French Central Bank Chief Nods Toward Monetary Easing

As the European Central Bank prepares for a closely watched early December meeting, Bank of France Governor François Villeroy de Galhau said low inflation and stunted growth remain threats to the broader European economy. In comments to German newspaper Handelsblatt, Villeroy de Galhau said central bankers still have some wiggle room with monetary policy.

Though Villeroy de Galhau did not say whether he would advocate further monetary easing in the December meeting, he noted observers should be patient in assessing the impact of central bank policies, looking at the medium term rather than the short term.

Central bank governors from the 19 eurozone countries are scheduled to meet Dec. 3 to decide whether to continue or deepen the extraordinarily accommodative policy of the past year. Since March, the ECB has bought up bonds totaling some 60 billion euros ($64 billion) a month, as part of a planned $1.2 billion debt-purchase program meant to goose sluggish eurozone economies back into higher growth. The eurozone has seen annual GDP growth stuck below 2 percent since the program began.

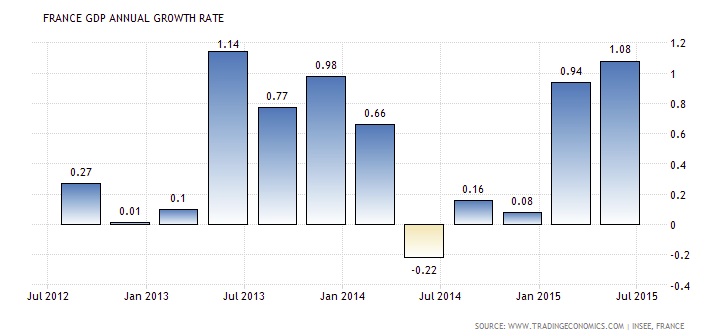

French GDP stalled between the first and second quarters, growing 1.08 percent over the same quarter the previous year.

In recent comments, ECB President Mario Draghi has assured markets further easing of benchmark interest rates could be on the agenda in December, along with further asset purchases. "Even though domestic demand remains resilient, concerns over growth prospects in emerging markets and other external factors are creating downside risks to the outlook for growth and inflation," Draghi told a Frankfurt audience last week, according to Reuters.

"In this context, the degree of monetary policy accommodation will need to be re-examined at the Governing Council's December meeting," he continued.

The December ECB Governing Council meeting will be the first for Villeroy de Galhau, who just took the helm at the Bank of France this month.

© Copyright IBTimes 2024. All rights reserved.