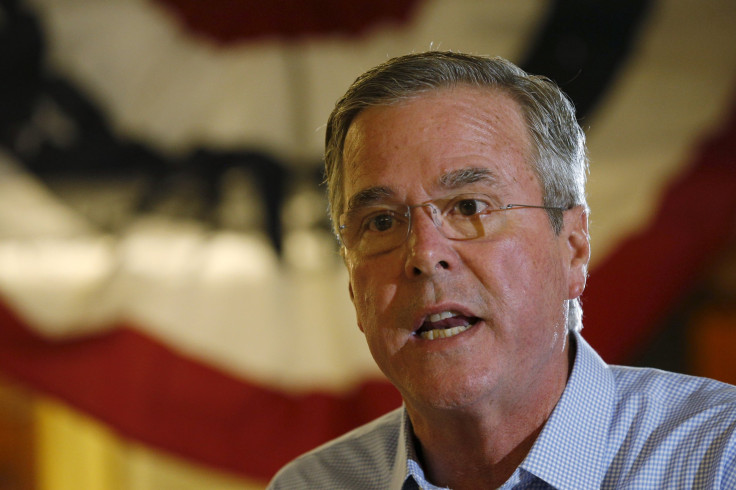

Four Questions About Jeb Bush’s Tax Plan Before The GOP Presidential Debate

Jeb Bush released his plan to cut taxes and simplify the tax code in order to fuel economic growth last week. Here are four questions the former Florida governor may have to answer about his proposals when he meets his Republican rivals on the debate stage Wednesday night.

Who Would Benefit?

Bush wrote in the Wall Street Journal that his plan would help “restore the opportunity for every American to rise and achieve earned success.”

His campaign published testimonials online from some of the regular people who would see tax cuts from his plan: A self-employed decorative painter in Florida says her family would see a $4,000 tax cut; A young nurse in Massachusetts would get a $1,911 tax cut and be able to pay off more of her student debt.

But a study from Citizens for Tax Justice, a progressive tax policy group, said that more than half of the income tax cuts from Bush’s plan would flow to the top 1 percent of earners. An analysis by the Tax Foundation, a pro-business organization, found that the “top 1 percent of all taxpayers would see an 11.6 percent increase in after-tax income.”

How Much Would It Cost?

Republican economists who analyzed Bush’s tax plan, at the behest of his campaign, said it would cost $3.4 billion over a decade. The economists said that “with conservative assumptions for revenue feedbacks,” the plan eventually would result in only $1.2 trillion in lost revenue and would be offset with spending cuts.

What Programs Would See Cuts?

So far, the answer is: wait and see. The GOP economists who analyzed Bush’s tax plan said he would make up for lost revenue with “proposals to restrain federal spending and reform health care policy, the nation’s education system, energy policy, trade and immigration policy.”

Bush’s campaign has not yet released those policy recommendations. In an interview Monday with the "Off-Road Politics" radio show, Bush pledged he would soon release plans to replace President Barack Obama’s health care law and to reform the country’s higher-education system.

Did He Copy Trump?

Bush has proposed eliminating the carried interest loophole, which allows hedge fund and private-equity managers to pay lower taxes on their incomes by treating them as capital gains instead of salaries.

It may have surprised some observers that Bush would adopt this idea, which is popular among Democrats, given his campaign has received substantial financial support from Wall Street. But he is not the only Republican to propose ending this tax benefit -- real estate mogul and Republican front-runner Donald Trump suggested it last month.

© Copyright IBTimes 2024. All rights reserved.