $149.99, which will be available starting Jan. 9.

The corporate news that impacted the market during Tuesday session are: General Motors, Ford Motor, Chrysler Group, Motorola, Motorola Mobility Holdings, Motorola Solutions, and Macy's. The companies that reported earnings news after the market close are: Sonic, AngioDynamics, Landec, Team, and Mosaic. The companies that reported guidance revision news after the market close are: Mattson Technology, and Trident Microsystems.

The Federal Reserve's second round of quantitative easing (QE2) is pushing oil prices higher, said Andy Xie, a prominent economist.

Qualcomm Inc. (Nasdaq: QCOM) is preparing to acquire semiconductor company Atheros Communications (Nasdaq: ATHR), for about $45 per share, or $3.5 billion, according to a report in the New York Times.

Insurance-linked securities are misunderstood by the public and their investors are often unfairly maligned as heartless operators who wager on the deaths of human beings.