Futures Hit Two-month Lows As FedEx Warning Stokes Slowdown Fears

U.S. stock index futures tumbled to two-month lows on Friday after a profit warning from global delivery bellwether FedEx spooked investors already worried about aggressive rate hikes from the Federal Reserve tipping the economy into a recession.

Shares of FedEx Corp plunged 20.7% in premarket trading after the company said a global demand slowdown accelerated at the end of August and predicted that it would worsen in the November quarter.

If losses hold through the day, it would mark the steepest one-day percentage drop for the stock, surpassing its 16.4% slump on Black Monday in 1987.

Rivals UPS and XPO Logistics slid 7.1% and 6.0% respectively, while Amazon.com Inc AMZN.O slipped 2.6%.

"The Fed will view the FedEx report as an indication that they are on the right path, rather than a warning that the Fed may be moving too aggressively," said Rick Meckler, a partner at Cherry Lane Investments in New Vernon, New Jersey.

"I don't believe that FedEx is likely to be part of the lower CPI solution that the Fed is seeking with higher rates, as it seems unlikely that they will cut prices in an effort to boost shipments."

Futures signaled that the benchmark S&P 500 would open below 3,900 points, a level that traders considered as a key support for the index.

The Federal Reserve is widely expected to deliver the third straight 75-basis-point rate hike at its policy meeting next week after recent data failed to alter the expected course of aggressive policy tightening.

Adding to the somber mood, the World Bank said the global economy might be inching toward a recession, while the International Monetary Fund said it expected a slowdown in the third quarter.

September, which is a seasonally weak period for markets, will also see the Fed ramp up the unwinding of its balance sheet to $95 billion per month, a move some investors fear may add to volatility in markets and weigh on the economy.

At 07:10 a.m. ET, Dow e-minis were down 245 points, or 0.79%, S&P 500 e-minis were down 31.5 points, or 0.8%, and Nasdaq 100 e-minis were down 115 points, or 0.96%.

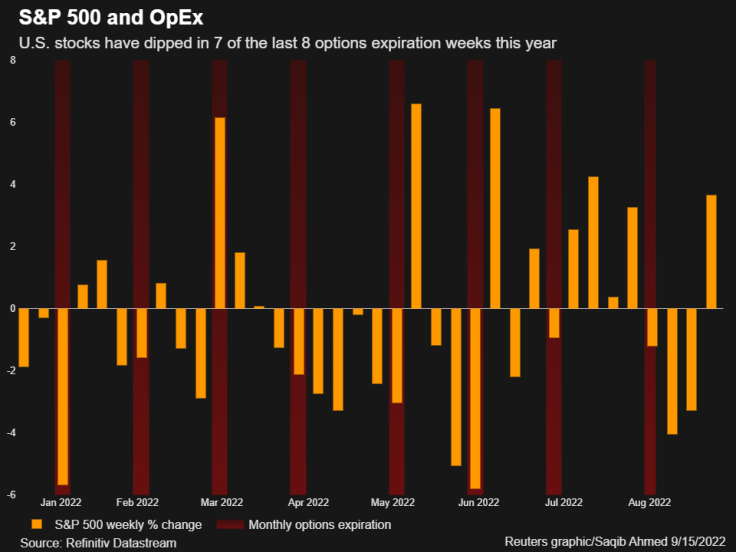

Meanwhile, the week of the monthly options expiration - ending on the third Friday of every month - has been marked by a greater-than-usual volatility this year, as options-hedging activity has helped amplify market moves.

GRAPHIC: S&P 500 and OpEx

On average, the S&P 500 has fallen 1.8% in options expiration weeks, compared with an average weekly gain of 0.09% in non-expiration weeks, according to a Reuters analysis.

The CBOE volatility index, also known as Wall Street's fear gauge, rose to 27.62 points.

All the three indexes are set for sharp weekly fall, with the tech-heavy Nasdaq down 4.6%.

Uber Technologies Inc dipped 4.7% as the ride hailing platform was investigating a cybersecurity incident after a report that its network was breached.

© Copyright Thomson Reuters 2024. All rights reserved.