Ford's Europe Sales Slipped, But Profits May Rise

Ford Motor Company (NYSE:F) said that its sales in Europe's key markets fell 3.4% in the second quarter from the same period last year, as gains in sales of Ford's commercial-vehicle lineup weren't quite enough to offset a significant decline in sales of the small Fiesta.

Through June, Ford's sales in the key markets of Europe were down 4.8% from the same period in 2018.

The raw numbers

Ford reports several sets of sales results for Europe, but two are noteworthy for investors. The first is for the 20 western and central European countries that Ford thinks of as its key markets in Europe. (Ford refers to that group of countries as the "Euro 20.") The second is for all of Europe, including the countries of eastern Europe, the former Soviet republics, Russia, and Turkey. (Ford calls the second group the "Euro 50.")

Ford slightly underperformed the overall market. According to preliminary industry estimates supplied by Ford, overall light-vehicle sales in the Euro 20 were down 2.2% from the second quarter of 2018.

What's working -- and isn't -- for Ford in Europe

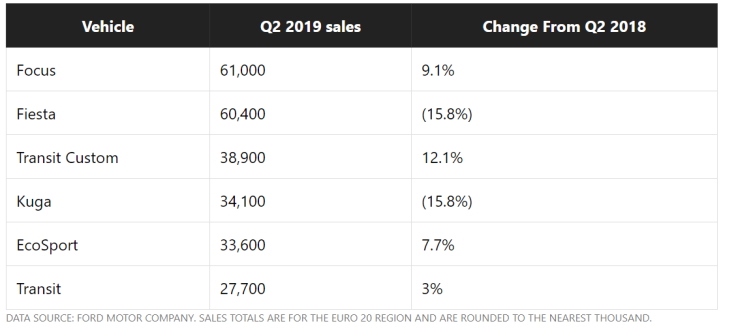

Here are the results for Ford's six best-sellers in Europe in the second quarter of 2019.

What do those numbers tell us?

First, Fiesta sales fell sharply, but there's a story there. Ford launched an all-new Fiesta in Europe in late 2017, ramping up production in the first few months of 2018. The car was still new and in high demand in the second quarter of last year. But demand for the new Fiesta cooled later in 2018 when Ford launched an all-new version of the one-size-larger Focus in the region. Long story short, it's not surprising to see that Fiesta sales slipped in the second quarter of 2019, while Focus sales were up versus the year-ago period.

It's also not surprising that sales of the small EcoSport crossover SUV were up, given high demand for small crossovers in the region. (That shift in demand may be another part of the story of the Fiesta's decline.) But why were sales of the one-size-up Kuga SUV down almost 16% from a year ago? The Kuga is a near-twin of the U.S.-market Ford Escape -- and, like the Escape, it's about to be replaced by an all-new model.

Finally, it's encouraging to see sales of the Transit-family commercial vans rise. (The Transit Custom is a shorter midsize version of the full-size Transit commercial van.) Ford's ongoing revamp of its European operation has put increased emphasis on commercial vehicles, a traditional Ford strength that generates good profits.

A look ahead to Q2 earnings

Ford lost $73 million in Europe in the second quarter of 2018. Did it do better this time around?

I'm thinking that even though Ford's sales in Europe fell year over year, the sales increases for Ford's profitable commercial vehicles should have helped its margin -- and might have given it a profit. We'll find out when Ford reports its second-quarter results after the U.S. markets close on Wednesday, July 24.

John Rosevear owns shares of Ford. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

This article originally appeared in The Motley Fool.