Fed's Messaging On Pivot Gets High Marks From Wall Street

Federal Reserve Chair Jerome Powell won high marks from Wall Street as he dialed up expectations late last year for a more hawkish policy stance to quell rising inflation, a survey by the New York Federal Reserve published Thursday showed.

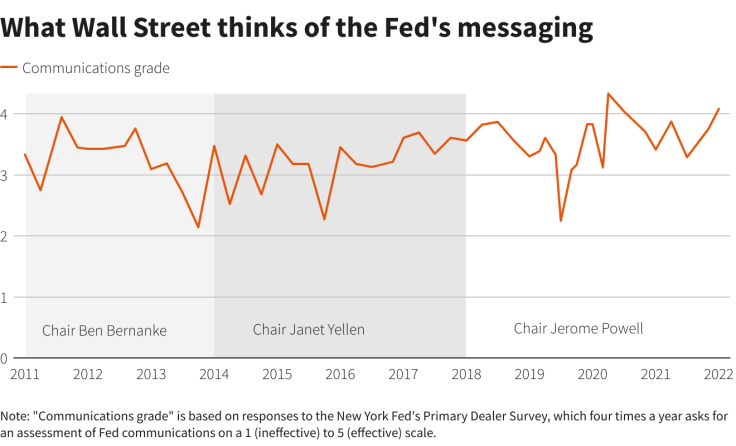

The report card is included in the New York Fed's quarterly survey of primary dealers who assess the U.S. central bank's communication with markets and the public, using a scale of one, for "ineffective," to five, for "effective."

The Powell Fed received an average score of 4.08 in the Jan. 12-18 survey released on Thursday. That is up from 3.75 in late October, the last time the Fed was graded on its messaging skills.

In the intervening period, Powell shepherded an effort to radically reset policy expectations, from a view that the Fed would not even begin raising rates until after mid-2022 to what many economists now expect will be a string of hikes beginning next month, quickly followed by a reduction in its $9 trillion balance sheet.

The shift is evident in the survey itself, with dealers seeing the Fed beginning to trim its balance sheet sometime between July and September, more than a year sooner than the survey showed two months earlier.

Overall, the Fed under Powell has received better communications grades than under previous chairs. It is the only Fed to have received any above-4 average mark since the surveys were first published in 2011.

GRAPHIC: What Wall Street thinks of the Fed's messaging -

"Most dealers noted that FOMC participants were in general clear or consistent in their communications on the policy outlook," the survey published Thursday said, referring to the Federal Open Market Committee, the panel of central bankers headed by Powell that sets U.S. interest rates.

"Several dealers suggested that communications on the outlook for balance sheet policy were less clear."

Powell likely faces an even tougher communications test in coming months, as investors struggle to figure out how quickly the Fed will raise rates and shrink its balance sheet to slow the fastest inflation in 40 years.

Investors have been particularly focused on whether the Fed will start the coming round of rate hikes at half a percentage point or a more typical quarter of a percent.

Dueling views from policymakers have roiled markets that investors use to place bets on or hedge against interest rate moves. St. Louis Fed President James Bullard has called for a full percentage point of rate hikes by June, while San Francisco Fed President Mary Daly has signaled a gentler approach.

Powell has not spoken publicly since immediately after the Fed's January policy-setting meeting.

"Powell has been out of the limelight in recent weeks and not providing the markets any guidance on this point," wrote SGH Macro Advisors' Tim Duy.

It will be up to Powell's messaging to guide expectations for March and beyond, he added.

© Copyright Thomson Reuters 2024. All rights reserved.