Five Of The Biggest Tax Inversion Deals

U.S.-based Burger King Worldwide Inc. (NYSE:BKW) said Monday it’s considering a merger with Canadian-headquartered Tim Hortons Inc. (NYSE:THI) to create the world’s third-largest quick-service restaurant chain. The deal would be structured as a so-called tax inversion, which would move the combined company’s home base to Canada and result in a lower corporate tax rate.

The U.S. has one of the world’s highest corporate tax rates, at about 35 percent. By comparison, Canada’s rate is closer to 30 percent.

Effective Corporate Tax Rates For 2013

Note: The effective corporate tax rate is defined as statutory rate plus average state (subcentral) tax rate.

Source: Organization for Economic Cooperation and Development, or OECD, June 2014

According to Wells Fargo’s Wealth Management Insights:

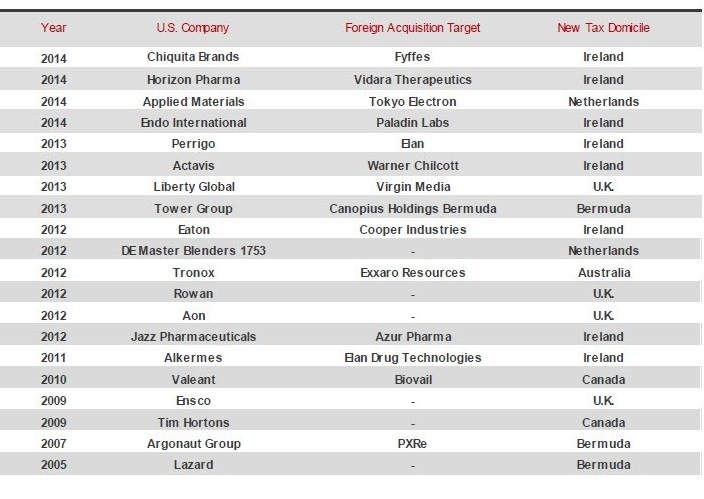

Over 40 public U.S. companies have become so-called ‘expatriated entities’ following a tax inversion since 1998. Changes in U.S. tax law caused a slowdown in the number of inversions following the enactment of the American Jobs Creation Act of 2004, but they have since rebounded considerably.

Here are five of the biggest tax-inversion deals this year, as noted by Forbes:

-- U.S. drug company AbbVie Inc.’s (NYSE:ABBV) planned $54 billion acquisition of Ireland’s Shire PLC (NASDAQ:SHPG), with headquarters in the U.K.

-- Ireland’s drug company Mallinckrodt PLC’s (NYSE:MNK) acquisition of Cadence Pharmaceuticals Inc., with headquarters in Ireland.

-- Ireland’s drug company Actavis PLC’s acquisition of Forest Laboratories Inc., with headquarters in Ireland.

-- U.S. medical-device company Medtronic Inc.’s (NYSE:MDT) planned acquisition of Ireland’s Covidien PLC (NYSE:COV), with headquarters in Ireland.

-- U.S. snack-manufacturing company Mondelez International Inc.’s (NASDAQ:MDLZ) planned merger of its coffee business with that of Holland’s D.E. Master Blenders, with headquarters in the Netherlands.

© Copyright IBTimes 2024. All rights reserved.