Fed Links Future Bond Purchases To Unemployment, In Historic Move

Even while recognizing the effects superstorm Sandy had already caused on U.S. economic output, the Federal Reserve was not shy about unleashing a flood of new liquidity on the world financial markets Wednesday, announcing a new round of monetary easing and, in a historic turn, explicitly tying its future actions to a numerical unemployment target.

In a statement following the conclusion of the Federal Open Market Committee (FOMC)'s two-day monthly meeting, the powerful rate-setting panel of the U.S. central bank said it was continuing its program of printing about $40 billion every month to buy mortgage-backed bonds in the open market, but was additionally initiating a new program that would have the Fed buy $45 billion in long-term Treasury bonds

"Taken together, these actions should maintain downward pressure on longer-term interest rates, support mortgage markets and help to make broader financial conditions more accommodative," the Fed noted in a statement.

The real shocker, however, was the Fed's decision to say it would keep its remarkably low benchmark interest rates for the moment and believed "this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent." The announcement essentially ties the bank's credibility to keeping near-zero interest rates for years to come: The Fed's last projections, in September, stated the Fed governors believe that level of unemployment will not be reached until 2015.

The idea of linking future Fed actions to a specific unemployment targets, which has been advocated most vigorously and publicly by Chicago Federal Reserve Bank President Charles Evans, has been considered by the central bank in the past. But it had been rejected as too difficult or complicated to implement in previous meetings.

Also of note, the Fed specified it would tolerate inflation up to half a percentage point over its 2 percent target, something that categorically puts to rest the view expressed earlier in the year that the central bank was using 2 percent as a "ceiling" on the level of inflation it would accept.

The reaction of the markets to the Fed's statement was somewhat confused in the minutes that followed the announcement. Stocks rose and the dollar dropped against foreign currencies, as would be expected given the fact the Fed exceeded most expectations on easing. Yields on long-date bonds dropped and then rose, as investors tried to guess what effect the Fed's purchases would have on those markets.

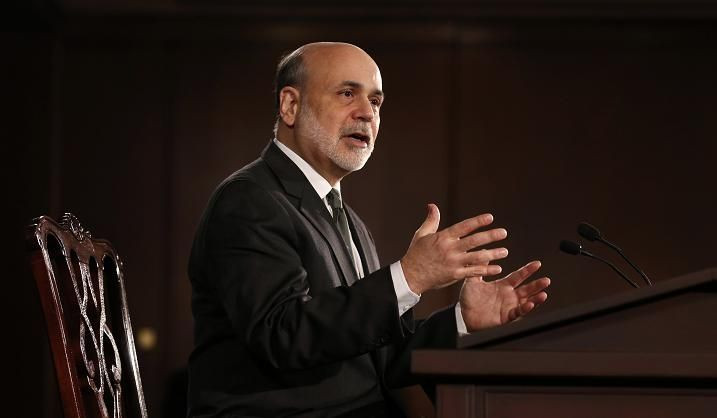

Fed Chairman Ben Bernanke is expected to speak at 2 p.m. EST.

© Copyright IBTimes 2024. All rights reserved.