Euro Just Off Two-decade Low, Volatility Highest Since March 2020

A pullback in the dollar offered the euro some respite, allowing it to edge away from two-decade lows reached this week after surging energy prices fanned recession fears.

Risky assets, including the euro, managed gradual gains on Thursday as investors grappled with the risks of a recession and a potential pause in interest rate hikes.

European Central Bank minutes about its June policy meeting failed to affect the forex market.

Meanwhile, implied volatility remained near its highest levels since late March 2020 at 11.2%, reflecting a nervous market while investors look at the parity between the single currency and the dollar.

"Parity is within reach, and one can expect the market to want to see it now," said Moritz Paysen currency and rates advisor at Berenberg.

The euro rose 0.1% to 1.0194 after hitting a two-decade low at 1.01615 on Wednesday.

According to George Saravelos, global head of forex research at Deutsche Bank, "if Europe and the U.S. slip-slide into a recession in Q3 while the Fed is still hiking rates, these levels (0.95-0.97 in EUR/USD) could well be reached."

"The two key catalysts to mark a turn in the USD embedded in our forecasts are a signal that the Fed is entering a protracted pause in its tightening cycle and/or a clear peak in European energy tensions via an end to Ukraine hostilities," he said.

The dollar index - which measures the value of the currency against six counterparts - slipped 0.2% to 106.86, pulling away from Wednesday's peak of 107.27, a level not seen since late 2002.

Commodity-linked currencies strengthened as copper prices climbed. Some investors returned to the market on Thursday after heightened recession fears sent the red metal to its lowest level in nearly 20 months.

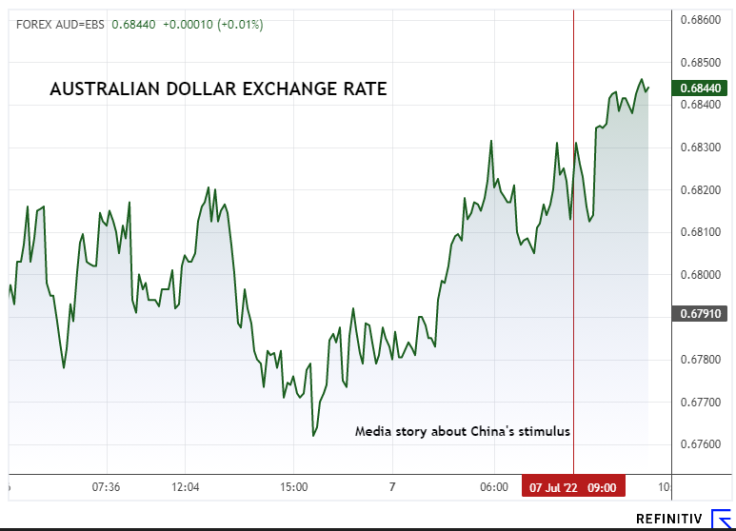

A Bloomberg News story, citing unnamed sources, said China mulled $220 billion stimulus with unprecedented bond sale.

"We saw a pretty muted reaction to the headline about China's stimulus plan, even for offshore yuan," said Roberto Mialich, forex strategist at Unicredit.

"We remain cautious about growth in China while we see commodity-linked currencies recovering today along with commodity prices," he added.

The offshore Chinese yuan was up 0.1% against the dollar to 6.705.

The Australian dollar rose 0.8% to 0.6841 against the U.S. dollar after recently hitting its lowest since June 2020 at 0.6762.

GRAPHIC: The Australian dollar

The Swiss Franc eased from its seven-year high, down 0.2% at 0.9909.

Earlier this week, inflation staying above the Swiss National Bank's (SNB) 0-2% target range for the fifth month fuelled talk that the central bank could soon tighten its policy again. Last month it hiked its policy rate for the first time in 15 years.

The SNB has signalled it is prepared to see the Swiss franc strengthen to choke off imported inflation.

Sterling was unchanged after British Prime Minister Boris Johnson said he would resign.

It was up 0.5% at $1.1977.

Analysts said the pound was mostly moving on broader economic concerns about a global recession, rather than Britain's political turmoil.

Bitcoin fell 0.7% and was last trading at $20,402. Ether fell 0.8% to 1,176.

© Copyright Thomson Reuters 2024. All rights reserved.