Facebook Inc (FB) Q2 Earnings: Social Network's Revenues Top $4 Billion, Mobile Accounts For 76% Of Ad Dollars

Facebook made one thing clear when it released second-quarter earnings Wednesday: the social network can sustain growth. Not only that, the website and mobile apps can pull in money with advertising across a slew of products. Facebook posted $4.04 billion in revenue for Q2, up 39 percent year-over-year and pushing past analysts estimates.

Growth was driven primarily by mobile advertising, which is now up to 76 percent of revenue, after accounting for 73 percent from last quarter and 69 percent from second-quarter 2014. Analysts had estimated that the network could reach $3.99 billion and some high-balled at $4.10 billion.

“I’m very impressed, and I didn’t expect that [mobile] number to grow anymore. The video advertising product is what's more impressive," said Jan Rezab, CEO of social media analytics company and Facebook marketing partner Socialbakers.

Facebook as a network is up with 1.49 billion monthly active users. The social network boasted 1.44 billion users, which notably pushed it past the population of China, for its first-quarter report in April. That user number is up from 1.3 billion in July 2014, meaning that the site alone has grown by 13 percent year-over-year. Mobile daily active users was also up by 29 percent at 844 million.

"Engagement across our family of apps keeps growing, and we remain focused on improving the quality of our services," Facebook CEO Mark Zuckerberg said in a statement.

Despite high revenues, profits margins fell for the company. Zuckerberg and his team reiterated that 2015 is an investment year for Facebook. “We’re improving the speed and reliability of our apps,” Zuckerberg said. “Our engineering focus is delivering great experiences.”

Shifting to Mobile

Revenue is pouring in not only from Facebook's main site and app. It has also improved on its ad options through a new mobile app install. That feature is number one driver of app installs for HBO’s video streaming app HBO Now.

“We’re capitalizing on a shift to mobile,” said Facebook’s Chief Operating Officer Sheryl Sandberg. “Video is making it even better. Mobile video was one of the biggest scenes at Cannes.”

Sandberg noted several of the ad campaigns -- including Procter & Gamble’s #LikeAGirl and Under Armour’s “I will what I want” -- that have reported success on Facebook and were highlighted at the Cannes Lions International Festival in June. Now, Facebook is surfacing more videos on users’ News Feed as well as testing more suggested content.

The network also boasted not only the visual appeal of its ads but a major appeal it has by being a social network -- direct targeting to a defined user base and improved capability to measure results afterwards. For example, LiveNation purchased mobile ads on Facebook and found that 66 percent of ticket purchases were made.

Over the past three months, Facebook has introduced more advertising options, such as "carousel ads" and "buy" buttons," into its photo-sharing app Instagram. But the network has stayed mum on how much money Instagram is bringing in. WhatsApp, a messaging app Facebook acquired in October 2014 for $19 billion, has yet to introduce advertising or other money-making strategies.

Building An “Ecosystem”

For Instagram advertising, Facebook has started relationships with brands and marketers to use both products. As a photo-sharing app, the app has found evident partners in fashion and auto companies. Indeed, Facebook hired former Lucky magazine editor Eva Chen as its head of fashion partnerships earlier this month.

However, the company continues to decline breaking down its revenue numbers. Both Zuckerberg and Sandberg professed the care they take to the growing Instagram community. Zuckerberg likened the pace of the progress to what he witnessed in introducing ads on Facebook’s News Feed on desktop. "We're very, very cautious,” Sandberg said. “Instagram remains small relative to Facebook and it’s really going to take time.”

As of June, Instagram has 300 million active monthly users, WhatsApp has 800 million active monthly users, and Messenger has 700 million. Those active user numbers did not significantly change from what had been reported in April 2015 -- even after Facebook allowed Messenger users to sign-in without a Facebook account.

Facebook did release new user numbers on its other standalone products, including 850 million people using Facebook Groups and 450 million people using Facebook Events. Groups has already developed into its own standalone mobile app, and the company has considered creating one for Events. Those developments add to Facebook’s own product unbundling, and the company has made major acquisitions to support what Zuckerberg calls an “ecosystem” as he focuses on “our next generation of apps.”

“I bet that Instagram and WhatsApp are making a big difference for them. I can see them making more acquisitions in the social space,” Socialbakers’ Rezab said.

The company has yet to release its own live-streaming video products or fully fleshed video app, unlike competitor networks Twitter-owned Periscope and Yahoo’s recently unveiled Livetext. In response to an investor’s question on developing their own version, "I don't think we'd rule out the things you just mentioned,” Zuckerberg said.

Investing Beyond 2015

Wall Street wasn't initially pleased with results. The stock price closed at 2 percent at markets close and fell 3 percent in after-hours trading after the numbers were released. That fall could in part be driven by the company's increased spending. Despite revenue rising by 39 percent, Facebook's reported a net income drop of 9 percent compared to the same period a year ago.

"It's clear Facebook is not rushing," Socialbakers' Rezab said. "There were overly positive expectations. I think the costs are something that investors can't really swallow even though Facebook has made it clear. I think that's why Google's results were more positive. They showed they cared about profits."

Facebook had poured $1.17 billion into research and development in the second quarter, according to the earnings report.

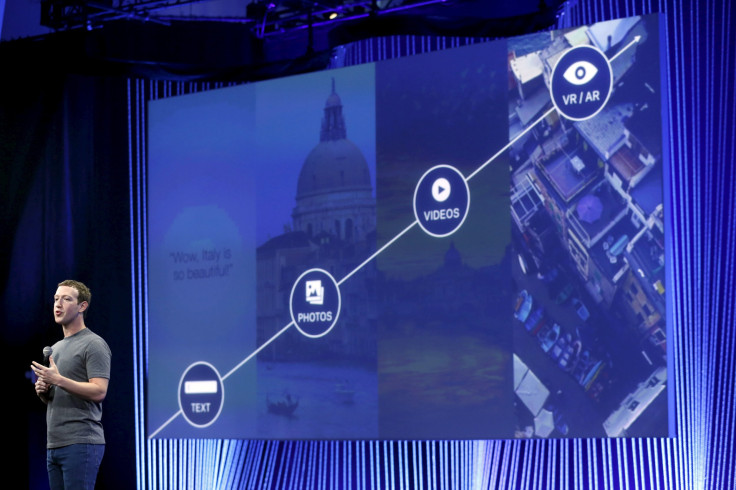

The company has made several acquisitions over the past three months, some of which contributed to its virtual reality division called Oculus. In May, Oculus acquired an augmented reality startup called Surreal Vision for an undisclosed sum. In July, Facebook spent $60 million on Pebbles, a gesture control company. Oculus isn't expect to release its first consumer product until spring 2016.

"We request for patience," Zuckerberg said. “I think there are plenty of other worlds we could be living in. The execution is hard.

Facebook may also be losing web traffic while it gains mobile-only users. Those users are also coming from the company's Internet.org initiative that provides mobile services to developing countries.

This story has been updated to include comment and insight from the 5 p.m. EDT investor's call.

© Copyright IBTimes 2024. All rights reserved.