For General Motors (GM) and Volkswagen (VOW), It's All About China And Brazil, Not So Much Russia And India

The 'B' and the 'C' in BRIC are seeing continued growth acceleration

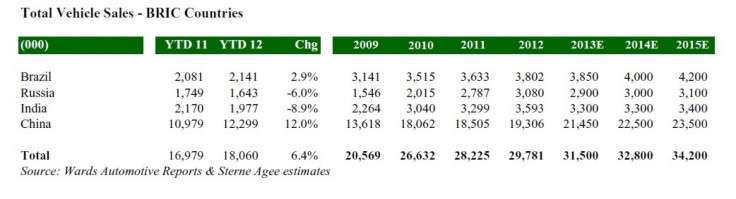

The BRIC countries are diverging when it comes to auto sales growth, with China and Brazil expected to see acceleration in sales compared to recent years, while sales growth in Russia and India is expected to slow down through 2015.

This bodes particularly well for General Motors Co. (NYSE:GM) and Volkswagen AG (FRA:VOW3) since they claim more than a fourth of the market share in these four countries. In China, the behemoth of the BRICs, the two companies account for nearly seven out of 10 cars sold in these countries last year, according to sales data from Wards Automotive.

BRIC countries – which are grouped together because they are viewed as being in similar stages of economic development – accounted for 40 percent of global noncommercial vehicle sales and are responsible for about 60 percent of growth in the industry since 2009, according to research released Sunday by Birmingham, Ala.-based global investment adviser Sterne Agee.

“China is on track to reach 21 million units this year, more than double the 2008 total,” said Sterne Agee auto industry analyst Michael Ward. “Russia was one of the strongest markets in Europe in 2012 but demand has declined in each of the last five months.”

Looking a little deeper into these numbers listed in the chart above, we can see that while growth is expected in all four countries, it is slowing considerably in Russia and India.

Auto sales growth figures for BRIC countries: 2010-2012

Brazil: up 8.2 percent to 3.8 million units.

Russia: up 53 percent to 3.1 million units.

India: up 18.2 percent to 3.6 million units.

China: up 6.9 percent to 19.3 million units.

Total: up 11.8 percent to 29.8 million units.

Auto sales estimated growth figures for BRIC countries: 2013-2015

Brazil: up 9.1 percent to 4.2 million units.

Russia: up 6.9 percent to 3.1 million units.

India: up 3 percent to 3.4 million units.

China: up 9.6 percent to 23.5 million units.

Total: up 8.6 percent to 34.2 million units.

Comparing the past three years to the estimates for the current and next two years, it seems that China and Brazil haven’t caught whatever flu has caused slowdowns in India and Russia.

Russia, with a population of 143 million, has seen a steep drop in gross domestic product (GDP) from last year as it cuts back on government spending and sees oil price growth slow while the private sector has been unable to take up the slack. The Bank of Russia said earlier this month that GDP growth was a lackluster 1.4 percent in the first half of the year compared to 4.5 percent in the latter half of 2012.

India’s macroeconomic condition is even worse; its GDP growth is down to a decade-low 4.8 percent. Just 10 years ago India was considered a rising economic star, but the slow pace of reforms has caused foreign investment to chill. The state is taking up that slack by increasing its deficit spending but its trade gap has widened because it depends heavily on oil imports while exports reeled under the last global recession.

Five percent growth for a fully developed economy like the United States would be considered good. For a giant underdeveloped nation like India it means the country of 1.24 billion people cannot keep up with the needs of job seekers entering the workforce, resulting in more people who can’t afford even the more economic brands manufactured by the global auto giants.

Brazil is not faring really well – industrial and consumer confidence is down – but the country of nearly 200 million people is expected to show solid growth figures for its second quarter when it reports GDP figures on Friday.

And then there’s China. Though there is increasing concern about the country’s growing public debt burden, China is in line to meet its 7.5 percent economic growth target in 2013, and analysts don’t see China’s ravenous demand for vehicles declining soon.

And that’s good for any of the top automakers with large market shares in the B and the C of the BRICs.

© Copyright IBTimes 2024. All rights reserved.