Fidelity, In A Reversal, Just Marked Up Snapchat And Dropbox

Fidelity sent shudders through the startup world last month when it marked down its investments in two star unicorn companies, Dropbox and Snapchat. Now the mutual fund giant has reversed course, raising its monthly valuations of shares in the private companies by 5 percent and 15 percent, respectively, underlining just how volatile and opaque the startup market is.

The reappraisals, first reported by Fortune, come amid growing scrutiny over the sky-high valuations of privately held Silicon Valley tech companies. Attention has focused squarely on the so-called unicorns, defined as pre-initial public offering companies estimated to be worth more than $1 billion.

Dropbox, the file storage company with an estimated valuation of roughly $10 billion, was among the companies whose valuations have raised eyebrows. Money manager BlackRock slashed 23 percent of its own valuation of Dropbox in June, and Fidelity’s markdown last month only intensified investors’ concerns.

The same goes for Snapchat, the disappearing-message app whose popularity has spread from teens to a more general audience. But Snapchat’s $16 billion valuation has come under fire as the company has struggled to reliably integrate advertising into its model.

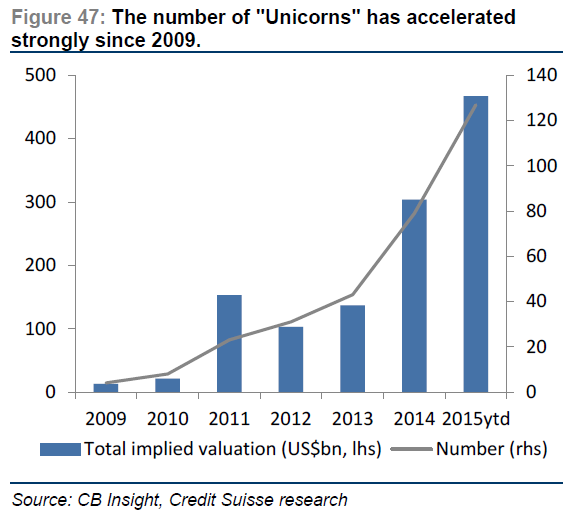

Despite those hurdles, however, venture capital investors remain generally sanguine on the startup market, which has seen its tally of unicorns rise from just eight in 2010 to 145 today, according to CB Insights. The explosive growth in such companies -- and the hunger to get in early on the next Google or Uber -- has led even conservative mutual fund mainstays like Fidelity to pile money into unicorn investments, despite the risks.

Unlike publicly traded companies, startups are under no obligation to share detailed accounts of their sales, executive salaries or financial performance. Only venture capitalists and other deep-pocketed investors are shown the books, and even these disclosures are limited.

That forces the wider investment community to look elsewhere for insights into startup performance, bringing private valuations at fund managers like Fidelity front and center.

Fortune saw the valuations of several other startups in Fidelity’s portfolio -- including Zenefits and Roku -- notch upward in October. Big losers for the month were Delphix, a maker of big data management software, and Blue Bottle Coffee, Fortune said.

© Copyright IBTimes 2024. All rights reserved.