Fed Poised To Attack Inflation With Another Interest Rate Hike

The Federal Reserve opened on Wednesday the second day of its policy meeting where it is set to announce another big interest rate increase, the fourth this year, in its ongoing battle to tamp down price pressures squeezing American families.

US central bankers are hoping their aggressive stance will cool red-hot inflation that topped nine percent in June, the highest in more than 40 years, without derailing the world's largest economy.

President Joe Biden is facing political costs for surging prices, which he blames mostly on the Russian invasion of Ukraine that has sent global food and energy prices soaring.

Biden insists the US economy will avoid a recession, but even as his approval ratings have cratered, he has supported the Fed in its battle to quell inflation.

Fed Chair Jerome Powell and others have made it clear they are willing to risk a downturn and will keep raising interest rates until they see clear evidence inflation is moving back towards the two percent goal.

The policy-setting Federal Open Market Committee is widely expected to announce another three-quarter-point increase in the benchmark borrowing rate at the conclusion of its two-day policy meeting at 1800 GMT.

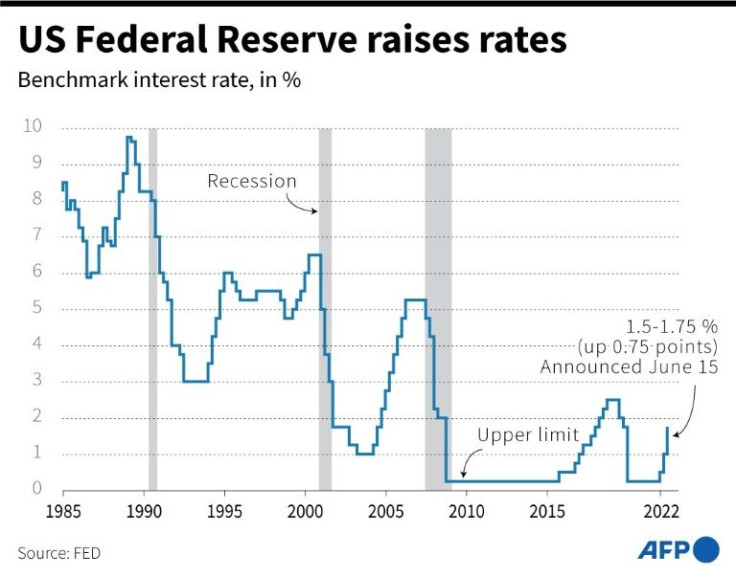

From zero at the start of the year, the Fed has raised the policy lending rate to a range of 1.5 to 1.75 percent, which has pushed mortgage rates higher and slowed housing sales for five straight months.

Economists say this has been the most aggressive Fed tightening cycle since the 1980s, when stagflation -- a wage-price spiral and stagnant growth -- crippled the US economy.

The challenge for policymakers is to quell inflation before it becomes dangerously entrenched without sending the world's largest economy into a recession that would reverberate around the globe.

While prices have continued to rise, with home prices hitting a new record, there are signs the pace of the increases has begun to slow, which may allow the central bank to ease up on its rate hikes.

Global oil prices are trending down, with the US benchmark WTI falling to below $95 a barrel from its peak of more than $123 in March, and gasoline prices at the pump have fallen 69 cents from the record of just over $5 a gallon in mid-June.

Meanwhile, the job market has remained strong, and surveys show inflation expectations in the months ahead have started to trend lower.

But consumer demand has not fallen dramatically, and data Wednesday showed new orders for big-ticket manufactured items continues to rise, even when discounting the massive increase in military aircraft.

Policymakers want to engineer a "soft landing," taming inflation without causing a downturn, but economists warn they face an increasingly narrow path to success and it would be easy to overshoot by being too aggressive.

"The Fed is now stuck between a rock and a hard place, with no easy way out without the economy feeling pain," KPMG chief economist Diane Swonk said in an analysis, noting that "Powell has started to underscore that reality by admitting a recession could occur."

In fact, it is rare that the central bank moves so decidedly without causing a downturn, and there are signs of concern among Fed policymakers.

"Brace yourself," Swonk said on Twitter, likening the surge in inflation to a cancer that will spread if left untreated. She said the policy rate will have to rise to a 3.75-4.0 percent range, which would mean another 150 basis points of increase in coming months.

Kansas City Fed President Esther George dissented at the June meeting, warning that going too fast could be "unsettling" and raise recession fears.

GDP in the first quarter contracted 1.6 percent, and the first reading on the April-June period is due out Thursday. Though the consensus forecast calls for modest growth, many economists expect a downturn.

Two quarters of negative growth are generally considered a recession, although that is not the official criteria.

But Fed Governor Christopher Waller said he was prepared to move even faster, with an unheard-of full point increase if inflation continues to accelerate.

© Copyright AFP 2024. All rights reserved.