Every Year, We Test Over 1,000 Hypotheses — Alisa Lynn On SKL.vc 'Hypothesis Testing Factory'

VC investors are closing out 2024 on a stable note and entering 2025 with optimism, a recent Pitchbook research says. The market maintains a cautious approach but remains confident in the disruptive potential of innovations such as AI, deep tech, and robotics, with key focus areas including healthcare AI (39%), AI infrastructure (33%), and biotech (24%).

We interviewed Alissa Lynn, a serial tech entrepreneur and Managing Partner at SKL.vc, a data-driven venture builder, to discuss strategies for succeeding in the highly competitive B2C market, key investment industries, major trends for 2025, and the cost of a single idea.

Could you tell us more about the venture builder model, why did you arrive at this particular structure? What sets SKL.vc apart, in terms of your team and investment thesis, from other traditional VCs and accelerators?

The world of venture building can be an alluring space, and many aspiring startup founders think their ideas are so brilliant that everyone will suddenly want to invest millions of dollars in them. However, spoiler alert: If you're looking for money, you most likely won't find it in entrepreneurship. If you're looking for the best strategy to achieve financial independence, you should head to large corporations. That's still the easiest way to secure a peaceful retirement in a mountain cabin with minimal risk.

But if you want to raise the stakes and build a product that could change the world, your only real option is tech startups. On this path, however, the success rate is similar to a lottery. There's a tiny fraction of a percent chance you'll become a unicorn — according to CB Insights, only 24 companies passed the $1B valuation last quarter. Then, there's only a 0,5% chance you'll grow a mid-sized business, and a 3-10% chance you'll build a small one. The rest is just wasting time and money.

Instead, here is what we offer to founders. If you're an aspiring entrepreneur with a brilliant idea, instead of playing the startup lottery, you can use a secret weapon — a venture builder like SKL.vc.

We provide founders with a simulator to test out their ideas.

As a venture builder, we are not a traditional VC firm. What this means is that we launch startups from the idea stage and focus all our resources on scaling our own projects.

SKL.vc takes care of all expenses and also offers to founders a very competitive salary, so the only thing they need is to focus entirely on their product. And we don't invest in external projects and don't participate in traditional funding rounds.

You've just selected startups for your new Launch Camp cohort. How many companies will participate in the new program? What is your vision for the next batch of entrepreneurs?

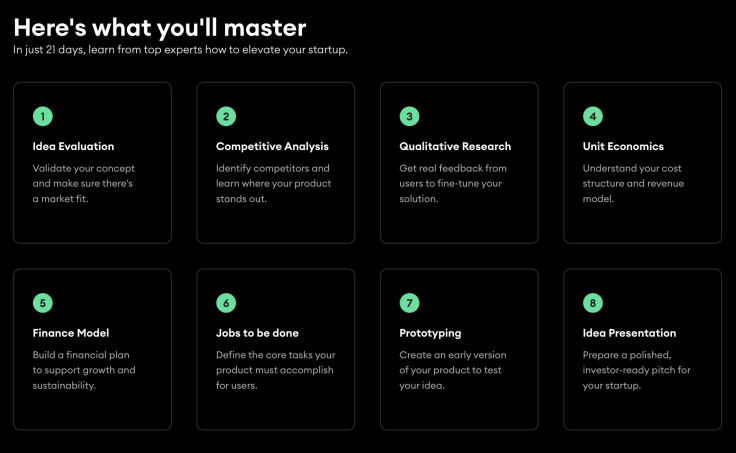

For those unfamiliar with it, B2C Launch Camp is an intensive program designed for aspiring entrepreneurs. In 21 days, participants refine their project ideas and turn them into market-ready products. SKL.vc covers all the costs of the program because we believe in our methodology and the founders we select for this program. The fact that the program is free for participants also allows us to filter out less motivated teams as people tend to place less value on things that are free.

We've recently launched the second cohort, and the participants' response has been phenomenal. This time, we've got even more applications than we did for the first one: 328 teams applied, and 184 were selected to join the program. Interestingly, Lifestyle is the leading industry, far ahead of others. Fintech, Co-pilots, and Creative economy followed closely behind.

During these 3 weeks, the teams went through several selection stages. Only those who could deliver high-quality results on time advanced. They gained full support from SKL.vc to further develop their projects. It was a challenging process, but the payoff is huge.

Your July-August 2024 camp had 458 participants from 279 teams, with 6 teams receiving offers. What's the typical success rate? What determines if a team makes it to the final stage?

The first thing we look at when selecting participants is the strength of their startup idea. Does it have the potential to become a unicorn? Is it scalable? Is it relevant for different markets and countries?

Moreover, Launch Camp is demanding — it requires serious time commitment, dedication and effort. Many of our participants have full-time jobs or work on other projects, and during the first camp, some even took some time off work to focus fully on the program. While our selection process is tough, that's intentional. It's not just about great ideas. We value teams and solopreneurs that can go beyond generating ideas and actually execute them successfully.

Out of all the participants from the first Camp, 5 projects are currently in the MVP development stage. Each of them will receive an investment of at least $500,000 from us.

Can you share specific examples of successful projects from your first cohort?

Overall, most people who apply to the camp program are driven by their ambitions. They want to build something meaningful that millions of people will use — and that's completely understandable. In fact, I'd say that's the main motivation for most people entering tech entrepreneurship today, as the chance to get rich here isn't as high as in large companies. But the chance to build a famous product is definitely greater.

Several projects stood out from the first Camp cohort, and one of our favorites was a virtual assistant designed to simplify online shopping. It finds the best available options in online stores or marketplaces, ready to order with just one click. You type your request, and the bot compares prices across different retailers. For example, a specific set of items might cost $100 at Whole Foods, while a similar selection (perhaps with minor adjustments) could be just $45 at Walmart.

There's no need to upload a strict grocery list. Users can describe their needs in simple terms, like "Quick dinner for a vegetarian" or "10 kilos of high protein food for the whole week." The bot then engages in a dialogue to check the details.

What were your biggest learnings and takeaways from the first cohort? How does your program help entrepreneurs pivot or validate their assumptions? What surprised you the most from this first batch of participants?

Every team goes through several stages during the camp: validating their idea, analyzing competitors, understanding unit economics, building a financial plan, prototyping, among others. So, in just 21 days, they go from a simple idea to a fully developed project.

At any point, a team might realize their idea isn't working. And that's okay. We've seen plenty of teams pivot their ideas during the camp, and honestly, that's where some of the best outcomes come from. Learning not to get too attached to an idea is one of the biggest skills that participants take away.

What does SKL.vc startup camp program add to the global startup ecosystem?

That's a good question. Launch Camp gives its participants a great opportunity to test their ideas for free, all they need to invest is just their free time and commitment.

Think about how much one idea costs, to test and to launch a very good idea. We often say that every idea is worth a 'minus $50,000,' which is the average cost of testing whether it will work. And each smaller experiment within that idea will set you back another $5,000.

That's why so many great ideas never really get off the ground: people are afraid to risk it all. Maybe they've got family responsibilities and can't just drop everything to jump into the world of entrepreneurship.

So we have a dedicated team of over 75 professionals — many of whom are experienced entrepreneurs themselves. They work closely with founders and provide full support during the program. And by 'full support' I really mean it: we help startups with anything they need from analytics to strategy, marketing, and beyond.

We also provide participants with the opportunity to save time and resources in testing their idea on their own. They could have been stuck with an idea for months, not knowing where to go next. But in just a few weeks, they have a clear plan for what comes next. They are going to have clear answers about what works, what doesn't, and what they should do next. There are very few programs like this anywhere in the world that offer founders this much value in such a short period of time.

Can you tell me more about your focus on "hypothesis testing,"why is that important to your investment thesis at SKL.vc?

For most IT entrepreneurs, the main problem is time, multiplied by money and resources. With a typical journey in this field, there's usually only enough time to test and launch 2-3 products, and the chances that they'll be successful aren't that high.

I like to say that SKL.vc is a 'hypothesis testing factory.' Every year, we test over 1,000 hypotheses, with the goal of building 3 to 5 fast-growing companies. As I mentioned, we've an environment where we can quickly test new ideas. So, we can instantly see if there's demand, how much people are willing to pay, and get a sense of how users will behave.

It's all about getting that working prototype out there as fast as possible, even if it's not perfect. Some of our products go live just 2 to 4 weeks after starting development. That way, we can start gathering feedback right away and make improvements in real time. This dramatically increases the chances of success.

The metrics depend on the project, but we often analyze the demand funnel to assess user interest in a specific offering. We also check the cost per action (CPA). In some cases, we use different parameters; for instance, with the online shopping assistant I mentioned earlier, we measured the average cart value per user.

Long-term vision: What is your vision for exits and returns given your unique equity structure?

Any exit strategy is entirely individual and depends on the specific project, there's no universal approach. But in general, as the project develops, founders and team members receive substantial stock options, which dilute our share in the cap table. Despite this, our stake remains significant enough to ensure a strong return at exit.

Transition from a corporate role to a startup founder: What corporate habits do you find most helpful/harmful in founders transitioning to startups?

The transition from corporate jobs to entrepreneurship is quite common, especially for those who've reached C-level positions and now want to start their own venture. These people have some real advantages. For example, they're usually more structured. They get the importance of being on time, respecting deadlines and keeping promises. After working in industries like big tech, they tend to approach ideas with a clear head and a more realistic worldview.

But there's a downside, too. A lot of them go through a trust crisis. They know that nothing comes for free, so they can become overly cautious. They also value stability, so they're often hesitant to take risks to avoid letting others down and protect themselves from disappointment.

How do you help founders think about global scaling from day one? Why is that important?

Playing small and playing big are entirely different games, each with its own set of rules. Over my career, I've mentored many startups, and one of the most important questions I always ask founders is: what do they truly want? Is it a small, comfortable business where they can do what they love and earn a decent living? Or are their ambitions so bold that they're ready to sacrifice everything to change the world?

Often, founders who would be happy running a small company choose the venture path, only to end up unhappy. The race for scale isn't for everyone. That's why at SKL.vc we work with founders who are driven by the ambition to grow big from the start.

As we're approaching the end of 2024, what key investment trends do you see emerging next year? Which global trends are you paying the most attention to at SKl.vc?

In 2024, the market saw the rise of startups using large language models. In reality, this led to an increased number of chatbots performing various tasks. However, by the end of the year, many of these projects did not prove successful, and investors became much more selective about funding them.

The second trend, shaped by the venture winter, is a shift in investor priorities. Across stages, investors are no longer focused only on growth — they're looking for profitable growth. This is a real challenge for business models that require significant upfront losses to scale. Many of these startups are now struggling to secure funding.

The third trend is the evolution of co-pilots. In fact, this is a reflection of a broader move toward AI-driven automation across many professions. It's not about replacement but rather about cost optimization and accelerating many professional activities.

In terms of your evergreen trends and priorities, why has SKL.vc been so focused on B2C specifically?

We focus on B2C projects, and that's what sets us apart from most other players in the market. Every time I bring it up, people are surprised because B2C is such a challenging market — it's competitive, mature, and well-established. For example, according to Pitchbook data, venture funding for B2B AI startups has reached $16.4 billion this year, while B2C AI startups receive just $7.8 billion, less than a half.

But the beauty of B2C is that you can test a huge number of hypotheses — just like 'the hypothesis factory' I mentioned earlier. This kind of rapid development is nearly impossible in B2B. However, the biggest motivation for us is that B2C products are the ones that truly change the world and impact people's daily lives. It's very rewarding to know that so many people use our products. Honestly, that alone is enough to keep us going in the consumer market.

© Copyright IBTimes 2024. All rights reserved.