Fed FOMC Minutes Squash Hopes For Imminent QE3, Stocks Turn Down

Newly released minutes of the U.S. central bank's June 19-20 Federal Open Market Committee meeting were being taken by the stock market as indicating unwillingness to engage in further monetary easing.

Only a few officials at the Federal Reserve felt that more asset purchases would be necessary, according to the minutes of the meeting.

Several others noted that additional policy action could be warranted if the economic recovery were to lose momentum, if the downside risks to the forecast became sufficiently pronounced, or if inflation seemed likely to run persistently below the Committee's longer-run objective, according to the minutes.

Only four Fed officials mentioned more quantitative easing in their individual forecasts, two in support of more easing and two saying they would consider it.

Major U.S. markets were disappointed in what they read from the Federal Reserve minutes. The benchmark S&P 500 Index of U.S. equities, which had been marginally up prior to the release, immediately fell to session lows shortly after 2:00 p.m. The index recently quoted at 1336.56, down 4.89 points, or 0.35 percent.

U.S. bond markets, which earlier in the day had seen unexpected, massive demand suggesting at least some players expected the Fed to announce it was more amenable to more bond-buying, were stable. Benchmark 10-year Treasuries recently yielded 1.498 percent.

Following the release, the price of gold on the Comex slipped slightly to $1,568.75, while crude oil futures traded in New York declined to $85.31.

At the end of its two-day meeting in June, the FOMC offered a bleaker picture of the U.S. economy than it had at its prior gathering in April. Officials cut forecasts for U.S. growth in 2012 to a range of 1.9 percent to 2.4 percent, from between 2.4 percent and 2.9 percent.

The Fed also maintained its assessment that exceptionally low interest rates would remain necessary until at least the end of 2014. Fed officials raised their estimate for the unemployment rate in the last three months of this year to a range of 8 percent to 8.2 percent from between 7.8 and 8 percent.

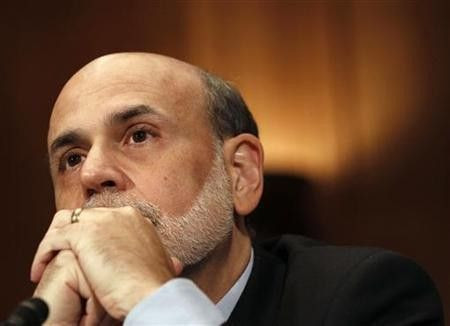

The importance of the minutes has diminished ever since Fed Chairman Ben Bernanke started giving press conferences after FOMC meetings.

Market participants are disappointed largely because Bernanke's recent comments were more dovish than Wednesday's Fed minutes.

Bernanke said the central bank was ready to ease monetary policy further if needed.

We are prepared to do what's necessary. We are prepared to provide support for the economy, Bernanke said at a post-FOMC press conference. Additional asset purchases would be among the things that we would certainly consider if we need to take additional measures to strengthen the economy.

Since any additional action would depend on the evolution of the incoming data. In that sense, the plunge in the ISM manufacturing index in June and the subdued 80,000 gain in payroll employment in the same month have increased the chances of QE3.

Much will depend on the gross domestic product (GDP) report for the second quarter, which includes the benchmark revisions for the previous year, and July's ISM index. Both will be released just days ahead of the Fed's next policy meeting, which concludes on Aug. 1.

Even if QE3 does set sail, some hold that pumping up the market further would only prove to be counterproductive, and a third attempt at QE may well miss the mark. One reason is because people are still unloading the burdens of the millennial debt bubble. Low interest rates and easy money won't necessarily prompt them to borrow more or to spend more.

© Copyright IBTimes 2024. All rights reserved.