Facebook’s Lockup Ends: 5 Things To Know

Thursday frees holders of as many as 271 million shares of Facebook (Nasdaq: FB), the No. 1 social networking site, to sell them for the first time since the first-day trading fiasco on May 18, when shares that had been priced at $38 first traded at $42.05, then didn't trade for 30 minutes and finally closed at $38.23.

On Wednesday, shares of the Menlo Park, Calif., money-losing site closed at $21.20, up 82 cents, or 44 percent below the IPO price. Its shriveled market capitalization is only $45.4 billion.

To be sure, the Facebook IPO raised $16 billion, the biggest technology IPO ever.

Here are five things to watch Thursday:

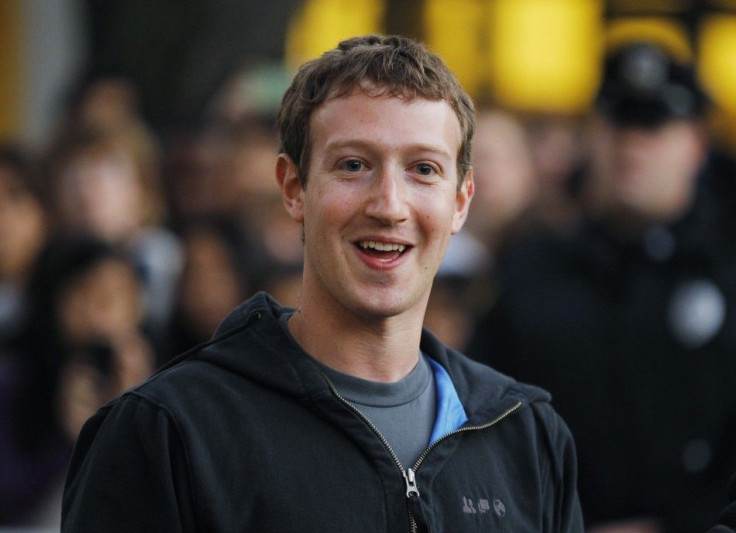

Who sells big blocks of shares. Big insiders like CEO Mark Zuckerberg, 28, can't sell out nor want to dilute their holdings. But Accel Partners, a venture capital firm that invested in the company early on, holds 152 million shares and might want to cash out. The money can be used to seed other companies. Another prospect could be Goldman Sachs (NYSE: GS), one of the major underwriters, as well as T. Rowe Price (Nasdaq: TROW), the Baltimore mutual funds complex that got in early.

Bear in mind: Prices of IPO stocks generally fall about 10 percent on the day lockups expire. So Facebook shares could fall as low as $19 by Thursday's close.

Who takes advantage of the decline to buy. We already know that George Soros of Soros Fund Management has bought 340,000 shares of the company, especially because they sell at a huge discount to the IPO price. And we know that investor Warren E. Buffett of Berkshire Hathway (NYSE: BRK/A) has not, although he reports sales and purchases on a lagging schedule. Due to Zuckerberg's nearly 58 percent control of the company, it's unlikely to attract activist investors like Carl Icahn or Third Point Capital, the group that shook up Yahoo (Nasdaq: YHOO) and now holds three board seats there.

Analyst recommendations. Mixed now, it will be interesting to see any new recommendations issued as third-quarter results are anticipated and Facebook announces plans to garner more revenue and perhaps start generating a profit again.

Overall market trends. Thursday's Facebook activity, while expected to be active no matter what, can't be immune from the market. A terrorist incident or announcement of a major economic policy in Washington could send the market down or up dramatically.

Performance of other social networking stocks. Closely linked to Facebook is Zynga (Nasdaq: ZNGA), the San Francisco game developer that relies upon Facebook for a significant part of its revenue. Zynga shares have plunged 68 percent since their December IPO. But those of LinkedIn (NYSE: LNKD) have gained 62 percent this year; Chairman Reed Hoffman is a Facebook director.

Meanwhile, shares of Jive Software Inc. (Nasdaq: JIVE), the professional social network site, have gained 5 percent since their December IPO.

© Copyright IBTimes 2024. All rights reserved.