First Solar's Biggest Problem? Too Much Cash

It's not often that I think a company has too good a balance sheet for its own good. But in the case of First Solar, that may be the case in 2020.

First Solar has built one of the steadiest and most profitable businesses in the solar industry, and that has resulted in a rock-solid balance sheet with a net cash balance of $1.2 billion. But the company has scaled back operations in recent years as it shed a lot of its vertically integrated segments, from project development to engineering and construction to long-term asset ownership. The result is a slimmer business -- and one that isn't doing shareholders any good by having a cash-rich balance sheet.

First Solar's cash needs have changed

Five years ago, a great balance sheet was one of the best qualities a solar company could have. For First Solar, it allowed the company to build solar projects on the balance sheet, generate strong profits when they were eventually sold, and vertically integrate the business from manufacturing to complete power plant development. A big, cash-rich balance sheet was necessary -- but the strategy has changed for First Solar and a lot of renewable energy stocks.

Over the last few years, First Solar has sold its yieldco, eliminated most in-house project development, and went away from engineering, procurement, and construction. What's left is primarily a solar panel manufacturing business. It's a more focused company, but it also doesn't need the balance sheet it once did.

An upgrade cycle is ending

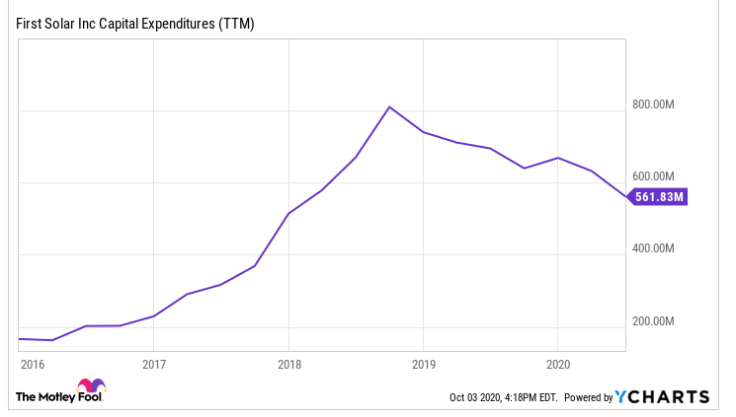

If we look at First Solar's cash needs today, they're going down significantly versus what it needed a couple of years ago. The company is nearing the end of a manufacturing upgrade cycle, having spent more than $1 billion to upgrade production to the Series 6 product. The final large factory is expected to complete upgrades in the first quarter of 2021. After spending as much as $800 million in a year on capital upgrades, in 2020 the upgrade costs are expected to be $450 million to $550 million. Guidance for 2021 hasn't been released, but costs will likely be much lower for the year, and ongoing capital costs will likely be close to the $200 million run rate of 2016 and 2017.

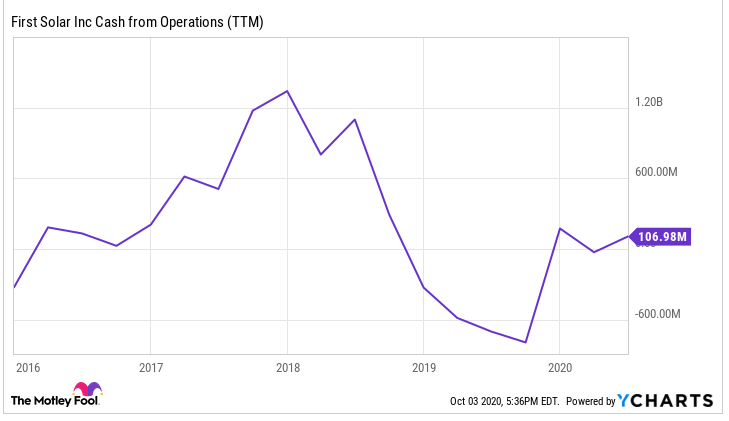

At the same time that capital spending is going down, operating cash flow is going up because production is increasing. Management expects to produce 5.9 gigawatts (GW) of solar panels in 2020, and in 2021 that figure will likely grow to over 7 GW when a Malaysian facility's Series 6 upgrades are complete.

We don't know exactly what management expects for cash generation since it pulled most of the 2020 guidance, but coming into the year the company expected $360 million to $420 million of operating income and a net cash balance of $1.3 billion to $1.5 billion to end the year. The company is growing operating cash flow now that production is up and running, and in 2021 it will likely be free-cash-flow positive.

Where does First Solar's cash go now?

Given the operating trends, First Solar will likely add to its cash pile starting next year. And given that First Solar is selling off or eliminating parts of its business to focus on a smaller segment of the market, it doesn't have a lot of opportunities for acquisition or investment unless it wants to build another manufacturing plant in the near future.

If management doesn't see large opportunities for investment, now is a time when it could use some of the cash it's sitting on and generating each year to pay a special dividend to shareholders. That way investors can deploy the cash where they see opportunities for growth.

Focusing First Solar on a smaller segment of the solar market was probably the right move, but now is the time to adjust the balance sheet to fit the new business reality. There's no reason to have over $1 billion of cash in the bank, and given the operating cash flow, a certain amount of debt may even be prudent given current low rates. That could free up billions for shareholders, something I think it's time for First Solar to consider.

This article originally appeared in The Motley Fool. The Motley Fool has a disclosure policy.