Global Stocks Keep Climbing After US Election As Dollar Retreats

Stock markets continued to push higher Thursday on continued buying momentum following the US election despite the still unresolved presidential contest, while the dollar slid as the Federal Reserve pledged to continue to support the economy.

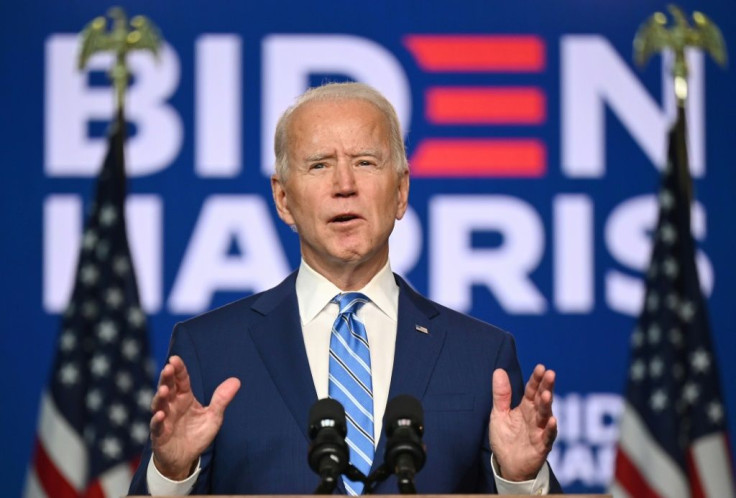

There were no major developments in the US presidential contest, with five states still undeclared. Challenger Joe Biden is ahead in the Electoral College tally following wins in Michigan and Wisconsin, but vote counting continued in Pennsylvania, Arizona, Georgia, North Carolina and Nevada.

"Investors largely ignored the heated debates and the uncertainty regarding the too-close-to-call states and that points to strong underlying buying pressure on the Street," said Gorilla Trades strategist Ken Berman.

"All of the key sectors closed in the green following a clearly bullish session on Wall Street."

Analysts have said the rally reflects enthusiasm at the apparent outcome of the election, which may leave Washington politically divided and pose a barrier to sweeping policy changes that could upset investors, such as tax increases.

US stocks have risen four days in a row, with the Dow, S&P 500 and Nasdaq all gaining at least two percent on Thursday.

Markets also are expecting additional fiscal spending in the US now that the election is over.

However, both the US and Europe are contending with rising coronavirus cases.

Europe has again become the worst-hit global region, and Romania became the latest government to announce tough new restrictions to counter the second Covid-19 wave washing over the continent.

Greece will go back into lockdown from Saturday for three weeks to battle a second wave of the coronavirus, Prime Minister Kyriakos Mitsotakis announced.

Worries about the virus also continue to cloud the outlook in the United States, prompting the Federal Reserve Thursday to reiterate its pledge to use all its tools to support the US economy.

The recent spike in Covid-19 cases is "particularly concerning," Fed Chair Jerome Powell told reporters following the central bank policy meeting.

While the United States has done better than expected economically, the outlook "is extraordinarily uncertain," he said.

The Fed chief warned that despite a jump in growth, "the pace of improvement has moderated" and spending has slowed, while the economy has regained just half the jobs lost in March and April.

"A full economic recovery is unlikely until people are confident that it's safe to re-engage in a broad range of activities," he said.

That dovish posture weighed on the dollar, which fell sharply against the euro and other currencies.

New York - Dow: UP 2.0 percent at 28,390.18 (close)

New York - S&P 500: UP 2.0 percent at 3,510.45 (close)

New York - Nasdaq: UP 2.6 percent at 11,890.93 (close)

London - FTSE 100: UP 0.4 percent at 5,906.18 (close)

Frankfurt - DAX 30: UP 2.0 percent at 12,568.09 (close)

Paris - CAC 40: UP 1.2 percent at 4,983.99 (close)

EURO STOXX 50: UP 1.7 percent at 3,215.56 (close)

Tokyo - Nikkei 225: UP 1.7 percent at 24,105.28 (close)

Hong Kong - Hang Seng: UP 3.3 percent at 25,695.92 (close)

Shanghai - Composite: UP 1.3 percent at 3,320.13 (close)

Euro/dollar: UP at $1.1832 from $1.1647 at 2100 GMT

Dollar/yen: DOWN at 103.55 yen from 104.66 yen

Pound/dollar: UP at $1.3150 from $1.2947

Euro/pound: DOWN at 89.92 pence from 89.96 pence

Brent North Sea crude: DOWN 0.7 percent at $40.93 per barrel

West Texas Intermediate: DOWN 0.9 percent at $38.79 per barrel

© Copyright AFP 2024. All rights reserved.