Fed Minutes: Some Think QE3 More ‘Potent’ Than Operation Twist

Some members of the Federal Open Market Committee (FOMC) were not quite satisfied with Operation Twist, the tool the Fed ultimately decided to announce in its September policy statement.

In Operation Twist, the Fed sells its shorter-term Treasuries and purchases an equal amount of longer-term Treasuries. By doing so, it stimulates the economy by lowering longer-term interest rates.

The Fed, however, does not inject cash into the financial system and keeps the size of its balance sheet unchanged.

Some members of the FOMC, however, thought large-scale asset purchases as potentially a more potent tool. Another round of large-scale asset purchases would be QE3, whether the Fed calls it by that name or not.

These dovish members thought QE3 should be retained as an option in the event that further policy action to support a stronger economic recovery was warranted.

QE3 is more aggressive than Operation Twist because it lowers longer-term interest rates without pushing up shorter-term interest rates and injects money into the financial system.

More hawkish members of the FOMC, however, thought QE3 would stoke inflation more than it would help the economy.

Nevertheless, the confession that some members of FOMC still believe in quantitative easing could be interpreted as a dovish sign.

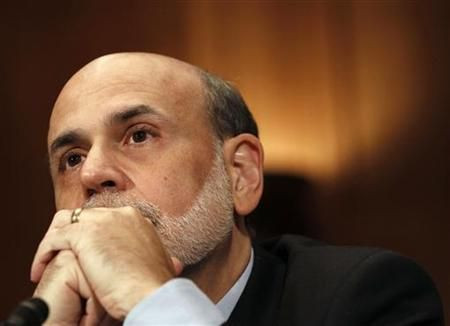

Bottom line, the Fed will continue with even cheaper money to counter the consequences of the previous period of Greenspan/Bernanke cheap money, warned Peter Boockvar, equity strategist at Miller Tabak.

© Copyright IBTimes 2024. All rights reserved.