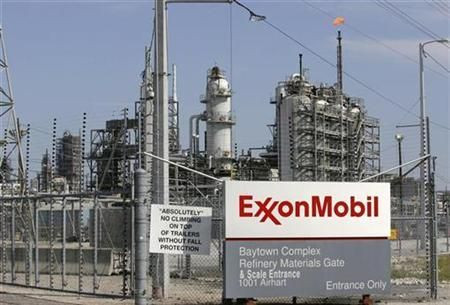

Exxon Mobil Corporation (XOM) Q2 Earnings Preview: Lowest Profits Since 2010 Due To Decreased Production And Hike In Crude Oil Prices

Exxon Mobil Corporation (NYSE:XOM), the world’s largest publicly owned integrated oil company and the largest company by market value, is expected to report a 44.0 percent year-on-year decrease in profits in the second quarter, stemming from lower upstream earnings from lower production and the collapse of refining margins in June.

Exxon Mobil, which reports earnings Thursday before the markets open, is likely to post a profit of $1.91 per share on $105.54 billion in revenue, compared with earnings of $3.41 per share for the second quarter of 2012 on revenue of $127.36 billion, according to analysts polled by Thomson Reuters. Net income is projected to rise to $8.47 billion, an 8 percent increase from $8.40 billion in the second quarter of 2012.

The disappointing projected results, which would be Exxon’s lowest EPS since the last quarter of 2010, are in large part caused by a decrease in production, which led to weaker exploration and production earnings.

“We expect production of 4,098 kboepd [thousand barrels of oil equivalent per day], 7 percent below 1Q13 levels, with the sequential drop driven primarily by seasonal factors in Europe,” said Katherine Lucas Minyard, an analyst for J.P. Morgan in a research note.

Exxon has been struggling with growth recently, as many of its fields are mature, and production has been declining. The company has several major fields in development, including the Kearl Initial Development in the Canadian tar sands, which started up in late April, that are expected to eventually increase output, but they are not likely to contribute until 2015.

"Lower production at Exxon is an ongoing trend. They need so many projects to come online to offset field decline,” said Brian Youngberg, an analyst at Edward Jones.

In addition, a dramatic increase in crude oil prices in June slashed refining margins for Exxon and other oil companies. On April 17, crude closed at $87.22 a barrel, and it steadily increased to the end of the second quarter, closing at $96.44. In contrast, gasoline prices closed at $2.63 a gallon on April 17, and showed a slight bump over the same period to $2.70 by June 28, a 2.66 percent increase against the 10.57 percent in crude, narrowing the spread between the price companies purchase oil and the price they sold fuel.

Natural gas prices have averaged 23 percent higher in 2013 compared to 2012, but an average of $3.74 per thousand cubic feet is still too low to inspire drillers to aggressively explore new fields.

So far in 2013, Exxon Mobil’s shares are up about 8 percent, underperforming the integrated oil and gas sub-industry index, which is up 13.6 percent through July 26, according to a research note from S&P.

© Copyright IBTimes 2024. All rights reserved.