Euro Zone Deficits Are Narrowing, Thanks To Lack Of Borrowing Sources And Exports To North America, Asia

Euro zone countries hit hardest by the sovereign debt crisis have significantly narrowed their deficits over the past year, a sign that -- despite social unrest and steep cuts to social spending in countries like Greece and Spain -- austerity is having the desired effect on account balances.

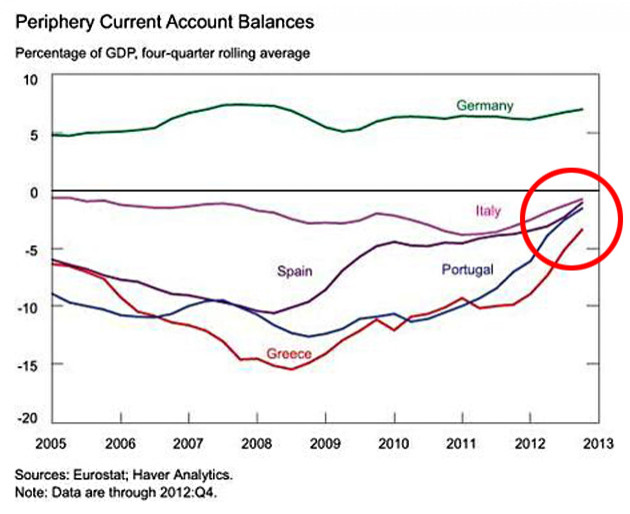

As seen above, some of the hardest-hit countries are approaching pre-crisis levels of deficit, a process that only began in earnest around the end of 2011. Meanwhile, Germany appears to be on its way to a pre-crisis surplus.

Read what the Federal Reserve Bank of New York said in its report on the subject that was issued on Wednesday:

Current account deficits in euro area periphery countries have now largely disappeared. This represents a substantial adjustment. Only two years ago, deficits stood at nearly 10 percent of GDP in Greece and Portugal and 5 percent in Spain and Italy (see chart below). This sharp narrowing means that spending has been brought in line with income, largely righting an imbalance that had left these countries dependent on heavy foreign borrowing.

Part of the reason for the rebound has been the loss of access to foreign credit. Three of the four counties in the chart above had to be bailed out by the IMF, the European Central Bank and the EU, led by Greece, which needed a staggering €380 billion (more than 50 percent above the country’s annual GDP) in order to stay in the union and avoid tanking the euro.

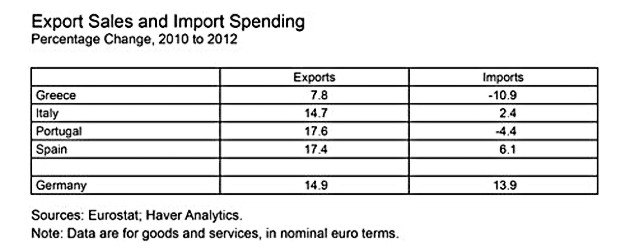

For Italy, Spain and Portugal, the difference between their domestic demand for imported goods and their exports to North America and Asia has helped close their gaps:

Read the whole N.Y. Fed report here.

© Copyright IBTimes 2024. All rights reserved.