Gilead to Buy Biotech Firm Pharmasset for $11 Billion

Gilead to buy Pharmasset for $11 billion

(Reuters) - Gilead Sciences Inc struck a deal to buy Pharmasset Inc for about $11 billion in a huge bet on hepatitis C treatments to diversify its portfolio.

Gilead, the world's largest maker of HIV drugs, will pay $137 per share for each Pharmasset share, a whopping 89 percent premium to Pharmasset's Friday closing price.

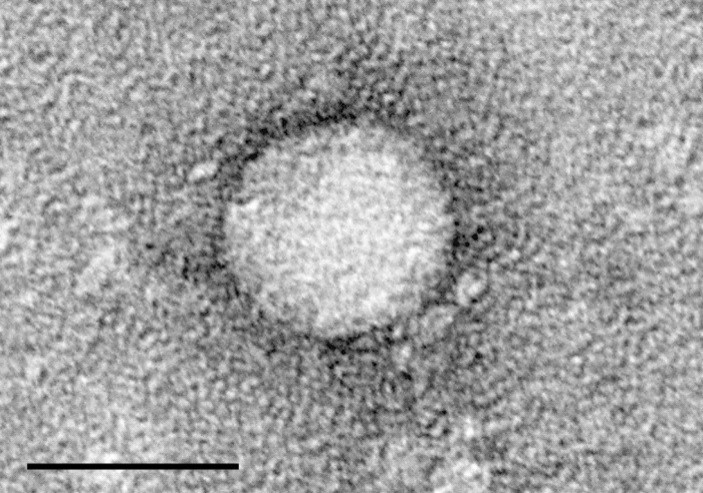

Pharmasset has been one of the hottest biotech companies, based on the promise of its experimental hepatitis C medicines.

Its shares have soared in the past year on the potential for its oral drugs to create a regimen without interferons, which cause flu-like side effects that lead many patients with the serious liver disease to stop or delay treatment.

Pharmasset has three hepatitis C medicines in clinical trials. Its lead candidate, PSI-7977, recently been advanced into two Phase III studies

Gilead projected the deal would hurt its earnings through 2014. It is expected to close in the first quarter of next year, when Gilead plans to provide further outlook.

Gilead said it had commitments from Bank of America Merrill Lynch and Barclays Capital for financing of the transaction.

Barclays and Bank of America advised Gilead on the deal, while Morgan Stanley advised Pharmasset. Skadden, Arps, Slate, Meagher & Flom LLP is Gilead's legal counsel, while Sullivan & Cromwell LLP is serving as legal counsel to Pharmasset.

(Reporting by Lewis Krauskopf in New York; additional reporting by Anand Basu in Bangalore; Editing by Esha Dey and John Wallace)

© Copyright Thomson Reuters 2024. All rights reserved.