Euro Zone February PMI Points To Deepening Slump; Schism Widening Between Germany And France

There are clouds gathering over the euro zone, as a closely-watched indicator showed the downturn in the region’s business activity worsened in February, putting a dent in hopes that the single currency bloc will emerge from recession in the first quarter.

“The PMIs raise concerns over the strength of the recovery for the rest of the year, with negative headwinds coming from fiscal austerity in southern Europe,” Societe Generale analyst Anatoli Annenkov said in a note to clients.

Markit's euro zone Composite Purchasing Managers' Index, a combination of the services and manufacturing sectors and seen as a guide to growth, fell to 47.3 this month, down from 48.6 in January, marking a year below the 50 threshold for growth and missing the expected uptick to 49.

The fall was mainly due to a drop in the services balance from 48.6 to 47.3. The manufacturing index also declined, but the drop from 47.9 to 47.8 was much smaller.

“A steepening rate of decline in February is a disappointment, and suggests that the euro zone is on course to contract for a fourth consecutive quarter in the first three months of the year,” Chris Williamson, chief economist at Markit, said in a statement. A contraction of 0.2 percent to 0.3 percent looks likely, Williamson said.

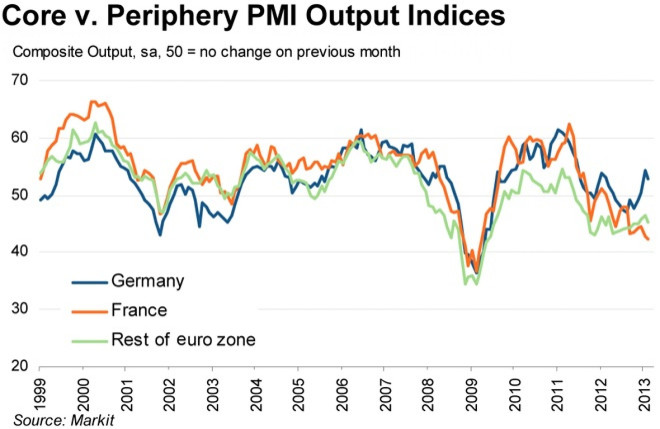

The survey also showed that the national divergences between France and Germany -- the two biggest economies in the euro zone -- have widened so far this year to the worst seen since the survey began in 1998.

Germany is on course to grow in the first quarter, recovering from the 0.6 percent gross domestic product fall seen in the fourth quarter, possibly expanding by as much as 0.4 percent, according to Williamson. In contrast, Frances’s downturn is likely to deepen, bringing the euro area’s second-largest member more in line with the periphery than with the now solitary-looking German "core."

Outside of France and Germany, the rate of decline was the fastest in three months, though it was weaker than the downturn seen in France.

“The improvement in the financial markets will not be enough on its own to kickstart an economic recovery,” Ben May, at Capital Economics, said in a note to clients.

© Copyright IBTimes 2024. All rights reserved.