Global Economy Is Recovering, But Some Developing Countries Must Be Careful As Fed Cuts Bond Buying, World Bank Warns

The global economy is expected to grow by 3.2 percent this year, reaching 3.5 percent by 2016. It’s a sign that the world is slowly emerging from the global financial crisis thanks to an upswing in developed economies.

Developing countries are expected to grow at a rate of 5.3 percent this year, but officials need to remain on their toes amid elections in their countries and plans by the U.S. central bank to cut down on its massive bond buying, according to a World Bank released Wednesday.

“With developing countries entering a potentially disruptive period of global financial tightening, maintaining a business-as-usual policy stance is no longer an option,” the report reads.

The U.S. central bank, or Federal Reserve, will begin cutting back on its massive bond purchases this year, which should work out fine if markets remain stable. But certain countries were shown to be vulnerable last summer, when the Fed announced its plans, and currency and equity markets slumped.

“International financial market developments during the summer of 2013 are a stark reminder of the vulnerability of developing economies to rapid changes in global financial conditions,” the report reads.

Currencies in Brazil, Indonesia, India and Turkey fell by 10 percent or more between May and September. These were countries with a low current account balance – meaning they import more value than they export.

When U.S. interest rates were at record lows, investing in these countries was more attractive because returns were higher. Consequently, it was easy for them to make up the difference between imports and exports with foreign money.

But in the summer, when the Fed announced its plans to taper and bring up interest rates, a lot of investors took their money out of these markets, causing their currencies to plunge dramatically.

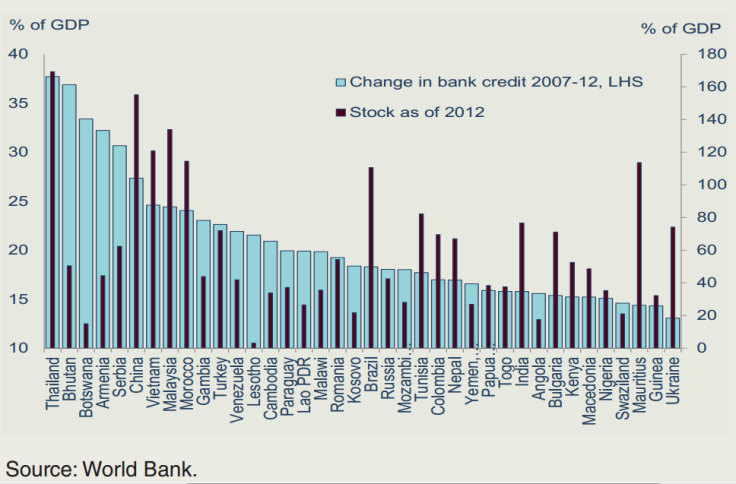

Another indicator of trouble ahead is the stock of a country’s credit as a share of gross domestic product (GDP). In certain countries, this has grown quickly, some increasing by more than 20 percent since 2007. This is due in part to policy stimulus -- encouraging more people to borrow money -- which could be a problem in the long run.

“This indicates the potential for debt servicing difficulties among untested or first-time borrowers and a possibly significant increase in the exposure of existing borrows,” the report reads. This could destabilize the local economies if the global economic environment changes suddenly.

The World Bank noted that while some countries will be able to cushion themselves with fiscal and monetary adjustments, others may have more difficulty than others.

“The already daunting political challenge represented by implementing necessary measures … may be made even more difficult given upcoming elections in several of those countries that were most tested during the summer,” the report reads.

South Africa, Thailand, Turkey, Indonesia, Brazil and India will all be holding elections in 2014, which will make fiscal policy decisions even trickier.

© Copyright IBTimes 2024. All rights reserved.