The top after-market NASDAQ stock market gainers are: EXFO, Sify Technologies, Mercury Computer Systems, Umpqua Holdings, and National CineMedia. The top after-market NASDAQ stock market losers are: DragonWave, optionsXpress Holdings, Geron, PostRock Energy, and American Capital Agency.

The rupee touched one-and-half-week highs early on Thursday, boosted by overnight losses in the dollar, but soon retreated tracking weak domestic shares, which added to worries of more foreign fund withdrawals.

Infosys Technologies' weaker-than-expected results sparked concerns over growth rates of India's showpiece outsourcing sector as the company flagged a sluggish global economic recovery and currency volatility.

Hong Kong stocks are likely to rise further on Thursday with traders expecting momentum to continue after the benchmark convincingly broke through short-term chart resistance on high volumes.

Following are news items and media reports that may affect the Taiwan stock market. Double click on the number in [] to read the stories.

China's largest lender, Industrial and Commercial Bank of China (ICBC), said it will not conduct fundraising from the capital markets within three years, the Securities Times reported on Thursday, citing the bank's chairman.

State-owned Bank of China Ltd's move to offer limited deposit services in the renminbi to U.S. customers represents a tiny step in what will be a long journey for the Chinese unit to become a widely-traded international currency.

Stock rallied as banks/financials stocks pushed higher following an upgrade of the sector by Wells Fargo and a successful bond offering in Portugal.

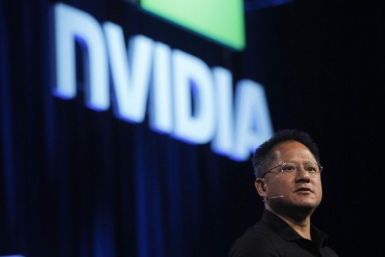

Shares of chip designer NVIDIA Corp. (Nasdaq: NVDA) are surging today, in what appears to be a delayed reaction to a series of good news surrounding the company.

The Nigerian naira NGN=D1 depreciated further against the dollar at both the interbank market and official window on Wednesday as the central bank was unable to meet demand for the greenback at its auction.

Ghana's inflation slowed to a new 18-year low of 8.58 percent in December, feeding expectations the West African economic heavyweight will keep its policy interest rate on hold in the short term.

Shanghai has launched a pilot scheme allowing qualified foreign institutions to make private equity investment in China, marking an important step in the liberalization of China's capital markets.

Cameroon will take a 207 billion CFA concessionary loan from the Export-Import Bank of China to fund construction of a deep sea port at Kribi, the government said on Wednesday.

Libya has abolished taxes and custom duties on locally-produced and imported food products in response to a global surge in food prices, Oea online newspaper reported.

Investors are likely to pour more funds into Egypt in 2011 as a strengthening economy and attractive yields outweigh a fragile social backdrop and uncertainty ahead of a presidential election.

The S&P 500 Index gained 3.69 points, or 0.29 percent, to trade at 1,278.17 at 9.30 a.m. EDT. The Dow Jones Industrial Average rose 32.93 points, or 0.28 percent, to trade at 11,704.81. The Nasdaq Composite Index advanced 11.50 points, or 0.42 percent, to 2,728.49.

Gold prices rose in Europe on Wednesday, as a retreat in the dollar, rising oil prices and caution ahead of a sale of Portuguese bonds later in the day all boosted interest in the precious metal.

The top pre-market NASDAQ stock market gainers are: China Recycling Energy, Affymetrix, Lululemon Athletica, A-Power Energy Generation Systems, Sequenom, and LeCroy. The top pre-market NASDAQ stock market losers are: Illumina, Vodafone Group, Zions Bancorp, Ryanair Holdings, and SanDisk.

The devastating floods that have inundated Queensland may significantly reduce Australia’s overall economic growth this year, according to an array of economists and analysts.

The extra fiscal stimulus in the form of tax cuts approved in December could produce a 4 percent growth rate for the U.S. economy in the first half of 2011, but there are lingering risks that could lead to a cold shower in 2012, according to the American Enterprise Institute (AEI).

German economy, Europe's biggest and the only bright spot in an otherwise bleak euro zone fiscal scene, grew at an impressive rate of 3.6 percent in 2010, official data showed.

In the NYSE on Tuesday, the top after-market gainers are: Zale Corp, Noble Corp, Parker Drilling, H. B. Fuller and Liz Claiborne. The top after-market losers are: Arch Coal, Alumina, Cablevision Systems, Excel Maritime and Kite Realty Group.

In the NASDAQ stock market on Tuesday, top after-market gainers are: lululemon athletic, Vermillion, Matrixx Initiatives, Warren Resources and Sterling Bancshares. The top losers are: Trimble Navigation, Tree.com, Career Education, Patterson-UTI Energy and QLogic Corp.

China's central bank bill and government bond yields edged lower on Wednesday as easing concerns over another monetary tightening step in the coming weeks along with ample liquidity kept sentiment cautiously optimistic, traders said.

Aluminium output in China, the world's top producer, may be trimmed further this month as smelters in southwest Guizhou province face power cuts to offset soaring energy demand linked to freezing weather, industry sources said on Wednesday.

Text of Goldman Sachs 8-K filing showing 2010 earnings under new disclosure standards

Stocks pushed modestly higher, buoyed by some better-than-expected earnings results from prominent companies like Alcoa Inc. (NYSE: AA).

Some market observers are extremely concerned about the impact of high-frequency trading upon the overall stock market.

Despite a still-fragile U.S. economy and persistently high unemployment, The Fidelity Charitable Gift Fund, the nation's largest donor-advised fund program, said its donors supported charities in record numbers in 2010.

Shares of gunmaker Sturm, Ruger & Co. (NYSE:RGR) are trading higher today apparently boosted by a surge in sales of handguns in Arizona following the weekend massacre in Tucson by Jared Lee Loughner.