Global Markets Signal Imminent Greek Departure From Euro Zone

Will Greece leave the monetary union on its own or be ejected?

Signs that a Greek departure from the euro zone has become inevitable proliferated worldwide Wednesday with Hong Kong's main stock index plunging more than 3 percent, bank runs in Athens and Britain's central bank finalizing contingency plans for a euro zone breakup.

In Hong Kong, a slew of major investment funds exited the stock market Wednesday, leaving the Heng Seng Index down 3.19 percent. Tokyo's Nikkei 225 and Singapore's Straits Times indexes were both down more than 1 percent.

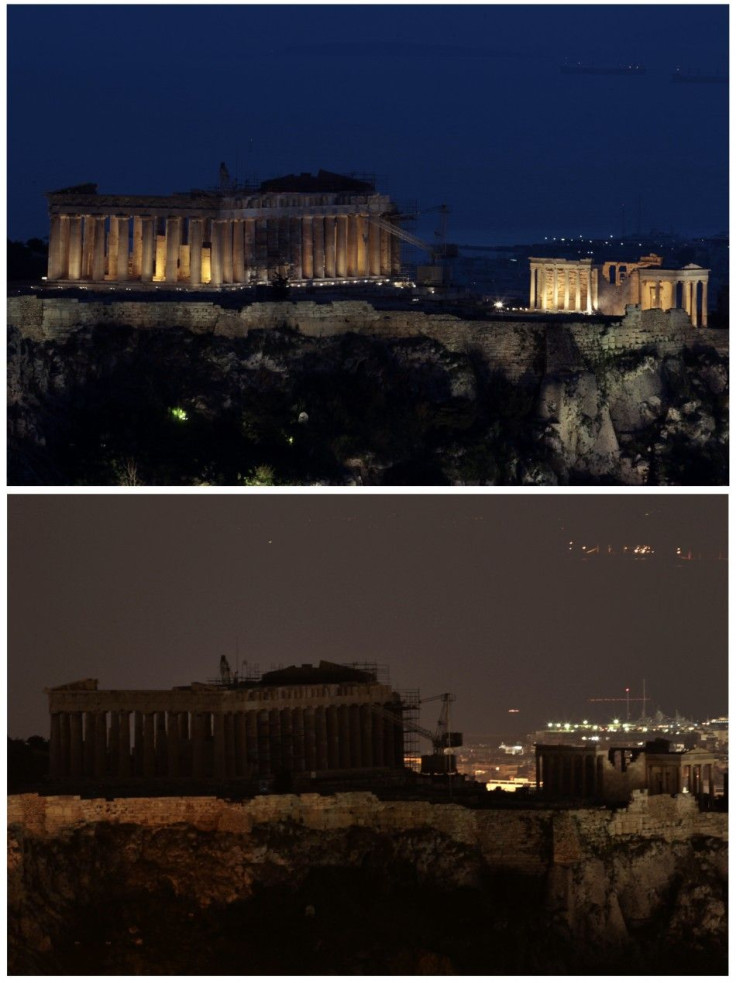

In Greece, expectations that whatever currency replaces the euro will be less valuable drove thousands to withdraw their savings. On Tuesday, depositors withdrew nearly $900 million from the nation's banks.

The Greek bank runs have been building for weeks: Since the end of last month, depositors have withdrawn $6.37 billion.

While Greeks drained cash from the nation's banks, European bond investors abandoned sovereign debt seen as likely to follow Greek sovereign debt into crisis. The yield on Spain's 10-year bonds, for example, soared to 6.5 percent, while yields on comparable German bonds dropped to 1.45 percent -- creating a record spread between the two types of securities.

The euro, meanwhile, was falling toward $1.27.

In London, the head of Britain's central bank warned Wednesday that the euro zone was tearing itself apart and the U.K. will not be unscathed, Mervyn King said, according to Reuters, adding that the Bank of England has been discussing contingency plans for a considerable time.

We have been through a big global financial crisis, the biggest downturn in world output since the 1930s, the biggest banking crisis in this country's history, the biggest fiscal deficit in our peacetime history and our biggest trading partner, the euro area, is tearing itself apart without any obvious solution, he said.

The idea that we could reasonably hope to sail serenely through this with growth close to the long-run average and inflation at 2 percent strikes me as wholly unrealistic. We're bound to be buffeted by this and affected by it.

The main question for European policy makers appeared to be whether Greece would leave voluntarily or be ejected from the monetary union -- seen as inevitable based on a likely default triggered by anti-austerity parties doing well in the upcoming elections.

With the failure of talks to form a coalition government, Greeks must vote again for national leaders, an event expected to take place June 17.

Until those elections, the Hellenic Republic will be managed by a caretaker administration, meaning the country's leaders will have no mandate to take decisive actions to ameliorate the crisis.

© Copyright IBTimes 2024. All rights reserved.