Ethereum ETFs Get Final Approval – What To Expect After Funds Launch

KEY POINTS

- Some traders believe the ETFs' launch will trigger a massive price pump among altcoins

- An ETF analyst expects issuers to kick off a series of marketing wars to gain traction among investors

- Another expert said the community shouldn't expect much on Day 1 of trading

Following back-and-forth communications between the U.S. Securities and Exchange Commission (SEC) and applying issuers for spot Ethereum ($ETH) exchange-traded funds (ETFs) in the past few weeks, the funds have finally been fully approved for trading starting Tuesday. What should cryptocurrency users expect and what does this mean for the broader digital assets sector?

Making history amid a lack of clarity

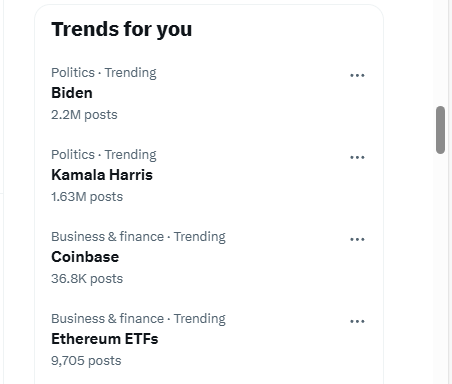

Ethereum ETFs trended on X (formerly Twitter) Sunday night after it was confirmed that the SEC gave its full approval for the funds to launch Tuesday morning.

Paul Grewal, the chief legal officer of crypto exchange giant Coinbase, celebrated the achievement for the Ethereum community, saying the approval is one of the moments when history took place "gradually, then suddenly." He added that the full approval "validates what we've been saying for years: ETH (the native token of the Ethereum network) is not a security."

History often happen gradually, then suddenly. Crypto is no exception. The approval of spot ETH ETFs today is yet another one of those moments. And it validates what we’ve been saying for years: ETH is not a security. https://t.co/1OGfaNr6ro

— paulgrewal.eth (@iampaulgrewal) July 22, 2024

The SEC under Chair Gary Gensler has made contradictory statements about Ether's status as a commodity or a security. Blockchain tech firm Consensys took legal action against the Wall Street regulator earlier this year, revealing that the SEC had already deemed $ETH a security since last year – weeks before Gensler appeared before Congress and refused to clarify the digital asset's status.

Following the revelation and callouts from the crypto community – and some lawmakers – the SEC partially approved spot Ether ETF filings before going silent for some time then ultimately working with issuers to iron out the filings' final touches.

The SEC has yet to clarify Ether's status, but an industry expert said the regulatory agency has already "implicitly stated" that $ETH without staking "is a commodity rather than a security" when it approved Ethereum ETFs.

What should the community expect now that another digital asset has its own ETF?

Altcoin season coming through

Crypto influencer Rover believes that after the launch of spot Ether ETFs Tuesday, "altcoin season is about to start." Altcoins are tokens aside from Bitcoin, the world's first decentralized digital asset.

With the Spot #Ethereum ETF launching tomorrow, I believe the Altcoin season is about to start.

— Crypto Rover (@rovercrc) July 22, 2024

Are you ready? pic.twitter.com/YvxxykFywr

Prominent crypto trader Ash said the digital assets space should expect "the beginning of the biggest altseason in crypto history," with prices pumping huge in the next six to 12 months.

THIS IS GONNA BE A BIG WEEK FOR

— Ash Crypto (@Ashcryptoreal) July 22, 2024

CRYPTO INDUSTRY.

ETHEREUM SPOT ETF WILL START

TRADING TOMMOROW AND IT WILL

BE THE BEGINNING OF THE BIGGEST

ALTSEASON IN CRYPTO HISTORY.

SO LOAD YOUR BAGS AND BE READY.

WE ARE ABOUT TO SEE A MASSIVE

PUMPS IN NEXT 6-12 MONTHS.

Web3 developer Nicolas agrees that altcoins may rise, but only "minimally." He added that he expects crypto holders to accumulate altcoins "probably until September."

Marketing wars

Senior Bloomberg ETF analyst Eric Balchunas said "marketing wars" should be expected as issuers look to woo $ETH supporters and other crypto investors.

Investment behemoth BlackRock kicked off the marketing wars with a pitch to "normies," or non-crypto holders who may be curious about the new ETF.

Here's BlackRock's Ether pitch to normies via @JayJacobsCFA: "While many see bitcoin's key appeal in its scarcity many find ethereum's appeal in its utility.. you could think of ethereum as a global platform for applications that run without decentralized intermediaries" $ETHA pic.twitter.com/ffyglfSTiB

— Eric Balchunas (@EricBalchunas) July 22, 2024

Jay Jacobs, head of thematic and active ETFs at BlackRock, explained in a video that potential investors can think of Ethereum "as a global platform for applications that run without decentralized intermediaries."

BlackRock is one of nine issuers – based on the numbers, BlackRock's IBIT is the by far the most successful spot Bitcoin ETF.

Bitwise, another issuer, has also started marketing its new Ether ETF, noting that its fund "donates 10% of profits to Ethereum open-source developers."

Introducing ETHW—the Bitwise Ethereum ETF.

— Bitwise (@BitwiseInvest) July 22, 2024

- Fund invests directly in ETH

- 0.20% management fee (0% for first six months / $500M)

- Donates 10% of profits to Ethereum open-source developers*

- Fund's Ethereum addresses public for transparency

- Built by crypto specialists… pic.twitter.com/7Pb7Lz2wPj

Day 1 won't be say much

James Seyffart, another Bloomberg ETF analyst, said observers shouldn't expect a lot during the first day of trading. "Honestly, the first day won't be indicative of much," he said, noting that the "more interesting" period to watch out for in terms of spot Ethereum ETFs' actual demand and market impact is from the second week of the funds' trading through its first month.

NEW: Bloomberg's @JSeyff on what to watch for when the Ethereum ETFs begin trading tomorrow 👀⬇️

— Coinage (@coinage_media) July 22, 2024

"Honestly the first day won't be indicative of much" pic.twitter.com/hcWsNrHPmO

© Copyright IBTimes 2024. All rights reserved.