Foreigners Turn Sellers Of Chinese Shares In July On COVID Worries

Overseas investors turned net sellers of Chinese stocks in July, as mainland stock prices tumbled on concerns that COVID-19 flare-ups and ensuing lockdowns would further disrupt economic activity.

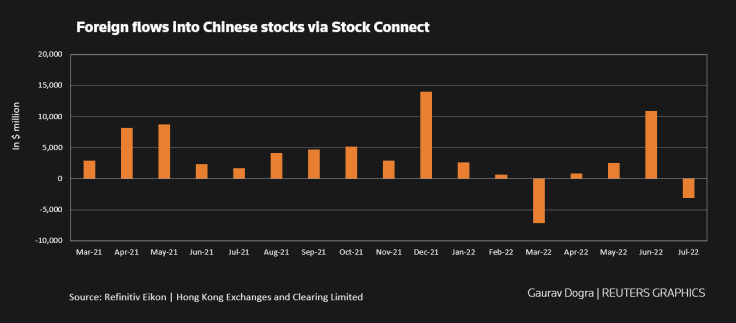

Refinitiv data showed foreigners sold a net 21.07 billion yuan ($3.12 billion) worth of mainland shares in July via Stock Connect, a key cross-border link between the mainland and Hong Kong exchanges.

They sold a net 11.8 billion yuan worth of shares in the Shanghai stock exchange, and 9.27 billion in the Shenzhen stock exchange.

Foreigners had bought a cumulative 95.45 billion yuan in the previous three months, according to the data.

Foreign flows into Chinese stocks via Stock Connect:

China's factory activity contracted unexpectedly in July, due to the fresh emergence of coronavirus cases, with its official manufacturing manager's index falling to 49 from a reading of 50.2 in June. A reading below 50 is considered as a contraction.

Also, a threat by Chinese home buyers to halt mortgage payments until developers resume construction of pre-sold homes deepened concerns about the debt-stricken property sector last month, raising fears banks could face hefty writedowns.

The benchmark CSI300 Index dropped 7% last month.

Winnie Wu, China equity strategist at BofA Securities, said renewed fears of Chinese ADRs delisting and heightened geopolitical tensions also affected money flows in July.

Foreigners have dumped about 962 million yuan worth of China-listed shares so far this month, as tensions between Washington and Beijing escalated on news U.S. House of Representatives Speaker Nancy Pelosi was set to visit Taiwan.

However, Herald van der Linde, head of HSBC's Asia Pacific equity strategy, said he had an overweight rating on Chinese equities.

"Beijing has shifted its policy tone from de-risking to being pro-growth, and policies like setting up the real estate fund should substantially reverse the investor gloom," he said.

"In addition, foreign institutional investors are generally underweight Chinese equities, so if there are improvements, they have plenty of room to add to their positions in this market."

Meanwhile, Chinese investors purchased about $405 million worth of Hong Kong shares via Stock Connect in July, which was their smallest net buying since November.

Southbound flows into Hong Kong stocks: https://tmsnrt.rs/3POUr5c

© Copyright Thomson Reuters 2024. All rights reserved.