The End Of Quantitative Easing: Bernanke’s Statements About Slowing Bond Purchases By The Fed Spook Global Investors; See Which Markets Declined The Most (MAP)

An hour after markets opened in the United States on Thursday, the S&P 500 was down 1.55 percent. The primary reason? Federal Reserve chairman Ben Bernanke hinted the day before at a press conference that the Fed’s strategy of purchasing U.S. bonds in bulk may be curtailed soon. The S&P 500 recovered only slightly by late afternoon, down 1.45 percent at 12:40 p.m. EST.

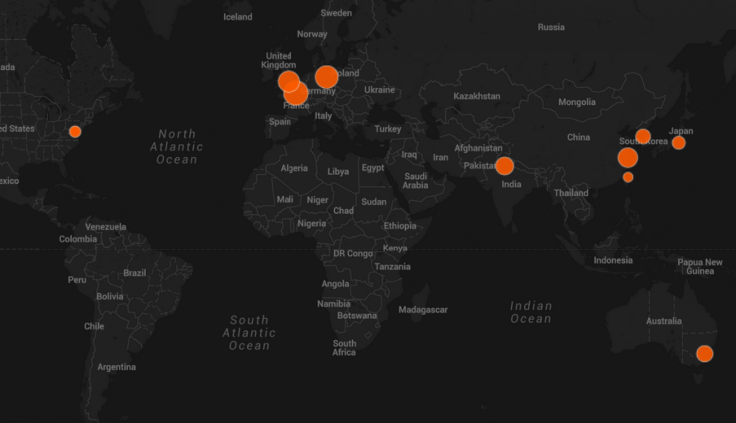

By that time, global markets, at the end of their trading days, were in even worse shape. The French CAC 40 and Germany-based EURO STOXX 50 declined the most -- a bit more than 3.6 percent. Meanwhile, the London FTSE 100, the Shanghai index and the Indian BSE Sensex were all down slightly less than 3 percent.

In his press conference, Bernanke said the U.S. economy is much stronger now than it was in late 2012. And although he reiterated that the Fed would continue to buy U.S. Treasury bonds, a monetary policy strategy known as quantitative easing, he warned that the central bank might scale back purchasing volume by the end of 2013 if forecasts of an improving economy were accurate.

Through the Fed’s actions -- it has consistently bought about $85 billion worth of government bonds each month -- the interest rate at which banks and institutions are able to borrow money has hovered at just above zero.

The availability of ample amounts of cheap capital makes financial assets with potentially higher returns than bonds, such as equities, far more attractive than low-risk, low-reward instruments. If quantitative easing were shut down or diminished, the returns on bonds would rise, making equities less attractive.

Check out this interactive map of how world markets responded -- that is, declined -- since Bernanke’s speech. A larger bubble indicates a steeper drop in that market:

© Copyright IBTimes 2024. All rights reserved.