Facebook To Stop Insider Trades Before April Roadshow For IPO

Facebook (NYSE: FB), the No. 1 social network website, will stop insider trades of its shares Friday because its initial public offering roadshow will begin next week.

The Menlo Park, Calif., company filed to raise $5 billion in a deal that could value the whole of Facebook at $100 billion, on Feb. 1.

By ceasing trading of its shares on secondary exchanges such as SharesPost and SecondMarket, Facebook is indicating the roadshow is near. Before the IPO can be conducted, the 31 underwriters and Facebook will have to determine a final share price.

Last month, the sale of a block of 125,000 Facebook shares on SharesPost went for $40 apiece, the exchange reported, about what the company would like to see as its IPO price.

Last week, Facebook held an analysts preview conference where CEO Mark Zuckerberg was absent and much of the briefing was by Executive VP Sheryl Sandberg. Some potential investors were miffed that Zuckerberg was away on vacation in China.

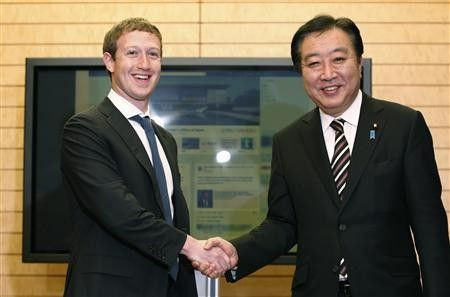

The Facebook CEO is on his way home now. Reuters reported he met Japanese Prime Minister Yoshihiko Noda on Thursday in Tokyo, where he was thanked for Facebook's help in the aftermath of the earthquake and tsunami a year ago.

Facebook has 10 million Japanese members although none of its 31 underwriters is Japanese.

Facebook Patent Lawsuits

Meanwhile, some Facebook critics said the company may have misled potential investors by failing to explicitly cite a March 5 hearing before the U.S. Circuit Court of Appeals in Washington that is specifically charged with hearing patent disputes.

Facebook amended its SEC filing to mention a March 12 lawsuit alleging patent infringement by Yahoo (Nasdaq: YHOO), the No. 2 search engine, as well as another case involving a former Zuckerberg contractor, Paul Ceglia, who claims he owns 50 percent of the company.

Lance Lieberman, IP lawyer with Cozen O'Connor in New York, said Facebook likely had "no need to update" its filing to mention the appellate hearing involving claims the appellate hearing involving claims by Leader & Co., because they had been discussed previously in Facebook's earlier filings.

Lieberman also said it's likely Yahoo and Facebook will settle their case before the IPO simply because of all the problems faced by new Yahoo CEO Scott Thompson.

Yahoo faces a challenge from Third Point Capital at its annual meeting for control of the board of directors as well as other pressures to boost the company's share price.

"Given all those pressures on Yahoo, the only question may be the size of the settlement," said Lieberman, whose firm isn't involved in the cases.

Yahoo shares fell 7 cents to $15.24 in Thursday afternoon trading. They have fallen about 2 percent since Thompson was elected CEO on Jan. 4.

© Copyright IBTimes 2024. All rights reserved.