Euro Bounces From Brink Of Parity With US Dollar

The euro rebounded on Tuesday after sliding to a 20-year low and nearing parity against the U.S. dollar as investors worried that an energy crisis in the region would bring on a recession.

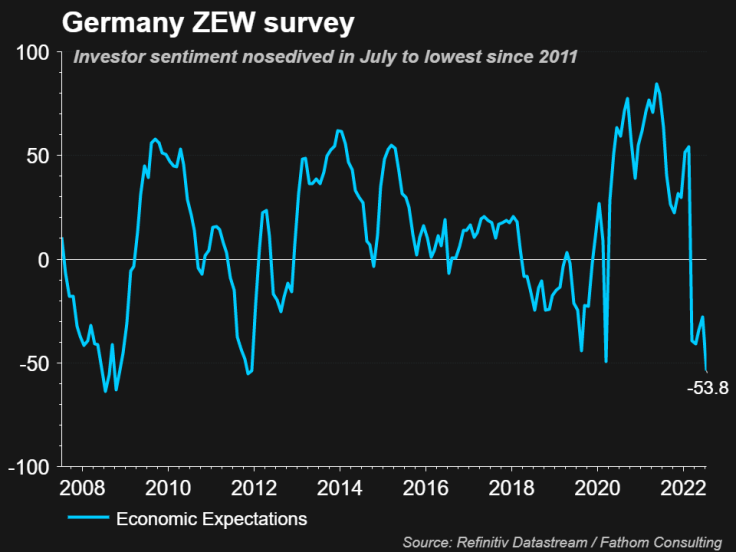

The single currency reached $1.00005 against the greenback, the lowest since December 2002, after data showed German investor sentiment in July plunged below levels at the outset of the coronavirus pandemic due to energy concerns, supply bottlenecks and rate hikes from the European Central Bank (ECB).

"It seems like it's a very gloomy outlook for the euro ..., a sub-parity paradigm is very much in the cards," said Mazen Issa, senior FX strategist at TD Securities in New York, adding that the single currency could drop to the 85-90 cents U.S. level.

Issa cited the Federal Reserve hiking rates further than the ECB, and macro factors including Europe's quickly deteriorating current account as weighing on the single currency.

GRAPHIC: Germany ZEW survey

The dollar is benefiting from expectations that the U.S. central bank has more room to hike rates than peers, which are facing more challenging growth outlooks.

Concerns that Europe could fall into a recession have increased since the biggest single pipeline carrying Russian gas to Germany, the Nord Stream 1 pipeline, began annual maintenance on Monday. Governments, markets and companies are worried the shutdown might be extended because of the war in Ukraine.

The single currency was last at $1.0045, after bouncing from the $1 area, which some analysts attributed to technical factors relating to options activity and short-covering.

Neil Jones, head of currency sales at Mizuho, said markets had been 'short' on the euro in anticipation of a break below parity, but "we didn't get it," which led these investors to buy the currency back.

Some of the rebound may also have had to do with the $1 area being an important psychological level.

"Parity is more of a psychological level than an important chart point," said Marc Chandler, chief market strategist at Bannockburn Global Forex in New York. "The important chart point is down to maybe $0.96 or $0.98 as a more important technical level."

GRAPHIC: Euro-dollar parity

A possible catalyst that could push the euro back lower is highly anticipated inflation data on Wednesday, which is expected to show that U.S. consumer prices rose by an annual rate of 8.8% in June.

"We may have to wait for U.S. CPI ... or a clearer picture for European energy markets once planned maintenance in Nord Stream comes close to finalising for euro-dollar to break the (parity) threshold," said Simon Harvey, head of FX at Monex Europe.

Richmond Fed President Thomas Barkin said on Tuesday he expected the U.S. central bank to succeed in its battle against inflation, but that the pace of progress was unpredictable.

The Australian dollar rebounded from a two-year low hit on global growth concerns as China implements new COVID-19 curbs.

The Aussie was last up 0.36% at $0.6761, after falling to $0.6712, the lowest since June 2020.

The U.S. dollar fell 0.47% against the Japanese yen to 136.78, after hitting 137.73 on Monday, the strongest level in 24 years.

The dollar index fell 0.07% to 108.06.

In the cryptocurrency market bitcoin dropped 1.95% to $19,560

========================================================

Currency bid prices at 3:07PM (1907 GMT)

Description RIC Last U.S. Close Pct Change YTD Pct High Bid Low Bid

Previous Change

Session

Dollar index 108.0600 108.1600 -0.07% 12.959% +108.5600 +107.8300

Euro/Dollar $1.0045 $1.0041 +0.05% -11.63% +$1.0074 +$1.0001

Dollar/Yen 136.7750 137.4150 -0.47% +18.81% +137.5300 +136.4700

Euro/Yen 137.38 137.93 -0.40% +5.42% +138.0700 +137.0300

Dollar/Swiss 0.9816 0.9834 -0.16% +7.64% +0.9858 +0.9804

Sterling/Dollar $1.1895 $1.1894 +0.02% -12.04% +$1.1915 +$1.1808

Dollar/Canadian 1.3015 1.3006 +0.08% +2.95% +1.3050 +1.2985

Aussie/Dollar $0.6761 $0.6737 +0.36% -6.99% +$0.6779 +$0.6712

Euro/Swiss 0.9859 0.9869 -0.10% -4.93% +0.9898 +0.9837

Euro/Sterling 0.8442 0.8440 +0.02% +0.50% +0.8484 +0.8434

NZ $0.6131 $0.6114 +0.32% -10.39% +$0.6145 +$0.6103

Dollar/Dollar

Dollar/Norway 10.2405 10.1930 +0.23% +15.97% +10.2675 +10.2070

Euro/Norway 10.2893 10.2409 +0.47% +2.76% +10.2979 +10.2403

Dollar/Sweden 10.5696 10.6317 -0.58% +17.20% +10.6843 +10.5348

Euro/Sweden 10.6176 10.6793 -0.58% +3.75% +10.6926 +10.6044

© Copyright Thomson Reuters 2024. All rights reserved.