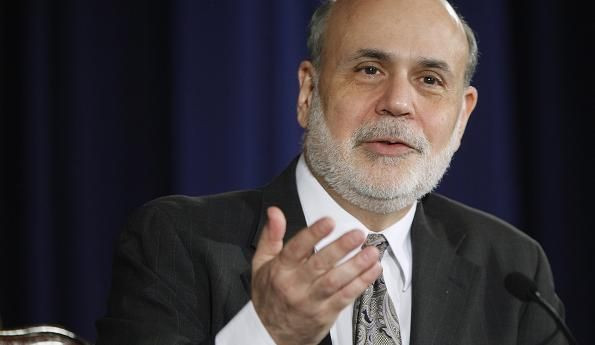

Federal Reserve Chairman Ben Bernanke Discusses Taper, Inflation, Interest Rates, And His Fed Reserve Term After FOMC Statement

Federal Reserve chair and all-round economic wizard Ben Bernanke tripped up markets again on Wednesday, as he announced a start to tapering, with a $10 billion cut to the body’s $85 billion monthly bond purchases to take effect in January.

He also strengthened the U.S. central banks’ forward guidance on interest rates, emphasizing that an unemployment rate of under 6.5 percent would not necessarily trigger interest rate hikes. Many economists expect unemployment to fall to that level by the end of 2014, while interest rate hikes are more likely to happen toward the end of 2015, he said.

Bernanke will step down in January, paving the way for Fed vice chair Janet Yellen to take over. Stanley Fischer, former Israel central bank chief, has been named as Yellen’s likely vice chair.

The handover represents the end of Bernanke’s eight year term, in which he oversaw the Fed’s extraordinary monetary response to the 2008 financial crisis and led six rounds of quantitative easing, which worked to different degrees.

Critics have said that the stimulus measures have failed to grow the U.S. economy quickly, though economists have widely lauded Bernanke’s response to economic crisis as necessary and suitable. Inflation has not risen over 2 percent since the crisis, quieting critics who hold that massive money printing ends in runaway inflation.

U.S. economic growth has proved better than expected, with economists estimating GDP growth of 2.6 percent in 2014. U.S. payrolls could see their largest expansions on average since 2005, and U.S. unemployment fell to 7 percent, according to labor statistics posted earlier this month.

On Wednesday morning, housing starts surged to their highest in nearly six years in the month of November. The health of the U.S. housing market has been one indicator for the Fed, since interest rates influence the mortgage market and housing is a bellwether of consumer spending.

In a news conference after the FOMC statement, Bernanke addressed questions about the leadership shuffle and his long reign as Fed chair. He said Janet Yellen agreed fully with his decision to taper in January, and added that he’d always consulted closely with her, even before her chair nomination by President Barack Obama.

Bernanke’s legacy and broad policy framework will carry on early into Yellen’s term, he said, in an effort to show consistency to markets, which were rattled this year by the Fed’s surprise decision not to taper in September, and by its first remarks on the topic in June.

Nine members of the 12-person Federal Open Market Committee voted to taper, with Boston Fed member Eric Rosengren as the lone objector.

Bernanke also made clear that low inflation is no laughing matter to the Fed. That’s a problem the Fed intends to take very seriously, he said.

“It’s not easy. Inflation cannot be picked up and moved where you want it. It requires, obviously, some luck and some good policy,” he said. “Inflation can be quite inertial, can take quite a time to move, and the responsiveness of inflation to increasing economic activity is quite low.”

The former economic historian and Princeton University professor defended his term overall, but mentioned one potential regret: not facing up to the financial crisis quickly enough.

“Obviously we were slow to recognize the crisis. I was slow to recognize the crisis,” he said at his final press conference. “In retrospect, it was a traditional classic crisis, but in a very different guise. That made it difficult for a historian like me to see.”

Bernanke dodged tough questions about the details of tapering and further monetary policy, maintaining that the Fed would stay flexible in the face of incoming data. He also had little substantive advice for Congressional lawmakers, who will review the structure and mandate of the Fed next year.

Nonetheless, he tentatively suggested that reductions of $10 billion, equally weighted between Treasury bonds and mortgage-backed securities, could be declared after each of the Fed’s meetings in 2014. On that regular schedule, bond buying would stop completely by late 2014.

Stern Agee chief economist Lindsey Piegza called the Fed’s tapering call a sort of “taper-lite,” in line with what markets expected in September. She also described it as a “wimpy reduction,” in a note on Wednesday afternoon. She criticized the Fed language on unemployment and forward guidance as vague and unhelpful.

Capital Economic’s chief U.S. economist Paul Ashworth called the taper more gradual than he’d previously expected, even though he also correctly called a January taper. Expected delays in interest rate hikes, and Fed language to that effect, may calm stock and bond markets in the meantime, he said on Wednesday.

Here’s the Fed’s full statement from Wednesday, with slightly more detail here.

Equity markets apparently took Bernanke’s remarks well, with the S&P 500 and the NASDAQ index up on Bernanke’s remarks. The Dow and the S&P could see their biggest daily gains in months.

As for Bernanke’s mark on history, he had this to say: “The Federal Reserve has rediscovered its roots in the sense that the Fed was created to stabilize the financial system in times of panic. We did that.”

“… This is one of the first examples of aggressive monetary policy taking place in a near zero interest rate environment. I think that will be an issue and area that monetary historians and monetary theorists will be interesting in studying.”

Bernanke may retire to North or South Carolina in coming years. He added: “I hope I live long enough to read the textbooks.”

Asked whether regulatory reforms during his term have sufficiently strengthened the financial and economic system, he described the system as improved, but added that it was an “open question” whether those reforms would prove enough next time around.

© Copyright IBTimes 2024. All rights reserved.