Facebook overvalued at $50 bln: Bloomberg's global poll

Sixty-nine per cent of investors say Facebook is overvalued after Goldman Sachs invested $450 million in a deal that valued the company at $50 billion, according to the quarterly poll of 1,000 Bloomberg customers who are investors, traders or analysts.

The Bloomberg poll conducted between January 21 and 24 shows investors disagree with Goldman Sachs' assessment that Facebook is worth more than Web pioneers such as Yahoo!, the biggest web portal, and eBay, owner of the biggest online retail marketplace. Palo Alto, California-based Facebook surpassed Yahoo! in October as the third most-visited website in the world, the report says.

Those investing in Facebook, expecting it to be the next Google, might be in for some bad news along the way, says poll respondent John J. Lee, a portfolio manager at PGB Trust & Investments in Morristown, New Jersey. Mountain View, California-based Google went public in August 2004 and the shares more than tripled in the first year to $279.99 from $85. The stock price averaged $617.2 this month.

Eventually, all fads get cheaper copycat lookalikes, he says. While being first to market makes Facebook a winner, another faster, stronger company with more something will come along and dilute its value. Lee says his firm owns Google shares in some portfolios.

Facebook raised $1.5 billion in a Goldman Sachs-led financing round this month. In addition to Goldman Sachs' $450 million investment, Russia-based Digital Sky Technologies put up $50 million and Goldman Sachs clients outside the U.S. snapped up a $1-billion stake in the company. Goldman Sachs, which retained the right to sell $75 million of its stake to Digital Sky, had originally offered Facebook shares to its U.S. clients in a private placement. That was called off after details became public because the offering risked running afoul of U.S. securities laws.

Stephen Cohen, a spokesman for New York-based Goldman Sachs, declined to comment. A Facebook spokesman, Jonathan Thaw, declined to discuss the valuation. We're focused on creating a useful service and building our business for the long term, he said in an e-mailed statement.

The Bloomberg poll shows that the Facebook deal has made investors uneasy about internet companies in general. More than half the respondents say the firm's valuation signals the beginning of a dangerous new bubble in the market, while only 17% saw it as the foundation of a lasting boom.

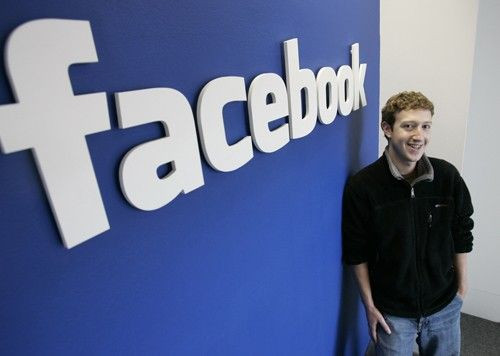

In 2008, Mark Zuckerberg, Facebook's founder and chief executive officer, became the world's youngest billionaire at 23 when Forbes Magazine listed his wealth at $1.5 billion. The magazine now says his net worth has reached $6.9 billion.

Facebook's social network has more than 500 million members and trails only Google and Microsoft Corp. as the world's most visited website, according to ComScore Inc.

© Copyright IBTimes 2024. All rights reserved.