Euro Inches Up After Falling To Brink Of Parity Vs Dollar

The euro inched higher on Tuesday, reversing earlier falls that had taken it to the brink of parity with the dollar, but it stayed under heavy pressure from a potential energy supply crunch and uncertainty over the ECB's rate rise campaign.

The euro fell as low as $1.0005, before edging off that level. By 1315 GMT it was up 0.15%, at $1.00540.

GRAPHIC: Euro-dollar parity

Neil Jones, head of currency sales at Mizuho, said markets had been 'short' the euro in anticipation of a break below parity, but "we didn't get it and now these shorts are buying back into the early New York market".

One-month implied euro-dollar volatility, a gauge of expected swings, around 12.5%, the highest since March 2020.

The biggest pipeline carrying Russian gas to Germany, the Nord Stream 1, began annual maintenance on Monday, with flows expected to stop for 10 days. But governments and markets are worried Russia might extend the shutdown, exacerbating the euro bloc's energy crunch and tipping its economy into recession.

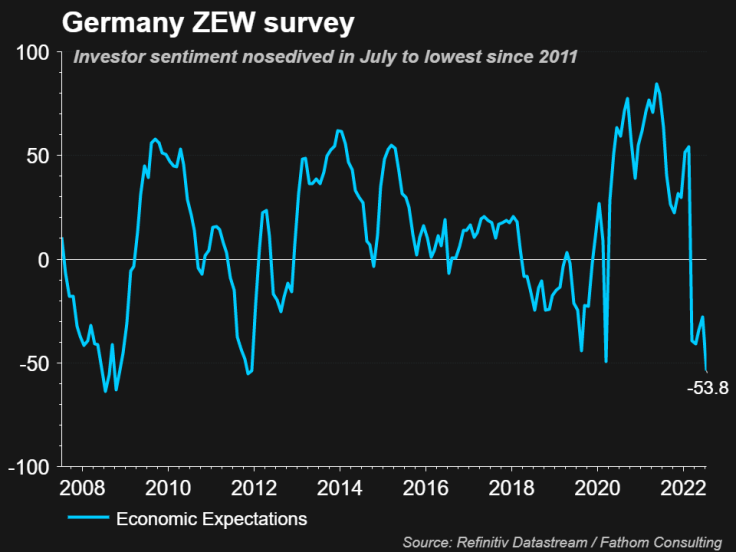

A dire reading from the ZEW economic research institute, reinforced the economic gloom, showing German investor sentiment nosedived in July to -53.8 points from -28.0 in June.

"The market is playing cat and mouse with euro parity at the moment in the absence of any major macro drivers," said Simon Harvey, head of FX at Monex Europe, adding that Wednesday's U.S. inflation data -- expected at 8.8% for June -- could prove the catalyst.

"We may have to wait for U.S. CPI...or a clearer picture for European energy markets once planned maintenance in Nord Stream comes close to finalising for euro-dollar to break the threshold," Harvey added.

GRAPHIC: Germany ZEW survey

Euro weakness was most pronounced against the dollar. The dollar index, which tracks the unit against a basket of six counterparts with the euro most heavily weighted, earlier climbed to 108.56, its highest since October 2002, but then eased to $108.10.

Analysts also cited growing uncertainty over the European Central Bank's plans to raise interest rates, initially by 25 basis points in July, then by 50 bps in September.

Fed funds futures, meanwhile, price U.S. rates reaching 3.50% by March, rising from 1.58% currently.

"The expectation is for the (U.S. Federal Reserve) to do 75 bps this month and its aim seems to be to get to neutral (rates) as soon as possible, while with ECB, it's more of a mixed message given the backdrop over gas," said Sarah Hewin, senior economist at Standard Chartered.

Euro weakness has been a big part of the dollar index's push higher, but the greenback has been also supported by worries about growth elsewhere, with China in particular implementing strict zero-COVID policies to contain fresh outbreaks.

The offshore-traded yuan approached one-month lows at 6.753.

The dollar slipped however to 136.72 yen, down 0.5%, following Monday's jump to new 24-year highs at 137.75.

The stuttering global economy is undermining commodity-focused currencies. Canada is expected to raise interest rates by 75 bps respectively on Wednesday but the Canadian dollar eased 0.2% versus U.S. dollar.

(The story refiles to fix exchange rate to add missing zero in para two).

© Copyright Thomson Reuters 2024. All rights reserved.