Ford's Profit Falls 44% On Big Challenges In China

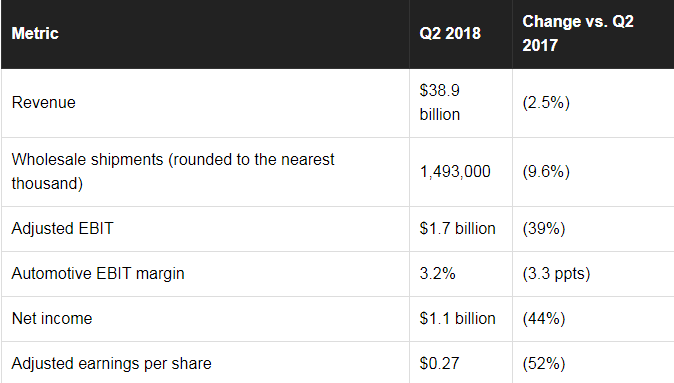

Ford Motor Company (NYSE:F) said that its net income fell 44% to $1.1 billion, on growing pressures in China and a disruption of pickup-truck production after a fire at a key supplier's factory in May. Ford's revenue fell about 2.5% from the second quarter of 2017, to $38.9 billion.

This article originally appeared in the Motley Fool.

Ford also cut its full-year guidance on growing concerns about its businesses in China and Europe.

The raw numbers

Here are the key numbers from Ford's second-quarter 2018 results.

Ford's quarter in a nutshell

The good news is that Ford's business in North America continues to be strong. Results were hurt to some extent by a fire at a key supplier's factory -- the resulting parts shortage led to an eight-day shutdown of production of Ford's huge-selling (and hugely profitable) F-150 pickup.

While Ford will be able to make up the lost truck production as the year goes on, the shutdown and costs related to recovery put a $591 million dent in Ford's North America profit.

The other key issue: China. Ford's wholesale shipments fell 26% in the second quarter, essentially wiping out profit from its joint ventures with Chinese automakers.

How Ford's business units performed in the second quarter

Here's a look at how each of Ford's business segments performed. Note that all financial results in this section are reported on an EBIT basis, except as noted.

North America: Ford earned $1.8 billion in North America in the second quarter, down from $2.4 billion a year ago. The drop was explained by the disruption in truck production and some nonrecurring charges related to warranty costs, which offset good incremental gains in pricing and product mix. Increased commodity prices had an impact of about $200 million as well.

Ford's EBIT margin in North America was 7.4%, down from 9.5% a year ago. But note that Ford's underlying business remains quite profitable: CFO Bob Shanks said that minus the effects of the fire and the one-time items, Ford's EBIT margin would have been 9.9%.

South America: Ford lost $178 million in South America in the second quarter, roughly equal to its loss a year ago. While wholesale shipments increased by about 3.2%, and pricing improved significantly, those good gains were offset by higher commodity costs and unfavorable exchange-rate moves.

Europe: Ford lost $73 million in Europe in the second quarter, a big swing from an $88 million profit in the second quarter of last year. Wholesale shipments fell about 2.1%; Ford more than offset that with pricing gains driven may new models, but higher costs and unfavorable exchange-rate movements hurt.

Middle East and Africa: Ford earned $49 million in this region, a nice improvement over the $53 million loss it posted a year ago. Simply put, sales were good: A 12% increase in wholesale shipments drove a 35% improvement in revenue.

Asia-Pacific: Ford lost $394 million in its Asia-Pacific region in the second quarter, a dramatic drop from a $167 million profit a year ago. The cause: A big drop in sales in China, as buyers have turned away from Ford's increasingly stale lineup. Equity income from Ford's joint ventures with Chinese automakers fell to just $3 million from $195 million a year ago.

Mobility: Ford's mobility segment, which includes its autonomous-vehicle effort and its Ford Smart Mobility initiatives, lost $181 million in the second quarter versus a $63 million loss in the year-ago period. The loss represents investments of about $58 million in Smart Mobility and $60 million in autonomous-vehicle development during the second quarter.

Ford Credit: Profit before tax for Ford's captive-financing arm was $645 million, up from the (very good) $619 million it earned a year ago. The gain was due to growth in global receivables, as well as higher auction values for off-lease vehicles returned to Ford. Ford Credit's lease penetration remains below the industry average, and its credit metrics remain quite strong -- all good news.

Debt and liquidity

Ford ended the second quarter with $25.2 billion in cash available to its automotive business, down by about $1.3 billion from the end of 2017. It has an additional $10.9 billion in available credit lines, for total automotive liquidity of $36.1 billion -- down a bit from year-end but still a stout reserve.

Against that cash reserve, Ford had $16.2 billion in well-structured long-term debt as of the end of the quarter, down by about $300 million from year-end.

Looking ahead: Ford's guidance

Ford revised its full-year 2018 guidance downward on concerns about Europe and China. Ford is in the midst of a major product-line overhaul in Europe, but its most recent new products aren't delivering the margins that Ford had expected, in part because of exchange-rate headwinds. In China, Ford is moving to accelerate a major restructuring effort that is already underway.

The key change: Ford now expects its full-year adjusted earnings per share to fall between $1.30 and $1.50, a drop from its prior guidance of $1.45 to $1.70. Ford earned $1.78 per share in 2017.

John Rosevear owns shares of Ford. The Motley Fool recommends Ford. The Motley Fool has a disclosure policy.