European Equity Funds See Biggest Outflows Since Brexit Referendum

Investors are dumping European stocks this year, seeking to minimise exposure to a region buffeted not merely by soaring inflation but also an energy crisis wrought by the Ukraine-Russia conflict.

Yet, despite worries over a global economic recession, rising policy rates and an earnings slowdown, fund managers are shopping for stocks in most other parts of the world.

According to Refinitiv Lipper data, European equity funds have witnessed outflows worth $31.2 billion in the first eight months of this year, the biggest since 2016, when recession worries mounted after UK's exit from the euro zone.

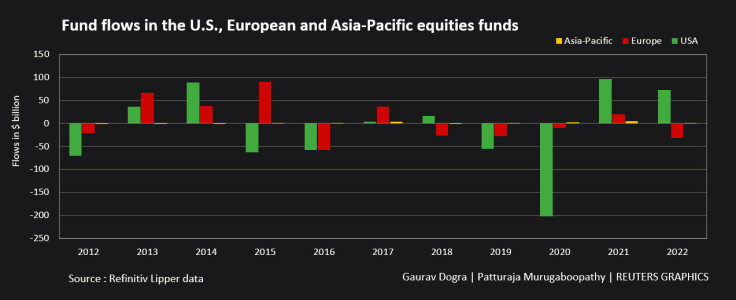

Graphics: Fund flows in the U.S., European and Asia Pacific equities funds:

At the same time, U.S. equity funds have lured a massive inflow of $72.69 billion, while Asian equity funds obtained $983 million.

"While inflation, growth and monetary policy concerns are global in nature, Europe is uniquely exposed to the Russian-Ukraine conflict which has exposed the fragility in the continent's energy infrastructure," said Jim Smigiel, chief investment officer at SEI Investments.

"With no end in sight to the conflict and winter fast approaching, uncertainty will continue to weigh heavy on investors' minds when it comes to allocating assets to Europe."

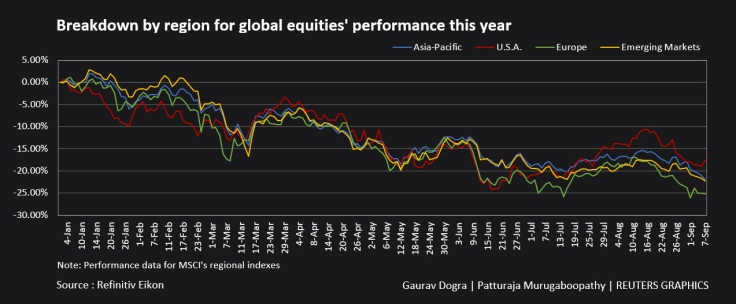

The MSCI Europe index has fallen 25.2% this year, compared with the MSCI United States index's decline of 17.5% and the MSCI All Country Asia Pacific's slump of 22%.

Graphics: Breakdown by region for global equities performance this year:

WEAKER EARNINGS OUTLOOK

Analysts said European firms' weaker earnings outlook has also deterred investments in the region.

Recent data showed manufacturing activity across the euro zone shrank for a second month in August. On the other hand, U.S. manufacturing grew steadily in August, and its new orders index also rebounded, suggesting strong demand for its products.

Morgan Stanley said leading indicators such as the Purchasing Manager's Index (PMI) point toward a 10% fall in European earnings in the next six months.

"With corporate pricing power starting to fade, the margin outlook for corporates is likely to get much more difficult next year," Morgan Stanley analysts wrote. "Our margin indicator is pointing towards the biggest decline in margins since the global financial crisis."

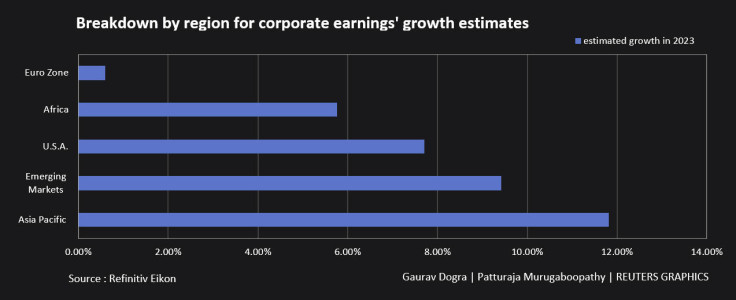

According to Refinitiv data, large- and mid-cap companies in Europe are expected to post earnings growth of just 0.3% in 2023, compared with such U.S. firms' growth of 7.7% and Asia-Pacific firms' 11.8%.

Graphics: Breakdown by region for corporate earnings' growth estimates:

Also, the euro's slump against the dollar this year is a reason for big outflows from the region, analysts said.

Both the Federal Reserve and the European Central Bank have taken aggressive steps to combat inflation by hiking their interest rates this year. Yet, the euro has fallen over 12% so far in 2022.

"The added attraction of U.S. dollar assets is potentially an additional tailwind to flows out of Europe," said SEI Investments' Smigiel.

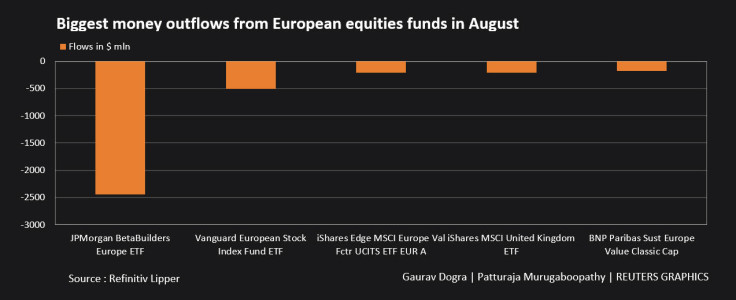

Graphics: Biggest money outflows from European equities funds in August:

© Copyright Thomson Reuters 2024. All rights reserved.