Falling Oil: Crude Production Steady Even As Low Prices Slam Drillers

Even as U.S. oil producers grapple with plunging prices, widespread layoffs and soaring debts, companies are boosting their output of crude. The steady stream of oil illustrates a challenging landscape for energy producers: Some are forced to keep pumping to manage ballooning debt obligations or keep their leases, while other drillers are striking revenues through aggressive cost-cutting on the oil patch.

“Some are making money because their costs have come down. Some are hoping prices will come back up. Some are drilling irrationally,” said Michael Webber, deputy director of the Energy Institute at the University of Texas in Austin. “A lot of these guys, they go by their guts. It’s not always an economic calculation; there’s a frontier spirit that they’re not going to give up that easily.”

U.S. crude oil output hit 9.194 million barrels a day for the four-week average ending Jan. 1, the U.S. Energy Information Administration reported Wednesday. That’s up 0.7 percent from the 9.129 million barrels a day produced over the same period ending Jan. 2, 2015.

While U.S. crude output has wavered over the last year — dropping from its peak of 9.7 million barrels a day in April — it’s still double the pre-boom levels of 2008.

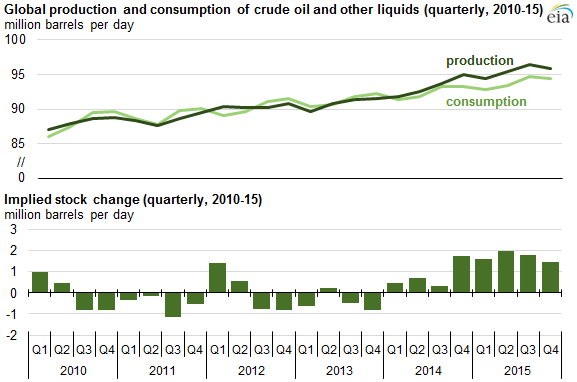

U.S. and global oil prices have plunged by nearly two-thirds since their peaks in June 2014. Surging oil supplies from the U.S. shale patch, Saudi Arabia, Iraq and other OPEC members is colliding with a steady slump in demand, led by slower economic growth in China. The global market is so oversupplied that even roiling tensions between Saudi Arabia and Iran — two of the world's most important oil producers — have not sparked a rise in oil prices.

In fact, the opposite is happening: Brent crude, the global benchmark, dropped to an 11-year low early Wednesday as traders feared the Middle East diplomatic blowup could keep OPEC nations from cooperating on squeezing down on output. Prices also fell on news that America’s thirst for gasoline is sliding.

Stockpiles of the fuel rose by 10.6 million barrels for the week ending Jan. 1, a jump of 4.8 percent from the week ended Dec. 25, 2015, the EIA said in its weekly report. U.S. crude inventories declined by 5.1 million barrels last week, a drop Fritsch attributed to falling imports.

Earlier Thursday, West Texas Intermediate, the U.S. price benchmark, fell 5 percent to a low of $32.10 per barrel, a level not seen since late 2003, before recovering slightly.

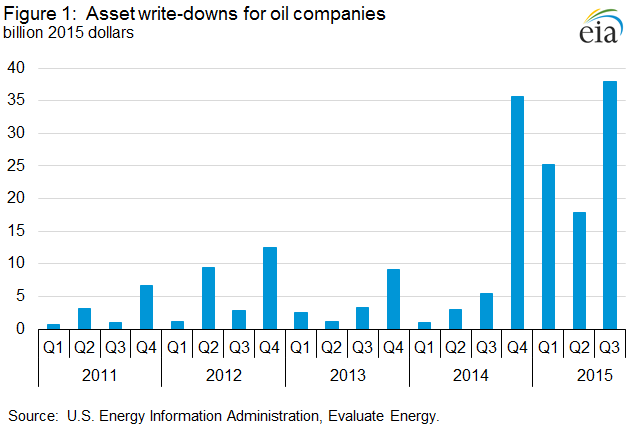

That figure is close to half as much as many U.S. drillers need to break even on shale oil projects. To curb their costs, companies have laid off tens of thousands of workers over the last year and a half and slashed investments by more than $220 billion for 2015 and 2016, Wood Mackenzie analysts reported last fall.

For some producers, those moves are working. Technological advances in hydraulic fracturing, or fracking, combined with more efficient operations, are helping drillers tap wells faster and frack them more intensively at a lower price. In November, a handful of companies — Oasis Petroleum Inc., Devon Energy Corp., Pioneer Natural Resources Co. and Diamondback Energy Inc. — cited such improvements as they announced higher production outlooks for the coming years, Reuters reported.

At the same time, new projects in the Gulf of Mexico and Alaska are starting to produce oil, helping to offset some of the dips across the U.S. shale patch. On the mainland, producers are also sitting on some 4,000 uncompleted wells — a “fracklog” — that could be quickly completed once oil markets improve, allowing for even more supplies to come online, said Carsten Fritsch, a senior commodities analyst with Commerzbank AG in Frankfurt.

Still, Fritsch and other oil analysts said they don’t expect U.S. oil supplies will hold steady throughout the year.

Eventually, the sharp cuts in investments and falling number of new wells drilled will drive a large dent in American production — meaning drillers in North Dakota and Texas will cede some of their hard-fought market share to Saudi Arabia and OPEC.

The EIA projected that U.S. production may slip to 8.8 million barrels per day on average in 2016, a drop of more than 5 percent compared to 9.3 million barrels in 2015, the agency said in December its short-term energy outlook report. Fritsch said U.S. oil output could drop even further, by more than 1 million barrels per day this fall.

“We still think that U.S. oil production will decline sharply this year,” he said. “This conviction rises even further with falling prices.”

© Copyright IBTimes 2024. All rights reserved.