Facebook Earnings: Growth Continues To Decelerate

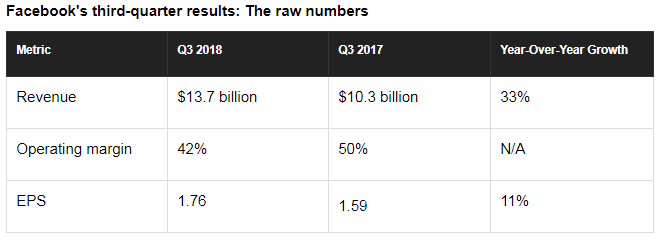

Going into Facebook's (NASDAQ:FB) third-quarter results this week, it was clear the social network would face decelerating revenue growth and higher costs -- and that's exactly what happened. Revenue growth decelerated from 42% year-over-year growth in the second quarter of 2018 to 33% growth in Q3, and operating expenses jumped 53% year over year.

This article originally appeared in the Motley Fool.

Here's a closer look at these trends, along with some other key takeaways, from Facebook's third-quarter earnings release on Tuesday.

Facebook's revenue increased 33% year over year to $13.7 billion. But outsize growth in the social network's operating costs meant Facebook's operating margin narrowed from 50% in the year-ago quarter to 42%. That led to underwhelming year-over-year earnings-per-share growth of 11%.

Facebook's business benefited from further growth in the company's uses across its social networks. Total users interacting with at least one of its apps each month, including Facebook, Instagram, WhatsApp, and Messenger, increased from 2.5 billion on Q2 to 2.6 billion in Q3.

It's worth emphasizing how substantial Facebook's profits have become. The company's net income alone in Q3 alone was $5.1 billion, up from $4.7 billion in the year-ago quarter.

Second-quarter highlights

- Monthly users on Facebook's native social network were 2.27 billion, up 10% year over year.

- Daily active users on the platform were 1.49 billion, up 9% year over year.

- More than 2 billion people now use at least one of Facebook's services every day.

- Facebook's daily active users in Europe fell for the second quarter in a row to 278 million, down from 282 million two quarters ago.

- Daily active users on Facebook in the U.S. remained at 185 million.

- Facebook's daily active users in its Asia-Pacific and rest-of-world geographic segments increased 2% and 2.7% sequentially, respectively.

- Helping Facebook's ad revenue was a 7% year-over-year increase in ad prices and 25% more ad impressions across its services.

- Facebook's 53% year-over-year jump in operating costs was an acceleration from a 50% increase in costs in Q2.

Looking ahead

For Facebook's fourth quarter, management expects a further deceleration in revenue growth. Specifically, management guided for its fourth-quarter revenue growth rate to be about 5 to 9 percentage points lower than in Q3. Explaining this forecast during the company's third-quarter earnings call, management cited expectations for ad impression growth to come from "product surfaces and geographies that monetize at lower rates" than Facebook's lucrative News Feed, headwinds from data privacy initiatives on ad pricing growth, and more prominent placement of products with undeveloped ad formats, such as Stories.

For its full-year expense guidance, management said it now expects 2018 expenses to increase 50% to 55% -- lower than a previous forecast for 50% to 60% growth.

Daniel Sparks has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Facebook. The Motley Fool has the following options: short November 2018 $155 calls on Facebook and long November 2018 $135 puts on Facebook. The Motley Fool has a disclosure policy.