Facebook Accounts For 25% Of Digital Advertising Revenue In US

Everyone is focused on digital video these days. Facebook (NASDAQ:FB) is investing hundreds of millions of dollars in an effort to compete with Alphabet's (NASDAQ:GOOG)(NASDAQ:GOOGL) YouTube. Meanwhile, Twitter (NYSE:TWTR) and Snap (NYSE:SNAP) are partnering with major media companies to produce video content for their respective platforms and share revenue. Not to mention the increasing budgets from companies competing in premium streaming video.

This article originally appeared in the Motley Fool.

Ad-supported video streaming is becoming increasingly popular. Roku's management says it's seeing a shift in time spent on its streaming platform toward free ad-supported channels. Meanwhile, Amazon is working on an ad-supported streaming service, while Hulu and others continue to operate a hybrid subscription-plus-advertising model.

The growing popularity in video has led to an estimated 30% increase in digital video advertising spending in the U.S., according to eMarketer. Overall, video ads account for about one-quarter of all digital advertising in the country. Facebook is absolutely dominant in the space, accounting for 25% of digital advertising revenue this year.

Getting bigger than YouTube

Facebook's U.S. video ad revenue, including Instagram, is projected to total $6.81 billion this year. That's over twice as much as the net revenue Google will generate from YouTube, $3.36 billion. eMarketer points out that YouTube shares more than half of gross revenue with its content creators, so the numbers aren't exactly comparable.

Overall, advertisers spend a very similar amount on YouTube and Facebook, despite the former's massive head start in video. YouTube typically takes a 45% cut of video ad revenue, sharing the rest with creators. So, based on eMarketer's estimate, advertisers are spending around $7.5 billion on video ads on YouTube in the U.S.

Comparing Facebook to other popular social networks is no contest. Twitter generates just $633 million in revenue from video in the U.S., and Snap expects to bring in $397 million in U.S. video revenue this year. To put that in perspective, Facebook generates about 18 times as much in video ad revenue from U.S. users despite having less than 2.5 times as many users.

Only YouTube is generating more gross video ad revenue than Facebook on a per-user basis. Alphabet doesn't release regular user metrics for YouTube, but the company announced it had 1.8 billion global users earlier this year. That's a bit smaller than Facebook's 2.5 billion unique users across its family of apps.

But again, Facebook keeps nearly all of its video ad revenue, whereas YouTube shares most of it. Furthermore, there are several reasons to believe Facebook could continue to grow faster than the rest of the market when it comes to video advertising.

3 reasons Facebook could take even more share of video advertising

Facebook's journey in video may be just getting started.

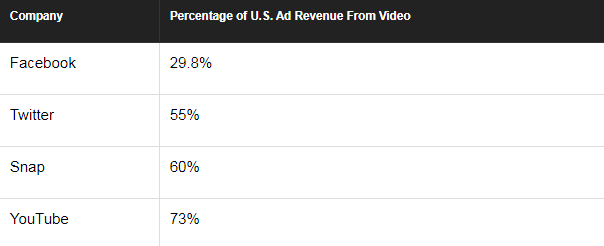

As a percentage of its overall ad revenue, video represents less than 30% in the U.S. for Facebook. That's far less than competitors

Video's disproportionately low share of advertising on Facebook compared with other competitors is perhaps understandable in a comparison with video-first products like Snapchat and YouTube, but feed-based Twitter is still generating more than half of its revenue from video ads. Facebook ought to produce a comparable amount of revenue from video content.

A second reason to expect further video advertising growth for Facebook is the growth of Stories, as the photo and video collections feature lends itself to video advertisements. Facebook has 1.15 billion users across its four Stories products. Those aren't all unique users, but the amount of engagement on Stories is currently under-monetized relative to Facebook's feed-based advertisements in Facebook and Instagram.

Finally, Facebook is investing in its Watch platform and in-stream advertisements. The company has bought the rights to live sports events and is working with production studios to develop originals for the platform. Both represent a major opportunity to attract advertisers. "We think advertisers will increase their usage of [in-stream video ads] because it is similar to linear TV advertising," eMarketer lead analyst Debra Aho Williamson said.

There's still plenty of room for Facebook to grow its video advertising and outpace YouTube to become the absolute largest digital video ad platform in the country.

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Adam Levy owns shares of Alphabet (C shares), Amazon, and Facebook. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Amazon, Facebook, and Twitter. The Motley Fool has a disclosure policy.