Euro Zone Industrial Production Falls Sharply In January, Fueling ‘Too Much Austerity?’ Debate

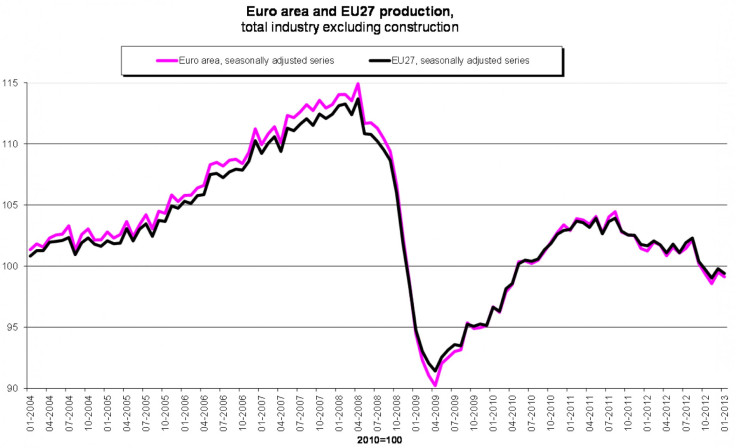

Industrial production in Europe sank faster than expected in January as traditionally stronger economies such as Germany, France and Finland saw factory output slip, reinforcing concern that the euro zone is headed for further contraction in the first quarter of 2013.

The monthly fall in production of 0.4 percent across all 17 countries sharing the euro was worse than the consensus expectation of a 0.1 percent decline and was the fourth fall in five months, the EU’s statistics office said on Wednesday.

Factory output in the euro zone was down by 1.5 percent in the three months to January compared to the three months to October 2012, while it was also down by 1.3 percent year-on-year in January itself.

Production of machinery used to make other goods, an indicator of future business, fell 1.2 percent in January from the previous month and output of durable consumer goods, such as cars and furniture, fell 1.4 percent in the same period.

Germany and France, the euro zone's two biggest economies, both recorded a contraction in manufacturing.

Ben May, European economist at Capital Economics, said that with business surveys still pointing to further falls in production, it was unlikely that the industrial sector was on the cusp of a sustained recovery.

The euro zone economy is struggling to regain momentum after five straight quarters of contraction, with unemployment at a record 11.9 percent.

The sinking demand for durable goods suggests that at a time of record unemployment, consumers are reluctant to spend on big-ticket items such as TVs and fridges.

It’s a “timely reminder that, despite the improvement in business and financial market sentiment, the region may have remained in recession in the first quarter,” May said in a note to clients.

Wednesday’s dismal industrial production data will surely feed the “too much austerity debate” that is set to be discussed during Thursday’s European council, just ahead of the Eurogroup, which will discuss the Cyprus case on Friday.

Jens Weidmann, Bundesbank president, reiterated at a press conference on Tuesday that the "crisis is not over despite the recent calm on financial markets.”

The European Central Bank said last week it still expected a gradual recovery to begin during the second half of the year. Euro zone gross domestic product shrank by 0.6 percent last year.

January’s fall in the euro-region’s industrial production will keep pressure on the ECB to cut interest rates to below the current 0.75 percent rate later this year, which would lower the cost of borrowing for companies and households.

“While sovereign debt tensions have eased markedly overall since autumn 2012 and business and to a lesser extent consumer confidence has improved, this is yet to really feed through to lift economic activity in most euro zone countries,” said Howard Archer, chief European economist at IHS Global Insight. “Businesses seem likely to be wary about stepping up their investment for the time being.”

© Copyright IBTimes 2024. All rights reserved.