Evergreen Solar files for bankruptcy

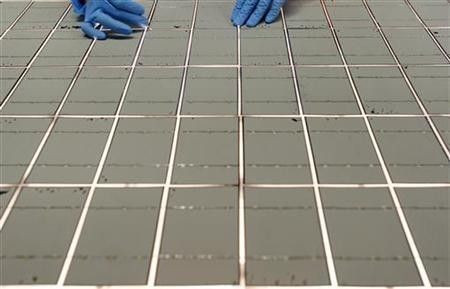

U.S. solar company Evergreen Solar Inc filed for bankruptcy on Monday, its once cutting-edge technology falling victim to competition from cheaper Chinese rivals and to solar subsidy cuts in Europe.

The Chapter 11 filing by a company once seen at the forefront of U.S. renewable energy technology came after a two-year struggle to stave off competition from Asia. The increasingly crowded market forced Evergreen to close its much-touted but short-lived Massachusetts factory and relocate manufacturing to China, and resulted in the virtual disappearance of its once-lofty stock market value.

Evergreen's solar wafer technology was a favorite of investors in 2007 and 2008 because it used dramatically less of the industry's key pricey raw material, polysilicon. At the time, however, silicon prices were 10 times what they are today, making that advantage less meaningful as silicon prices gradually retreated from their highs.

But the Marlboro, Massachusetts, company's troubles worsened markedly in recent months as top solar markets Italy and Germany pared back subsidies, increasing global supplies of solar panels and sending prices into a tailspin.

This year's turmoil in the solar market has hurt the profits of even the industry's top manufacturers, including U.S. heavyweights First Solar Inc and SunPower Corp

In April, Evergreen warned investors that it had been hurt by the downturn in demand and might need to raise cash sooner than expected. It failed then, however to reach a deal with bondholders to restructure its debt, a development that would have made it easier to raise capital.

According to documents filed on Monday in U.S. Bankruptcy Court in Delaware, Evergreen has now reached a deal in which the holders of its secured notes will bid the $165 million they are owed for the company. The so-called stalking horse bid is subject to higher offers, and the company and its bankers will market Evergreen to potential buyers. Delaware's bankruptcy court must approve any deal.

Holders of the company's unsecured notes may get nothing unless the company is sold for more than $165 million. As in many bankruptcies, shareholders are likely to be wiped out.

In court records, the company listed assets of $424.5 million and debts of $485.6 million.

Evergreen's top creditors include U.S. Bancorp; its Chinese manufacturing partner, Jiawei Solar; Massachusetts economic development organization MassDevelopment; Lazard Capital Marketing; and Korea's OCI Co Ltd.

Shareholders with more than 5 percent voting stakes in the company include Aristeia Capital LLC, OCI and Vanguard Group.

Evergreen's stock was trading at 29 cents Monday on the Nasdaq. It hit an all-time high of $113.10 in late 2007.

© Copyright Thomson Reuters 2024. All rights reserved.