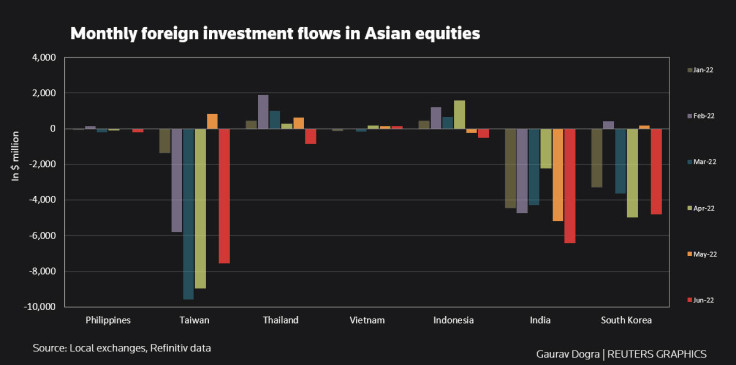

Emerging Asian Equities Post Biggest Foreign Outflows Since March 2020

Emerging Asian equities ex-China recorded massive outflows in June, as risk assets took a hit due to heightened concerns over a potential recession, with major central banks set to further tighten their monetary policies aggressively.

Data from stock exchanges in Taiwan, India, South Korea, the Philippines, Vietnam, Indonesia, and Thailand showed that foreign investors exited equities worth a net $20.22 billion, marking their biggest net selling since March 2020.

(Graphic: Monthly foreign investment flows in Asian equities,

)

"The month of June has seen recession fears taking greater control of risk sentiments, which drove some paring back of positions in global equities as seen from the foreign outflows in Asia as well," said Jun Rong Yeap, a market strategist at IG.

The Federal Reserve lifted interest rates by 75 basis points last month, and a Reuters poll projects the U.S. central bank will deliver another 75-basis-point rate hike in July, followed by a half-percentage-point rise in September.

Tech exporters Taiwan and South Korea witnessed outflows worth $7.54 billion and $4.8 billion, respectively, as recession fears prompted traders to fret over sluggish demand for electronic items.

Meanwhile, Indian equities recorded outflows of $6.44 billion, which took the second-quarter cumulative net sales to $13.85 billion, the biggest since at least 2008.

Thailand, Indonesia, and the Philippines also had outflows amounting to $858 million, $502 million and $207 million, respectively.

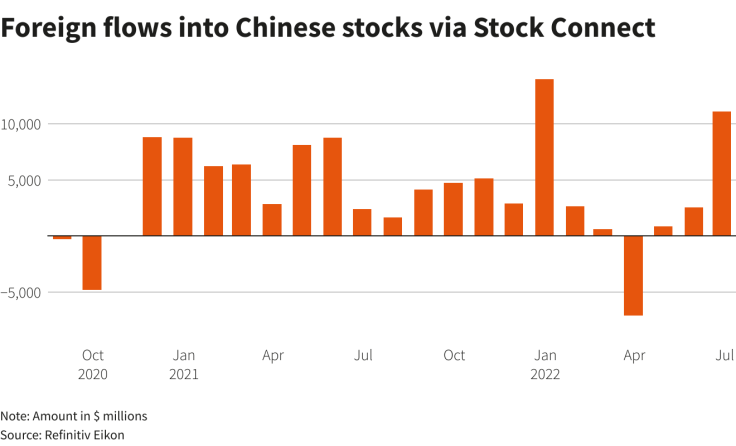

On the other hand, foreign investors bought about $11 billion worth of China-listed shares in June, the biggest monthly inflow since December, according to data from Refinitiv Eikon and the Hong Kong stock exchange.

(Graphic: Foreign flows into Chinese stocks via Stock Connect Foreign flows into Chinese stocks via Stock Connect,

)

"We believe some investors have relocate some of the assets in other EM markets back into China," said Zhikai Chen, head of Asian equities at BNP Paribas Asset Management.

© Copyright Thomson Reuters 2024. All rights reserved.